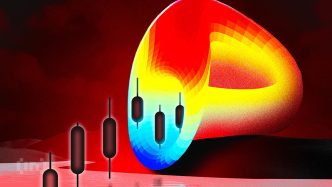

Bitcoin has experienced a period of sideways price action over the past two weeks. Despite this, the leading cryptocurrency has seen one of its largest bouts of accumulation in recent memory.

This accumulation, valued at $23 billion, has helped maintain Bitcoin’s price above the critical $96,000 level.

Bitcoin Investors Are Optimistic

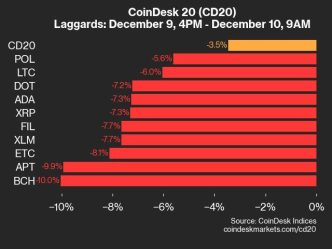

The Cost Basis Distribution (CBD) provides key insights into the Bitcoin market’s current sentiment. Data reveals that $99,559 has emerged as the largest accumulation zone, with 125,000 Bitcoin bought just below the $100,000 mark.

Meanwhile, the range between $96,000 and $98,000 has also seen significant accumulation, with 120,000 BTC added in the last two weeks. This suggests that the range between $96,000 and $100,000 has now solidified as a key support zone for Bitcoin, helping to keep the price above the $96,000 mark.

Bitcoin is maintaining support above this zone, which is a signal of strong investor confidence, even amid market fluctuations. As the largest accumulation zones cluster near this $96,000 to $100,000 range, these price levels have now taken on even greater significance.

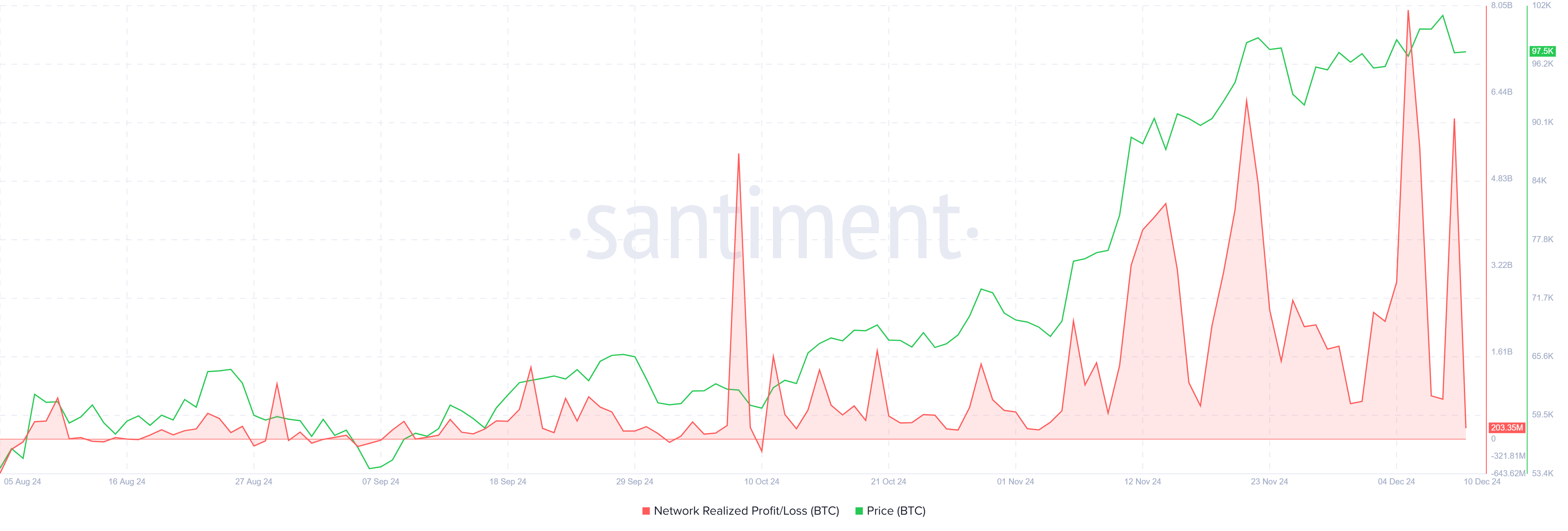

Looking at the broader market momentum, realized profits show that investors remain actively engaged with Bitcoin. Despite the accumulation, spikes in realized profits suggest that traders continue to book profits during periods of growth. This highlights the ongoing volatility within the market, as profit-taking behavior can potentially hinder Bitcoin from sustaining further upward momentum.

While these realized profit spikes demonstrate a healthy level of market activity, they also serve as a reminder of the challenges Bitcoin faces in maintaining bullish momentum. Investors who are taking profits may contribute to short-term price corrections, but this behavior is part of the normal market cycle.

BTC Price Prediction: Breaking Out

Bitcoin’s price is currently hovering near the $96,000 support level after failing to break the $100,000 mark. The large-scale accumulation in the $96,000 to $100,000 range has created a solid base, which may prevent any significant decline. If Bitcoin can hold this range, it could attempt another push toward $100,000.

However, Bitcoin may face resistance at $100,000 as it has struggled to secure support above this level. Should the price fail to surpass this key threshold, the cryptocurrency could remain stuck within a sideways range, with potential price fluctuations between $96,000 and $100,000.

If Bitcoin manages to reclaim and hold above $100,000, it could resume its bullish trend. This would likely prompt a move toward the next key resistance level, potentially bringing Bitcoin closer to its all-time highs. The ongoing accumulation at these price levels suggests that investor confidence remains strong, which may drive future price growth.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoins-rise-likely-as-profits-await/

2024-12-10 13:30:00