Cardano (ADA) has been consolidating with a clear upward potential, and if market conditions remain favorable, the cryptocurrency could be on the verge of a breakout. Investor behavior has shown strong bullish sentiment, with increasing inflows into Cardano.

As long-term holders (LTHs) continue to hold their positions, this could push the price higher, potentially leading to a price surge.

Cardano Has Its Investors Backing

The Mean Coin Age metric has recently seen an uptick, signaling that long-term holders (LTHs) are holding onto their ADA instead of selling. This trend is crucial for Cardano, as LTHs tend to act as the backbone of the asset. Their confidence in ADA suggests they expect a future price rise, reinforcing the potential for a price breakout.

This behavior reflects optimism in the market, as LTHs’ reluctance to sell ADA highlights their conviction in the long-term value of Cardano. As the supply remains more constrained, with fewer coins available for sale, this could create upward pressure on the price, setting the stage for a breakout.

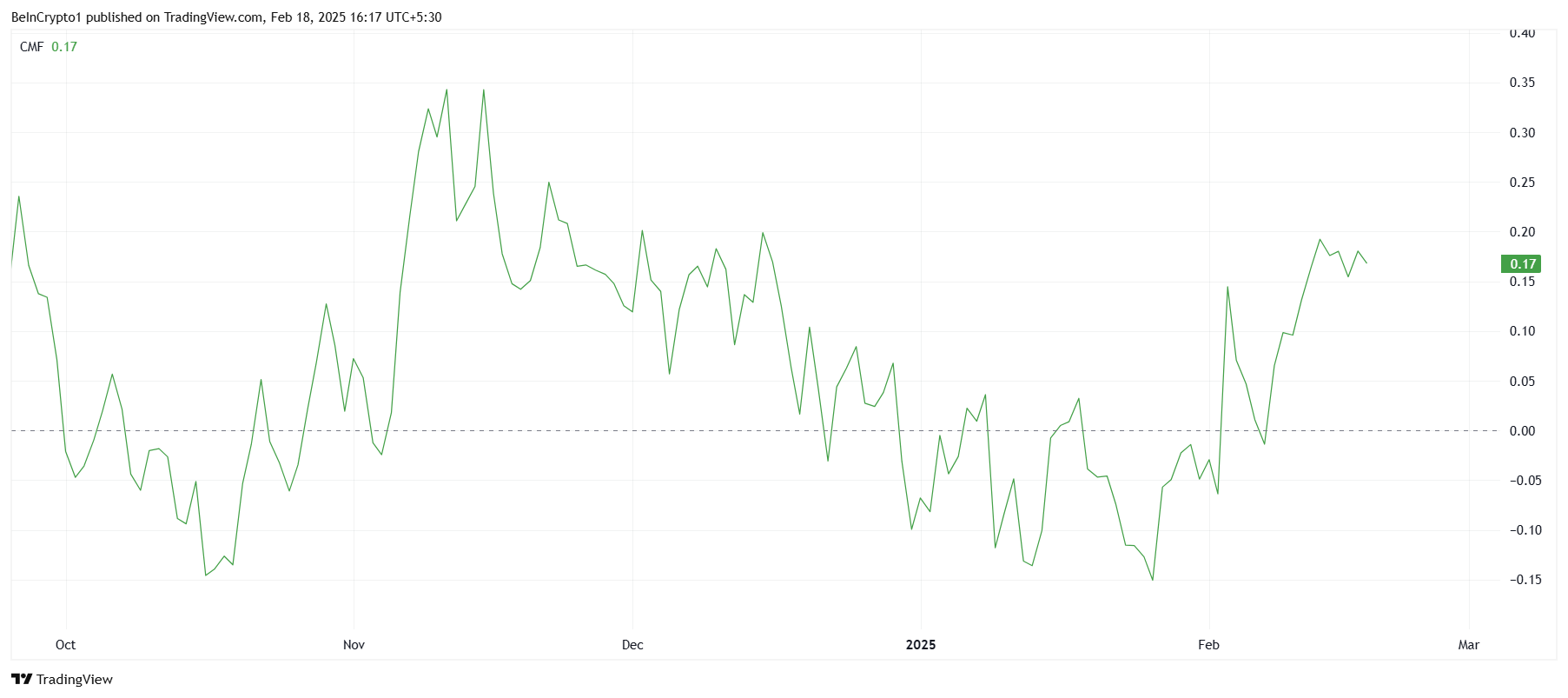

Cardano’s macro momentum also looks promising, with technical indicators supporting bullish expectations. The Chaikin Money Flow (CMF) has been rising sharply since the beginning of the month. This means that traders are becoming more willing to invest in the asset. The surge in CMF also suggests a strong demand for Cardano, which is expected to continue.

The growing buying pressure supports the idea that investors are positioning themselves for a breakout. As more funds flow into Cardano, this influx of capital further solidifies the potential for price appreciation. ADA holders are positioning for a strong upward move, and the market conditions seem to align with these expectations.

ADA Price Prediction: Breakout To A Rally Likely?

Cardano’s price is currently breaking out of a descending wedge pattern. This is often associated with a 26% rally to $0.99. The potential price movement requires strong investor support, and ADA appears to have the backing needed to reach this target. As long as the positive investor sentiment persists, ADA could be primed for the next leg up.

To confirm the breakout and reach the $0.99 target, Cardano will need to breach and flip $0.85 into a support level. This would be a key signal of strength for ADA, confirming the bullish trend and allowing for a rise toward $0.99.

At the same time, the altcoin must maintain $0.77 as a support floor to ensure continued upward momentum.

Failure to secure these support levels could lead to a decline, dragging Cardano’s price down to $0.70. Losing these key levels would invalidate the bullish outlook and the breakout pattern, extending investors’ losses. Thus, ADA holders must watch for these levels to be maintained in order to validate the upward price trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-breaks-out-of-bullish-pattern/

2025-02-18 15:30:00