Since reaching its all-time high in June, Notcoin (NOT) has declined by 62%. The last 30 days have been challenging as well, with the price dropping by double digits.

However, this analysis suggests that the Telegram-based cryptocurrency might soon see some relief.

Notcoin Bullish Divergence Triggers Change in Positions

As of this writing, Notcoin’s price is $0.010. This is a notable fall from $0.012, which it hit on August 19 and eventually turned out to be a false breakout. But on the daily chart, the Chaikin Money Flow (CMF) has exited its stay in the negative region and jumped to the positive side.

The CMF is a technical indicator that evaluates the level of buying or selling pressure in the market to provide insights into future price direction. Typically, a rising CMF implies that market participants are accumulating.

A falling rating of the indicator, however, shows that distribution is very much present. Therefore, the opposite movement of NOT’s price and the CMF is a bullish divergence, suggesting that investors are capitalizing on the recent discount and buying the dip.

Read more: Where To Buy Notcoin: Top 5 Platforms In 2024

Furthermore, past performance as recent as July reinforces the bias. For instance, as shown above, NOT experienced a downtrend to $0.010 on July 5.

During the downturn, the CMF also followed. But moments after the indicator changed direction, the price also followed, eventually driving a 43% increase to $0.017.

However, this does not imply that Notcoin’s price will replicate the exact upswing. But if money continues to flow into the token, a notable rebound could be next. It also appears that traders in the derivative market share a similar sentiment.

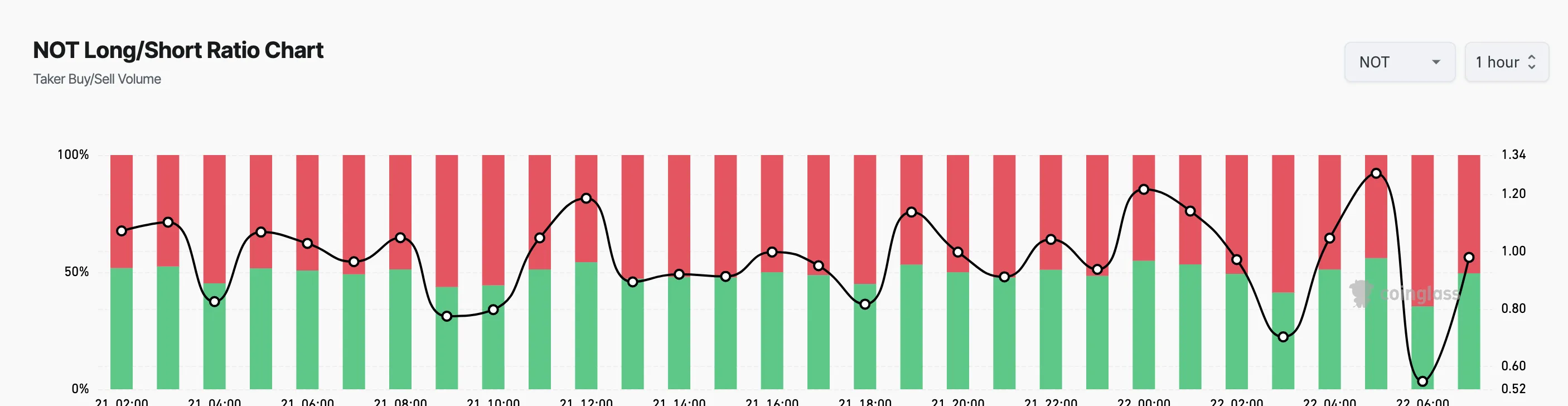

According to Coinglass, Notcoin’s Long/Short Ratio has hit an exact reading of 1. This ratio is a barometer of investor expectations.

If the reading falls below 1, the average open position is bearish, while a reading above the value suggests otherwise. Therefore, the rising ratio reveals that there are more longs (buyers) than shorts (sellers).

NOT Price Prediction: Ready to Revisit $0.013

At press time, the NOT/USD chart displayed a descending triangle, a pattern typically signaling bearish continuation. However, in some cases, a reversal can occur, and Notcoin appears to be one of those exceptions.

As shown below, and supported by growing buying pressure, Notcoin seems poised to break above the bearish formation. For this breakout to happen, buyers must outpace sellers to shift market momentum.

If successful, NOT could rise to $0.013 in the short term and potentially reach $0.016. However, this outlook may be invalidated if crypto whales continue to dump the token.

Read more: Notcoin (NOT) Price Prediction 2024/2025/2030

Recall that this investor cohort played a key role in driving the price down previously. If these sell-offs persist, Notcoin’s price could decline further, potentially dropping to $0.0085.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/notcoin-investors-buy-the-dip/

2024-08-22 11:00:00