Breaking out of an eight-month downward trend, Ethereum (ETH) is back in the news. This marks a major turning point for the second-largest cryptocurrency by market capitalization.

The coin rose more than 5% in a single day, reaching $3,525, and has gained 38% in the last 30 days. Analysts are buzzing, implying that ETH still has a lot of upside potential as it continues to rise.

Related Reading

This latest breakthrough has inspired more general market confidence. ETH has risen by 10% over the past week, therefore confirming its dominance in the crypto scene. Technical analysts like Logical Trader say that this action signals the beginning of a longer-term bullish trend with medium- and long-term expansion obviously evident.

What a move in ETHUSD

This is how the price should behave when it breaks out of the descending trend channel. #crypto #Ethereum pic.twitter.com/tepsK7grmO— Logical Trader (@logicaltra6er) November 23, 2024

Bullish Technical Signals

Ethereum’s technical indicators show a strong upward trend. The Relative Strength Index (RSI) has reached 70, indicating heavy buying pressure. Furthermore, ETH has broken its 30- and 200-period moving averages, strengthening its bullish trend.

Titan of Crypto noted an interesting development: a weekly closure higher than the Kumo Cloud. With a probable second aim of $4,862 should momentum continue, this technical breakout projects ETH might soon test resistance levels near $4,189.

#Altcoins #Ethereum Golden Cross Incoming 🚀#ETH has closed above the weekly Kumo Cloud: an important milestone.

This breakout could pave the way to $4,100 next! 🎯 pic.twitter.com/q0eOVgxgnU

— Titan of Crypto (@Washigorira) November 25, 2024

The upside would get further boosted with an upcoming Golden Cross, in which the shorter-term moving average will cross above the longer-term one. In fact, this has historically led to very strong price rallies. If such bullish signs are accompanied by sustained buying activity, ETH may approach these higher price levels in the near term.

Ethereum Fundamentals Remain Solid

Beyond the technical prowess, Ethereum shines still through its strong dominance in decentralized finance, or DeFi, and a myriad of blockchain applications. The network holds more than half of the total value locked into DeFi, so it is surely pertinent to the ecosystem.

Furthermore, the emergence of ETH-based layer-2 solutions increases their scalability and appeal to both developers and users.

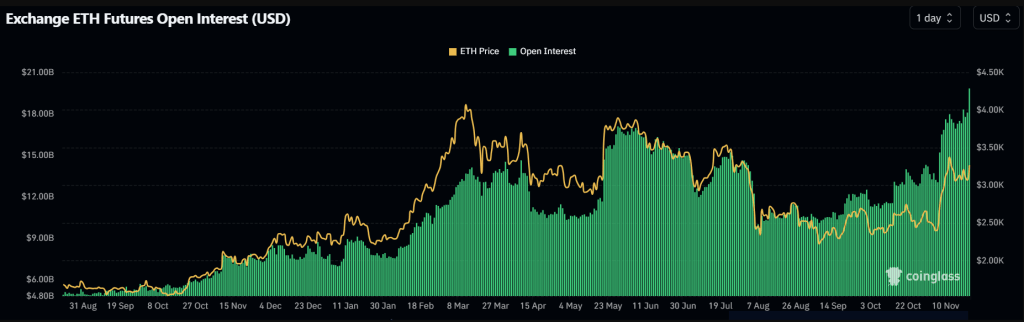

Meanwhile, activity in the Ethereum derivatives market is soaring. Open interest has topped $20 billion, with traders eyeing $3,400 and $3,500 for options that expire soon. Increased transaction volumes per block are also driving up fees, lowering ETH’s circulating supply and potentially raising prices even further.

Related Reading

Room For growth amidst optimism

While Ethereum’s price has increased by 66% in the previous year, many analysts say it remains undervalued. Predictions of a gain above $4,800 this cycle indicate the market’s belief in ETH’s future.

At the same time, if pro-crypto legislation passes in the US, it could speed up the rise of crypto even more. Ethereum looks like it will go up, maybe even to new all-time highs, because its fundamentals are strong, it is becoming more popular, and its technical setup is good.

Featured image from DALL-E, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/ethereum-momentum-builds-10-surge-sparks-ath-hopes/

2024-11-26 19:30:01