From concerning on-chain metrics to technical indicators, Chainlink’s (LINK) price might encounter a rough path as it aims for a higher value. These warning signs came after the token recently showed readiness to reach $12.

While the potential move to the price above remains an option, this on-chain analysis explains why it could take longer than anticipated.

New Concerns Emerge for Chainlink

On Tuesday, September 11, Chainlink’s Sharpe ratio was nearing a higher level. However, as of now, the ratio, which measures whether the risk taken in investing is worth the potential reward, has dropped to 0.25.

When the Sharpe ratio rises, it suggests a likely positive return on investment. Conversely, a decline or negative reading indicates that the volatility of the asset may not justify the risk-adjusted returns.

Based on this analysis, purchasing LINK at its current price in the short term could pose a notable risk to invested capital.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

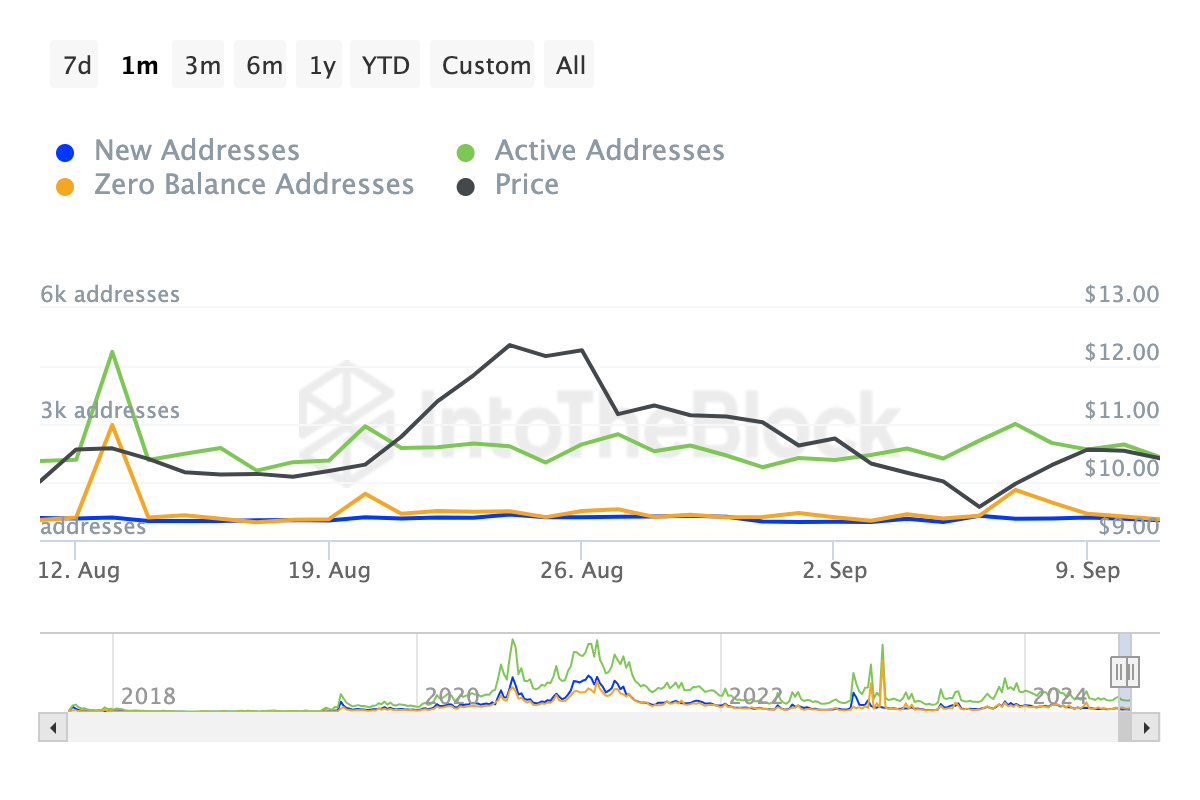

Another metric displaying such sentiment is Chainlink’s network activity. According to IntoTheBlock, the active, zero-balance, and new addresses have decreased significantly in the last seven days.

An increase in these metrics indicated a high level of user engagement, which is typically a bullish sign. Thus, this decline indicates that fewer market participants are utilizing the network.

Such a reduction in overall activity could negatively impact Chainlink’s price, especially as it coincides with decreased trading volume.

LINK Price Prediction: Critical Days Ahead

An analysis of the daily chart shows that LINK’s price last exceeded $12 on August 25. Two weeks later, it dropped by 22%, falling below $10. While the altcoin has since rebounded, BeInCrypto noted potential resistance at $10.74.

Furthermore, the Chaikin Money Flow (CMF), a key indicator of market trends, failed to rise above the zero midpoint. The CMF is crucial for determining whether a cryptocurrency is entering an uptrend or downtrend. A rising CMF signals an uptrend or the potential to sustain one, while a declining CMF suggests the opposite.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in September 2024

If the CMF continues to fall, it could indicate increased profit-taking from the recent price surge. Consequently, LINK’s price could drop to $9.47, with a highly bearish scenario potentially bringing the token down to $8.08. However, if the broader market shifts into a sustained bullish phase, LINK could rise to $12.33.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/red-flags-for-chainlink-price/

2024-09-12 18:00:00