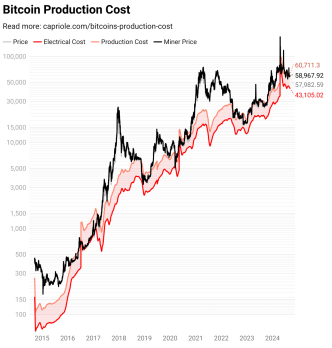

Crypto analyst Astronomer, known by the handle @astronomer_zero on X, has put forth a potentially compelling bottom signal for Bitcoin, which hinges on the electricity costs incurred by miners to produce BTC. According to him, this particular metric has historically served as a reliable indicator for identifying optimal buying opportunities within Bitcoin’s price cycles.

Is The Bitcoin Bottom In?

The analysis titled “BTC Miners electricity cost, a 100% accurate bottom signal,” leverages data to illustrate a scenario where the cost of Bitcoin production dips below its market price, suggesting a pivotal moment for potential investors. Astronomer elaborated on his methodology and findings by referencing his previous predictions which successfully pinpointed market tops, notably a 30% drop from a $70,000 peak, which was guided by similarly data-driven signals.

Related Reading

Astronomer’s current focus on the cost of mining stems from its significant implications on Bitcoin’s supply dynamics. Despite the halving events designed to reduce the reward for mining Bitcoin, there remains a 0.84% annual inflation in its supply, equating to roughly $10 billion worth of Bitcoin entering the market each year. This is equivalent to the total holdings of significant corporate investors like MicroStrategy, indicating a substantial influx of Bitcoin from miners, who are inclined to sell gradually to sustain their operations.

However, the current market conditions, as described by Astronomer, have reached a rare state where the market price of Bitcoin has fallen below the average weighted cost of electricity required to mine it. This situation typically constrains miners from selling their holdings at a profit, thus potentially reducing the sell pressure on the market.

“Not only does that mean that the miners can’t sell their BTC for a profit. It also means that it is simply cheaper to just log into a CEX and buy 1 Bitcoin, instead of going through the pain of mining 1 Bitcoin. So not only does this make the miners (the people controlling BTC) not want to sell, it also makes them want to buy, because it is cheaper to just buy instead of mine them,” Astronomer suggests.

Related Reading

This shift not only impacts the selling behavior of miners but also their buying strategies, contributing to a decrease in supply pressure and possibly triggering upward price movements. Astronomer supports his claim by pointing out that historically, when the cost of production fell below the market price, it has consistently led to substantial price recoveries.

He detailed instances from the recent past, including notable dips in March 2023 when Bitcoin hit $19,500, November 2022 at $16,500, June 2022 at $18,000, May 2020 at $8,900, March 2020 at $4,700, and November 2018 when it bottomed out at $3,500. Each of these moments was followed by robust bull runs, underlining the potential reliability of this signal.

“How many times? 17 out of 17 times, it meant that price was at levels that, according to history (with high statistical significance), you would want to buy, or would miss and regret it for a very long time,” the analyst adds.

Currently, with the production cost of Bitcoin, according to Capriole Investment’s data, standing at $60,711 and the price lingering at $56,713, the conditions described by Astronomer are manifesting yet again. This juxtaposition poses a critical question to the market: Is now the time to buy?

While Astronomer’s analysis is backed by historical data and detailed market observation, he remains cautiously optimistic about the outcomes, encapsulated in his closing remark, “Will this time be different? Maybe.”

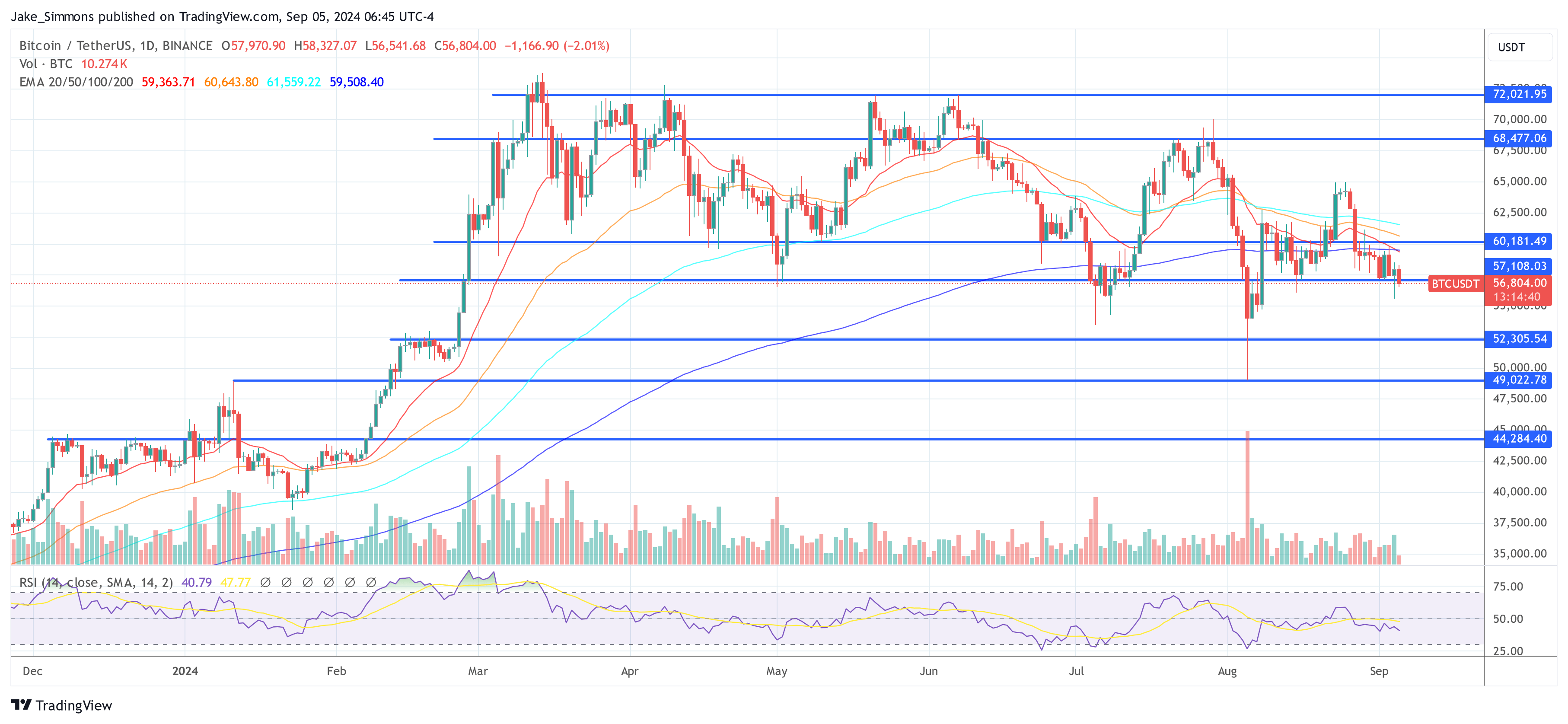

At press time, BTC traded at $56,804.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/news/bitcoin/100-accurate-bitcoin-bottom-signal-hits-time-to-buy/

2024-09-05 15:00:19