Ethereum has made a slow but steady attempt at recovering from the significant 33% price loss observed toward the end of February. The recent recovery is being largely driven by investor confidence, with many accumulating ETH at current low levels.

These investors are anticipating an eventual price uptick, hoping to capitalize on Ethereum’s potential growth.

Ethereum Finds Investor Support

Ethereum’s supply on exchanges has decreased by 635,000 ETH in the last six days, representing a value of over $1.28 billion. This drop in supply reflects a strong accumulation phase by investors who are purchasing ETH at the low price levels at which it’s currently trading. These buyers are betting on future price increases, contributing to the growing optimism surrounding Ethereum.

The fact that Ethereum’s exchange supply is being absorbed so quickly indicates investors’ belief in a price rebound. As the holders of this accumulated ETH look to HODL, the decrease in available supply could lead to upward pressure on the price.

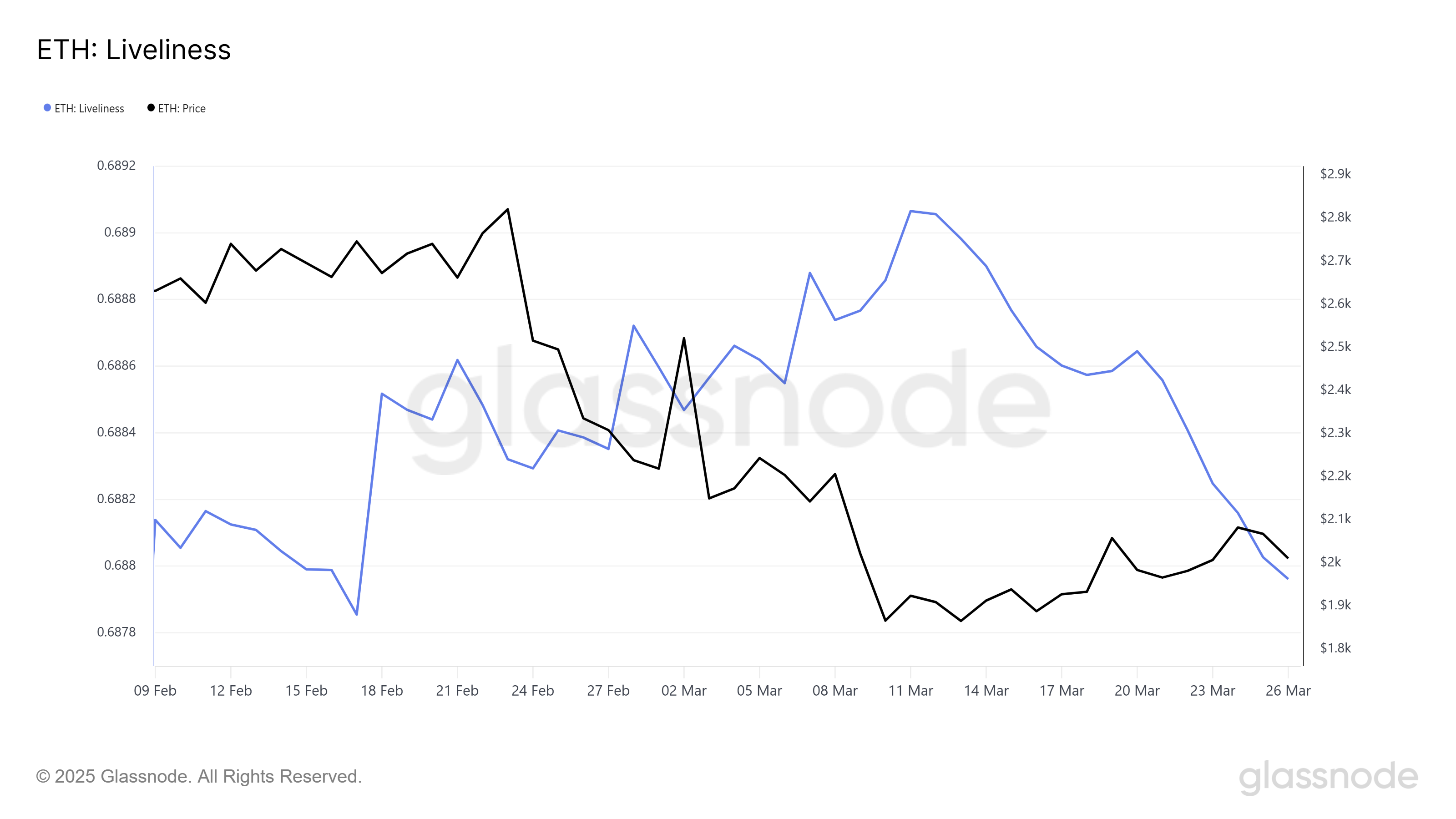

Ethereum’s macro momentum is further supported by the Liveliness indicator, which tracks the activity of long-term holders (LTHs). The Liveliness indicator recently hit a monthly low, signaling that LTHs are accumulating and holding onto their ETH. This shift towards HODLing by Ethereum’s key holders suggests confidence in the altcoin’s future performance.

The growing support from LTHs and their accumulation efforts indicate a belief in Ethereum’s long-term value. As these holders continue to lock up their ETH, it reduces the circulating supply, which can contribute to price appreciation.

Is ETH Price On Track To Breaking Out?

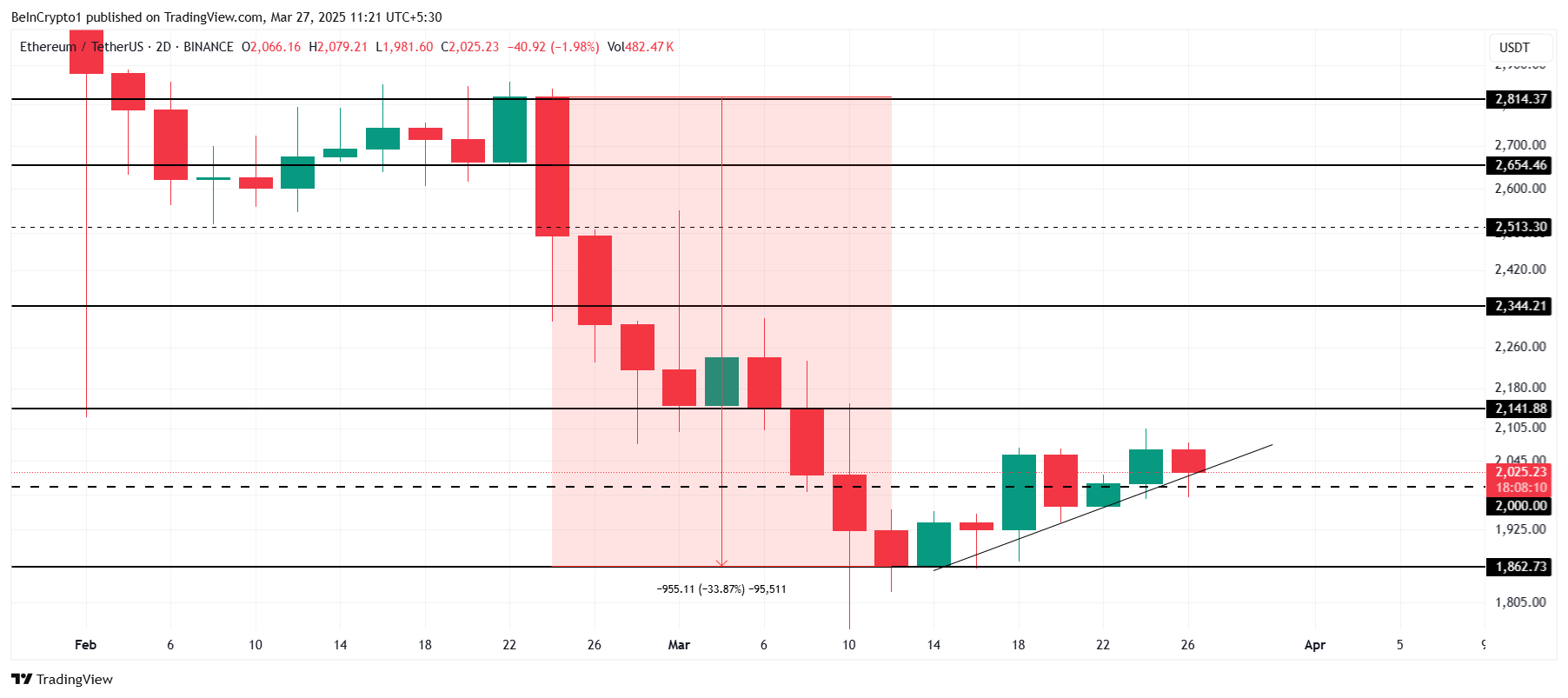

Currently trading at $2,025, Ethereum price has reclaimed the $2,000 level as support on the daily chart. However, it has yet to breach the $2,141 resistance, which is key to solidifying its recovery attempt. Successfully breaking through this barrier would confirm Ethereum’s upward momentum and set the stage for further gains in the coming days.

If Ethereum successfully secures $2,141 as support, it could be on track to recover the 33% decline from late February. A sustained break above this resistance could push ETH toward $2,344, helping to reclaim lost ground and continue the bullish trend. This would signal renewed confidence in Ethereum’s market outlook.

However, if the bullish momentum fails to materialize and Ethereum struggles to breach the $2,141 barrier, the altcoin could face a pullback. A failure to push past this resistance would likely lead to a decline back below $2,000, potentially testing the $1,862 support level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/ethereum-price-recovery-bolstered-by-accumulation/

2025-03-27 06:46:21