The crypto market is set for potential volatility as approximately $7.7 billion worth of Bitcoin and Ethereum options expire today.

With Bitcoin options totaling $5.8 billion in notional value and Ethereum options accounting for $1.9 billion, traders are eyeing the expiration for its potential impact on prices.

Fourth Quarter Crypto Outlook: Analysts Predict Strong Market After Expiring Options

According to data from Deribit, 89,037 Bitcoin options contracts will expire on September 27. This tranche is significantly larger than last week’s of 20,037 contracts. These contracts have a put-to-call ratio 0.64 and a maximum pain point of $59,000.

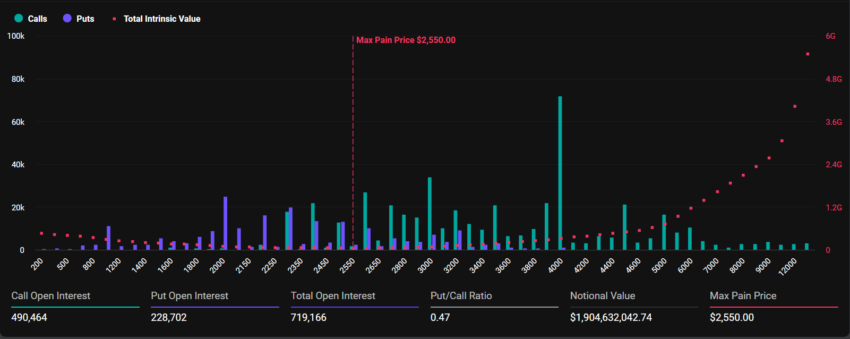

Similarly, Ethereum’s options market is set to expire with 719,130 contracts. Today’s expiring Ethereum contracts have a put-to-call ratio of 0.47, with a maximum pain point of $2,550.

Read more: An Introduction to Crypto Options Trading

In options trading, traders analyze the put-to-call ratios to gauge market sentiment. Bitcoin’s put-to-call ratio indicates a relatively balanced market with a slight preference for call options, suggesting more bullish expectations. Meanwhile, Ethereum’s put-to-call ratio reflects even stronger bullish sentiment among traders.

The maximum pain point suggests that Bitcoin and Ethereum prices may hover around these critical levels as the options expire, causing losses for both bulls and bears. As these options settle, they could generate volatility, with the potential for sudden price shifts based on how the market reacts.

Analysts at Greeks.live have provided further insight into the expiring options, noting the influence of the broader market trends.

“Today is the third quarter delivery day, and crypto has rallied strongly in the last three weeks, fueled by the Fed’s 50 bps rate cut, which has boosted market confidence immensely. With the quarter ending, and judging from previous years, the fourth quarter is usually favorable, especially with the US election and two additional rate cuts on the horizon,” they wrote.

Bitcoin’s price has steadily climbed since the Federal Reserve’s rate cut on September 18. Following this, Bitcoin surged from $57,000 to $65,075, while Ethereum’s price increased from $2,278 to $2,625. Analysts expect continued market volatility as traders reposition themselves for the fourth quarter, which is traditionally a strong period for crypto assets.

Despite the positive momentum, traders are advised to remain cautious. Historically, options expiration often leads to short-term instability in the market.

Read more: 9 Best Crypto Options Trading Platforms

The next few days will be crucial in determining whether Bitcoin and Ethereum can sustain their upward trends or if a period of correction is imminent. With market volatility expected, how the prices react in the aftermath of this major options expiry could set the tone for the coming weeks.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lynn Wang

https://beincrypto.com/bitcoin-ethereum-crypto-options-expire-september-27/

2024-09-27 04:19:50