On August 7, Ripple’s (XRP) price climbed to $0.63, prompting speculation that the cryptocurrency could be on the brink of a notable breakout. However, that did not happen, as the price had fallen to $0.59 at press time.

The previous price jump led traders to increase their bets on contracts tied to the token, aiming to profit from the movement. However, that momentum has shifted as of this writing.

Traders Step Back as Ripple Dominance Wanes

According to CryptoQuant, the XRP Estimated Leverage Ratio (ELR) is down to 0.060. As the name suggests, the ELR suggests how much leverage traders are using to bet on their positions in the market.

Increasing leverage ratio indicates that traders are taking high-risk bets in the market. This usually means confidence that the price will move in a particular direction.

However, a decrease suggests that traders are skeptical about the price movement. So, instead of opening contracts with 25x, 50x, and 100x leverage, recent data shows that they are applying caution to avoid being liquidated.

Read more: How To Buy XRP and Everything You Need To Know

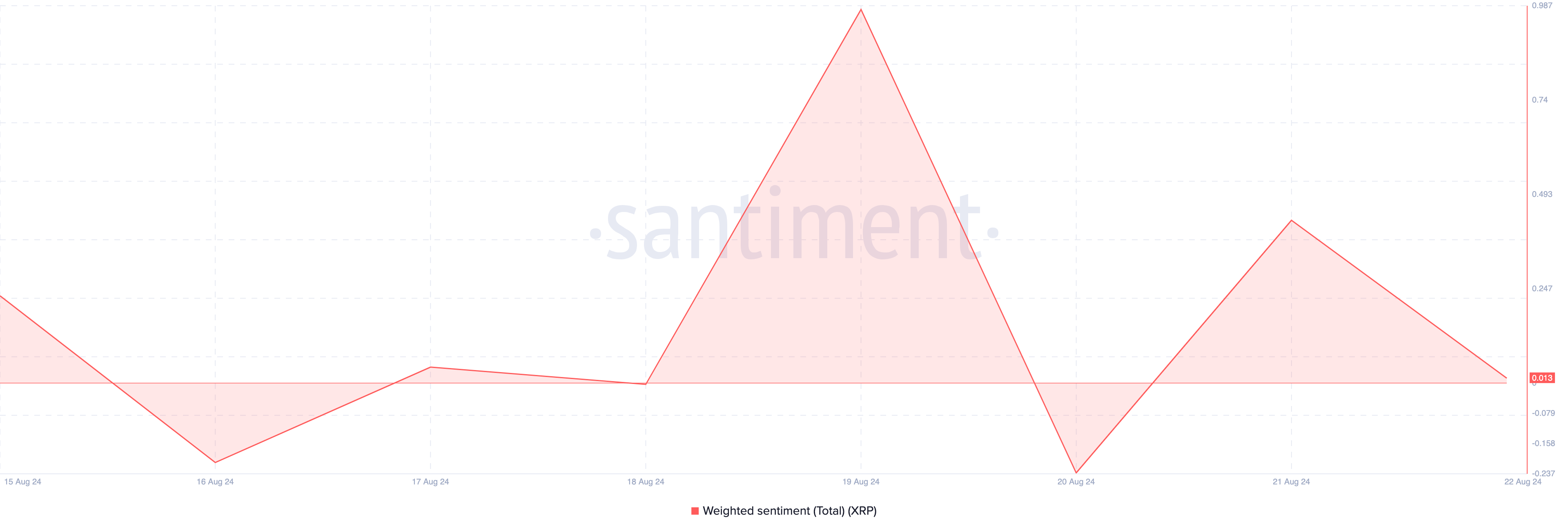

This cautious approach appears connected to XRP’s recent performance. Both traders in the derivatives market and the broader market have started to temper their bullish outlook on XRP. This shift is reflected in the Weighted Sentiment metric, provided by the on-chain analytics platform Santiment.

Weighted Sentiment gauges how positively or negatively market participants feel about a cryptocurrency. When this metric rises and stays positive, it suggests high confidence that the price will increase. Conversely, a negative reading indicates pessimism in market sentiment.

Currently, the metric is nearing negative territory, signaling a decline in bullish sentiment. If it dips further, demand for XRP may weaken, potentially leading to a price drop below $0.59.

XRP Price Prediction: Next Stop Could Be $0.55

XRP price rally to $0.63 coincided with the partial conclusion of the Ripple-SEC lawsuit. However, while market participants expected a further increase, the crypto faced a failed breakout.

As seen in the chart below, bulls managed to keep XRP from dropping below $0.55. However, the token could face resistance at $0.60, which is a crucial psychological level. Interestingly, the Stochastic Relative Strength Index (Stoch RSI) has shown an upward trend.

Stoch RSI measures a cryptocurrency’s momentum based on the speed and magnitude of price changes. The indicator typically signals an overbought status when the reading hits 80.00 and an oversold status when it drops below 20.00.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

For XRP, the Stoch RSI currently reads 87.24, signaling an overbought status. This could potentially lead to a pullback, pushing the price back to $0.55. However, if buying pressure builds or the broader altcoin market rallies, XRP’s price could bounce toward $0.63.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/ripple-xrp-traders-scale-down/

2024-08-23 16:45:00