The Shiba Inu (SHIB) price has remained lackluster for a while now, with the second-largest meme coin by market cap still below the crucial price level at $0.00002. This unimpressive price action is thanks to several factors, including Bitcoin’s tepid price movement.

Why The Shiba Inu Price Is Down

Shiba Inu’s price has been on a downtrend mainly due to its strong positive price correlation with Bitcoin. Data from the market intelligence platform IntoTheBlock shows that Shiba Inu’s price correlation with Bitcoin is currently at 0.94 and nearing its peak at 1. As such, the meme coin’s price is imitating the flagship crypto’s price action.

Related Reading

Bitcoin has struggled these past few days to hold above the $60,000 support level, and Shiba Inu is also in a similar situation as it continues to swing below and above the $0.000014 price level. Bitcoin’s weak price action has been attributed to the significant slowdown in its demand growth, which can also be said about Shiba Inu.

Further data from IntoTheBlock shows that the interest in the meme coin has been on the decline for a while now, even among whales. Shiba Inu’s large transactions have remained flat and bearish, highlighting the lack of confidence these Shiba Inu whales have in the meme coin’s trajectory.

These whales have been integral in keeping Shiba Inu’s price afloat, especially as there has been a lack of new investors in the meme coin’s ecosystem. Daily new addresses on Shiba Inu have continued to range between 1,000 and 2,000 over the last three months. Meanwhile, the total number of addresses with a balance has remained around 1 million since the start of the year.

With such a bearish outlook, Shiba Inu’s price is undoubtedly at risk of further decline. The meme coin could drop lower if Bitcoin fails to reclaim and hold above $60,000 soon enough. This could also spark a massive wave of sell-offs, as over 52% of Shiba Inu holders are currently out of the money, leading to more downward pressure.

A Positive Amid The Storm

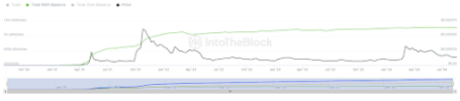

The layer-2 network Shibarium experienced a massive spike in its daily transactions, rising to 28,680 on August 20 from a meager 1,740 the previous day. This development is significant, considering that the network’s daily transactions have ranged between 1,000 and 4,000 over the last 30 days. Shibarium’s daily transactions have also drastically declined since the start of the year.

Related Reading

However, it remains to be seen if this surge recorded on August 20 marks the beginning of an increase in the daily transactions on the network. If so, it could positively impact Shiba Inu’s price since increased network activity on Shibarium leads to more Shiba Inu burns, ultimately affecting its price.

At the time of writing, Shiba Inu is trading at around $0.00001375, down in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/shiba-inu/whats-going-on-shiba-inu-price/

2024-08-21 16:00:51