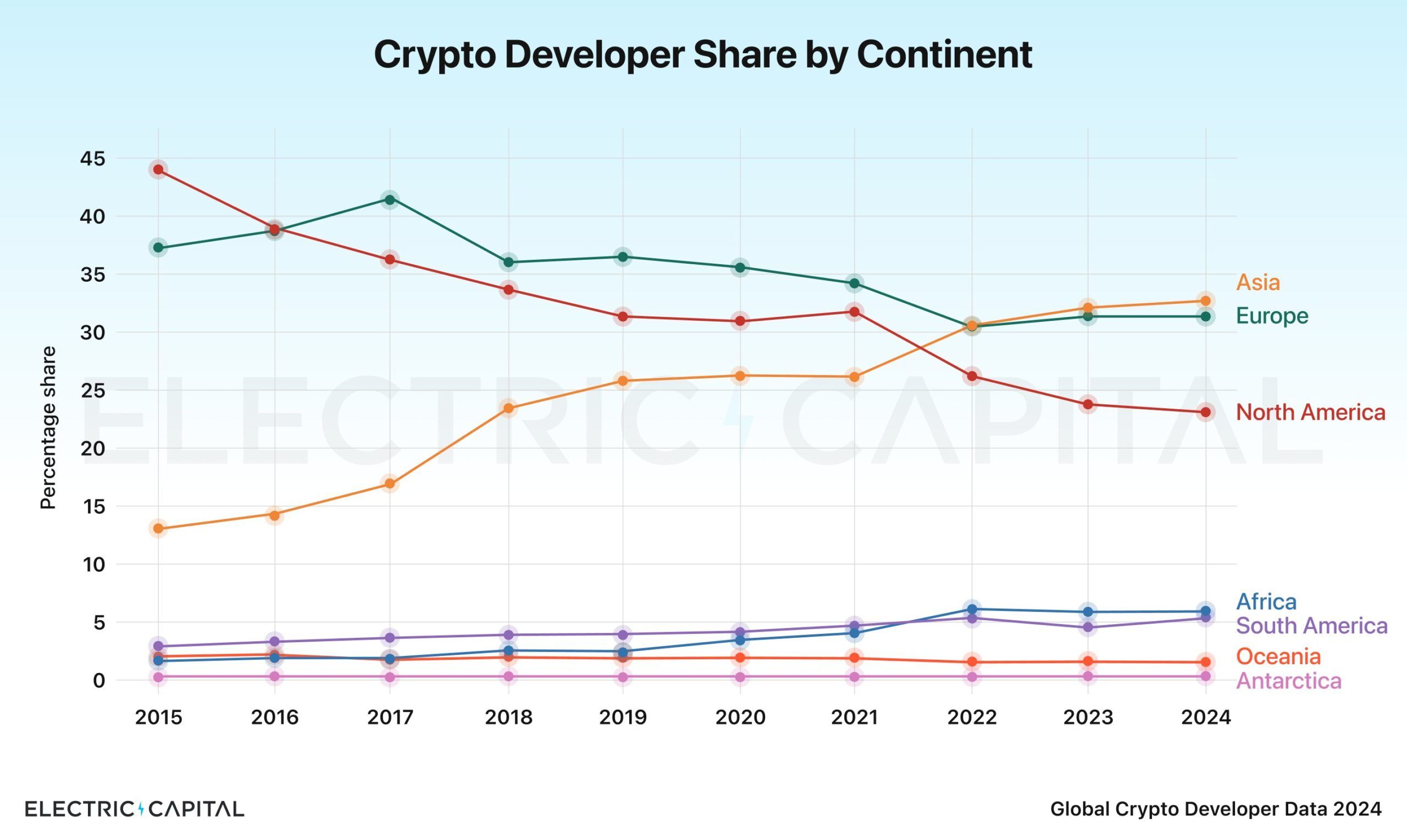

A recent study by Electric Capital reveals that the proportion of crypto developers in the US has significantly decreased over the past decade.

Although the US still leads the world in the proportion of crypto developers, this position may be lost if policies encouraging crypto development are not strengthened.

Why the Proportion of Crypto Developers in the US is Declining?

Electric Capital’s study analyzed a sample of over 110,000 developers worldwide. According to the study, the top three countries in terms of developer proportion are the United States, India, and the UK, with rates of 18.8%, 11.8%, and 4.2%, respectively.

Read more: Top Blockchain Companies in 2024

However, the US’s proportion has dropped by 51% over nearly ten years. This means that 81% of crypto developers now live outside the US, shaping the future of the crypto market. Maria Shen, a General Partner at Electric Capital, questions whether this is the result of a negative regulatory environment.

“Is this the result of a negative regulatory environment? The US needs clear crypto policy to maintain its country lead… Crypto thinks of itself as CA & NY based – but 64% of devs live outside of these traditional tech hubs! This is an opportunity for job & wealth creation for policymakers. Crypto should not be partisan – devs live in every state, representing all political backgrounds,” Shen commented.

Additionally, the study results show a clear shift in the proportion of crypto developers in Asia and North America. While Asia’s proportion has increased from 13% to 32% since 2015, North America’s proportion has decreased from 44% to 24%.

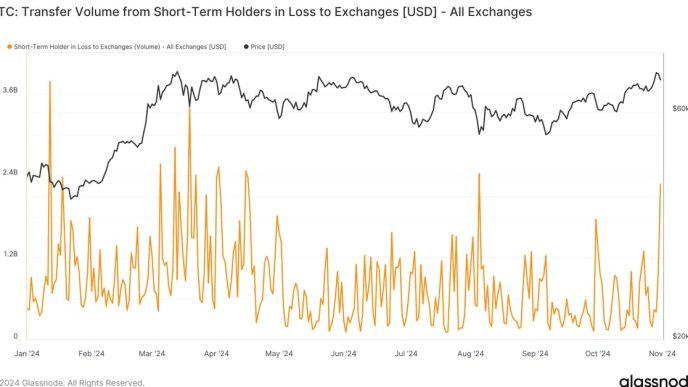

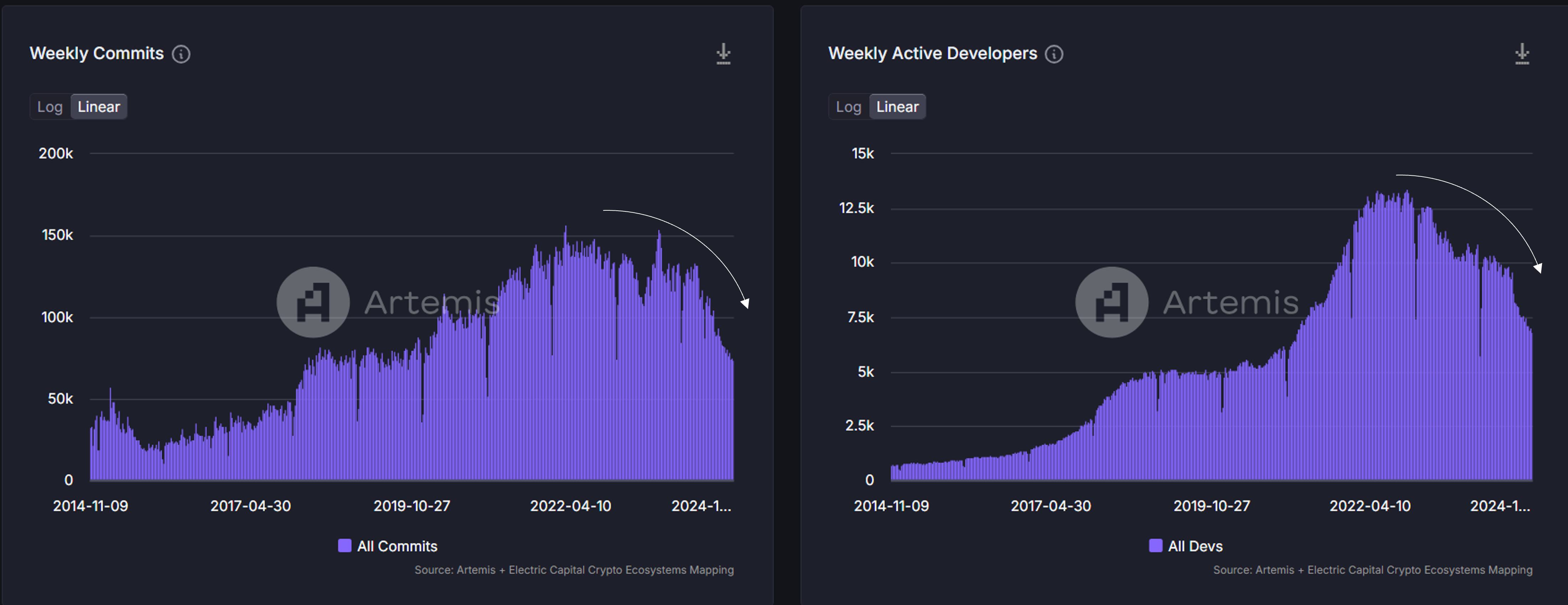

Tthese research results come in the context of a significant decline in developer activity across the market over the past two years. Data from Artemis shows that the number of weekly commits has dropped by 50% over the past year.

Read more: Finding Blockchain Developer Jobs: Everything You Need To Know

Additionally, the number of weekly active developers has decreased from over 13,000 to about 6,800, a drop of approximately 50%. A paradox arises here: the number of tokens continues to increase while developer activity decreases.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Nhat Hoang

https://beincrypto.com/crypto-developers-outside-us/

2024-11-01 10:46:39