Pudgy Penguins (PENGU) price has dropped more than 9% in the last 24 hours, following its brief moment as the biggest meme coin on Solana, now surpassed by BONK and ai16z.

The recent decline comes amid cooling momentum, reflected in key technical indicators like the RSI and DMI.

PENGU RSI Is Cooling Off

PENGU Relative Strength Index (RSI) sits at 45.9, reflecting a notable decline from 68.3 recorded on January 1. This drop indicates that buying pressure has weakened, and the recent momentum driving the price upward has cooled off.

The current RSI level places PENGU in the neutral zone, signaling a balance between buyers and sellers without a clear dominance from either side.

The RSI is a widely used momentum indicator that measures the speed and magnitude of price changes on a scale from 0 to 100. Readings above 70 indicate overbought conditions, often signaling a potential pullback, while readings below 30 suggest oversold conditions and the possibility of a rebound.

With PENGU RSI at 45.9, the indicator suggests that the asset is neither overbought nor oversold, pointing to a consolidation phase. In the short term, this level may signal limited price movement unless market sentiment shifts significantly, potentially driven by increased buying or selling activity.

PENGU Downtrend Is Getting Stronger

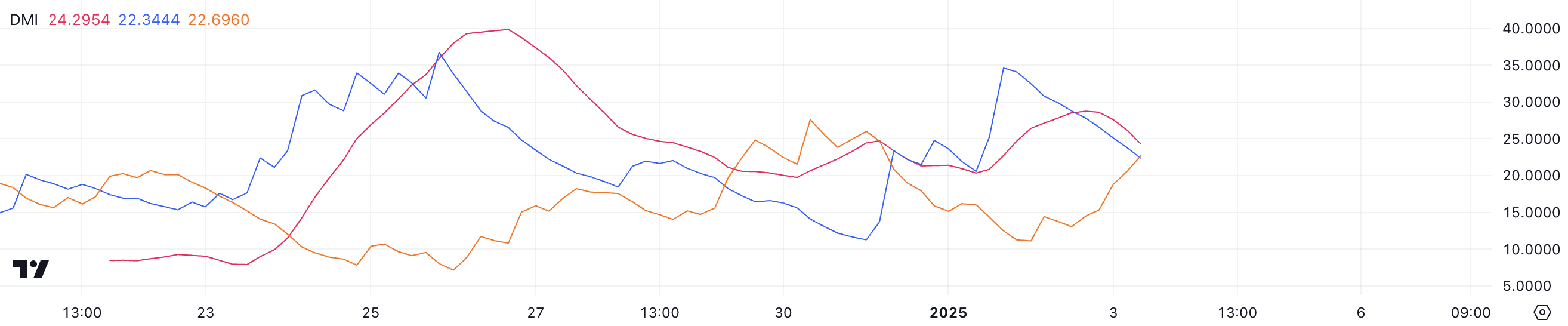

PENGU’s DMI chart shows its ADX currently at 24.2, indicating a moderately strong trend. The ADX, which measures trend strength on a scale from 0 to 100, suggests that while there is notable momentum in the market, it is not decisively strong yet.

The +DI (Directional Indicator) has declined to 22.3 from 34.6 just two days ago, signaling a reduction in buying pressure, while the -DI has risen to 22.6 from 11.2, reflecting an increase in selling pressure, which could make PENGU losing its spot as the 3rd biggest meme coin on Solana to WIF.

This shift in the directional indicators, with the -DI slightly overtaking the +DI, suggests that bearish momentum is starting to gain traction in the short term. The close values of the +DI and -DI indicate a market in transition, where neither buyers nor sellers have a decisive advantage.

For PENGU price, this could mean continued consolidation or a potential tilt toward bearishness unless the +DI regains strength and the ADX climbs further above 25 to confirm a stronger trend.

PENGU Price Prediction: A Potential 27.6% Correction

PENGU’s EMA lines indicate the possibility of a death cross forming soon, a bearish signal where the short-term EMA crosses below the long-term EMA.

If this occurs, it could reinforce the current downtrend, pushing PENGU price toward its nearest support at $0.0296. A failure to hold this level could result in further declines, with the next support at $0.025 representing a significant potential 27.6% correction.

Conversely, if the trend reverses and bullish momentum takes over, PENGU price could retest the $0.0409 resistance level. Breaking above this resistance could pave the way for further gains, with a potential rise to $0.0439, marking an upside of 26.5% and possibly making PENGU price rising to claim the 1st spot among the biggest Solana meme coins, as it did last week.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/pengu-price-risks-correction/

2025-01-03 21:30:00