Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Shiba Inu’s price action in the past 24 hours has been characterized by a brief recovery after hitting a low of $0.00001237. This 24-hour price recovery is part of a 15% recovery after Shiba Inu reached a low of $0.00001102 on March 11, which is its lowest point in over a year. In spite of the modest increase in price, a slowdown in a key Shiba Inu metric might threaten this price recovery that’s just beginning.

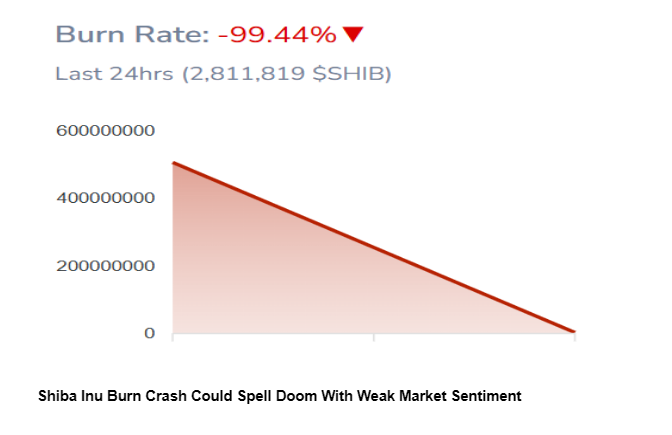

This threat is revealed in the Shiba Inu burn rate, which has taken a massive 99.44% nosedive in the past 24 hours.

Related Reading

Shiba Inu Burn Rate Plummets 99% In A Day

Shiba Inu’s burn mechanism has long been considered a vital factor in its tokenomics, reducing the supply to create scarcity and, in turn, drive up value. However, in the last 24 hours, on-chain data shows that SHIB’s burn rate has dropped by an alarming 99.44%, which is a sharp change to the relatively high burn numbers recorded in previous days.

According to data from the Shiba Inu burn tracker Shibburn, a total of 2,811,819 SHIB tokens have been sent to burn addresses in the past 24 hours. Although this might look like a lot of tokens at first glance, it actually falls short of the volume required to make an impact in the current market conditions. It also marks a 99.44% decline from the over 500 million SHIB tokens burned in the previous 24-hour timeframe.

Shiba Inu Burn Crash Could Spell Trouble With Weak Market Sentiment

The burn rate’s volatility has often coincided with fluctuations in trading volume and overall market sentiment, and this latest crash raises doubts about whether investors are still committed to the long-term burn initiative. The idea behind the Shiba Inu burn process, where SHIB tokens are sent to any of three dead wallets, is that the available supply diminishes by continuously removing SHIB tokens from circulation. This, in turn, makes the remaining tokens more valuable and helps prevent further price declines during market crashes.

Related Reading

At the time of writing, Shiba Inu is trading at $0.00001285, up by about 3% in the past 24 hours. A resurgence in the burn rate would be an important factor for Shiba Inu to maintain its recent gains and push for further recovery. A consistent and substantial burn rate would contribute to the notion that Shiba Inu has already established a local bottom at $0.00001102 and pave the way for a stronger uptrend.

On the other hand, if the burn rate continues to decline over the next 24 hours, it could weaken this recovery effort and increase the likelihood of a retracement back toward its March 11 low.

Featured image from Gemini Imagen, chart from TradingView

Source link

Scott Matherson

https://www.newsbtc.com/meme-coins/shiba-inu-burn-update-99-44-daily-burn-crash-could-spell-trouble-for-meme-coin/

2025-03-16 08:30:19