Monday is a holiday in the US for Presidents’ Day, so traditional markets are closed. Crypto markets never close, but they are already showing signs of weakness as another week begins.

There are several Federal Reserve speeches to look out for this week in addition to manufacturing and services purchasing manager’s indexes.

“Inflation is officially at its highest in at least 8 months, and [stock] markets are nearing all-time highs,” observed the Kobeissi Letter.

Economic Events Feb. 17 to 21

Both CPI and PPI reports came in above projections last week. The forward-looking producer-price index reflected the persistence of inflation, hinting at higher February CPI readings.

There are some housing reports due out this week, but they have little bearing on high-risk assets such as crypto.

The Federal Open Market Committee (FOMC) January meeting minutes will be aired on Wednesday, providing reasoning behind the central bank’s decision to keep interest rates unchanged and potential insight into future rate cuts.

Philadelphia Fed President Patrick Harker, San Francisco Fed President Mary Daly, Chicago Fed President Austan Goolsbee, and St. Louis Fed President Alberto Musalem will also deliver remarks this week.

February’s S&P Global Manufacturing PMI and Services PMI preliminary readings are due on Friday. These reports are leading indicators used to gain insights into changing economic conditions.

January’s Michigan Consumer Sentiment Index and Inflation Expectations are also due Friday, offering the results of a monthly survey of consumer confidence levels and views of long-term inflation in the United States.

Key Events This Week:

1. US Markets Closed – Monday

2. January Housing Starts data – Wednesday

3. Fed Meeting Minutes – Wednesday

4. January Existing Home Sales data – Friday

5. 10 Fed speaker events this week

6. ~20% of S&P 500 companies report earnings

Short but busy…

— The Kobeissi Letter (@KobeissiLetter) February 16, 2025

Retail giant Walmart, along with US-traded Chinese e-commerce companies Alibaba and Baidu, are set to deliver earnings reports this week.

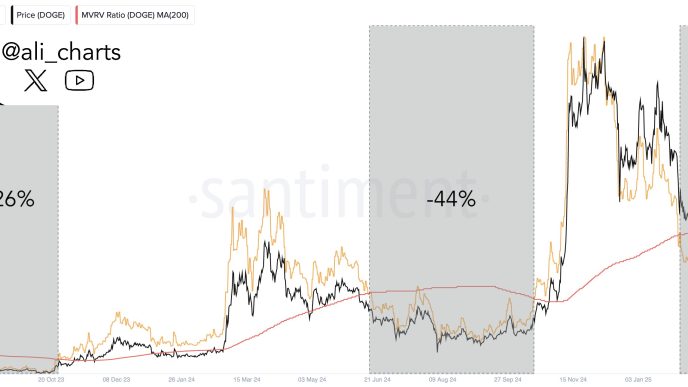

Crypto Market Outlook

Crypto markets have retreated again this Monday morning with a 2.3% slide on the day, dropping total capitalization to $3.33 trillion. Markets remain at the lower bounds of a three-month sideways channel with support at $3.25 trillion.

Bitcoin lost 1.3% on the day, falling to just over $96,000 during early trading in Asia, having spent most of the weekend in the mid-$97,000 level. The asset has also been range-bound for the past three months.

Ethereum remains weak having fallen below $2,700 as its tightly bound channel continues sideways. ETH has been in a downtrend since early December, when it topped $4,000 briefly.

Altcoins are generally mixed at the moment with minor gains for Binance Coin, Cardano, and Hyperliquid, and minor losses for Solana, Sui, and Litecoin.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Martin Young

https://cryptopotato.com/3-things-that-could-impact-crypto-markets-in-the-week-ahead/

2025-02-17 07:04:29