Interest in Toncoin (TON), the native token of The Open Network, has surged to an all-time high. This spike follows the arrest of Telegram CEO Pavel Durov in France.

However, the arrest’s impact on the Telegram-linked cryptocurrency goes beyond just heightened interest, as this analysis uncovers several other key effects.

Pavel Durov’s Arrest Drives Surge in Toncoin Speculation

Earlier today, BeInCrypto reported that TON’s price fell sharply after the public knew that Durov had been apprehended. According to our findings, the CEO of the Telegram messaging app faces charges ranging from conspiracy and money laundering to terrorism.

As a result, Toncoin’s Open Interest (OI) soared to $294.14 million, marking its highest level since the token’s launch. OI tracks the value of active contracts in the derivatives market.

An increase in OI often suggests more buyers than sellers, but that’s not always true. In this case, the significant spike indicates that traders are increasingly engaging in contracts tied to Toncoin, reflecting heightened market activity and interest.

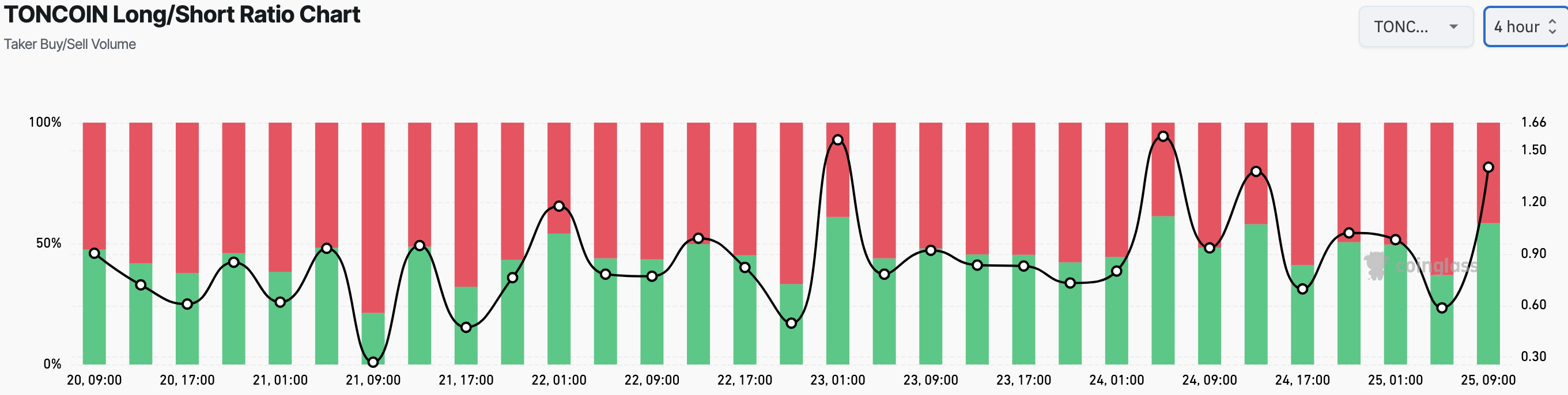

The Long/Short Ratio has moved from 0.58 to 1.40 within the last four hours. The Ratio measures investors’ expectations about a cryptocurrency. When the value is lower than 1, traders anticipate a price decrease.

Therefore, the recent jump indicates that a large part of those with open contracts expect TON’s price to rebound in the short term.

Read more: 6 Best Toncoin (TON) Wallets in 2024

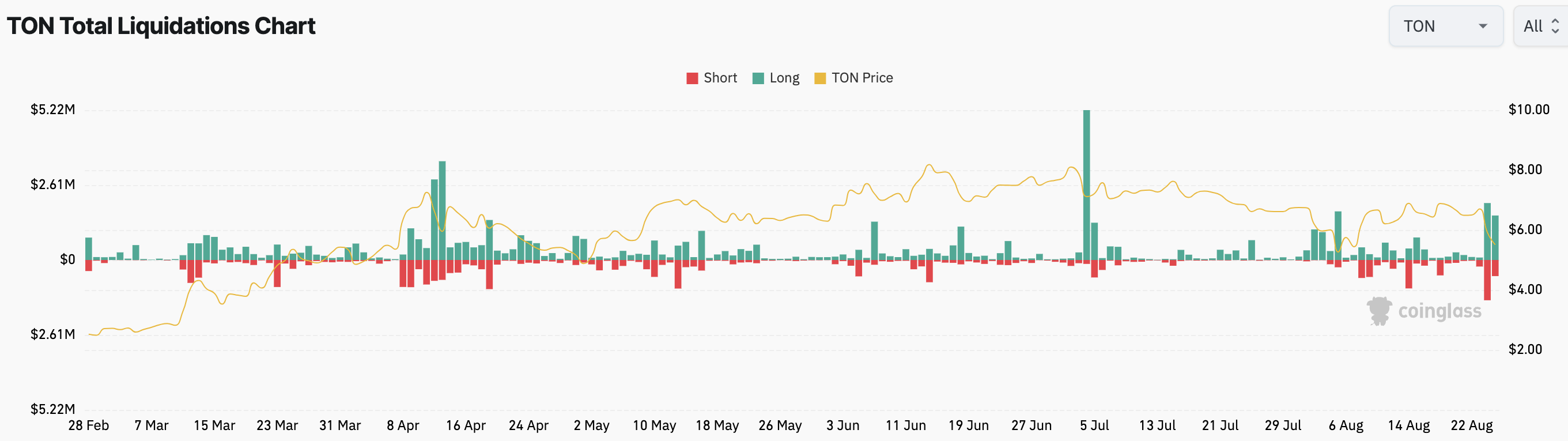

Meanwhile, Coinglass data shows that TON-related liquidations surpassed $2 million in the last 24 hours.

Liquidation happens when a trader’s margin balance falls below the required level, forcing the exchange to close the position. In TON’s case, the rapid price drop following Durov’s arrest largely triggered the liquidations.

It’s important to note that liquidations, coupled with rising OI, can influence price trends. Given the spike in Open Interest alongside substantial long liquidations, TON’s price might experience further declines before any potential recovery.

TON Price Prediction: Recovery Is Underway

The hourly chart shows that Telegram CEO Pavel Durov’s arrest triggered a sharp drop in Toncoin’s price from $6.80 to $5.33. This decline pushed the Relative Strength Index (RSI) into oversold territory.

The RSI measures momentum to indicate whether an asset is overbought or oversold. An RSI above 70.00 signals overbought conditions, while a reading below 30.00 indicates oversold levels.

In this case, the RSI on Toncoin’s hourly chart plunged to 13.60, clearly showing it was oversold. However, the RSI has since rebounded, suggesting that market participants are taking advantage of the dip by buying at lower prices.

This is also evident in TON’s price. Within the last hours, it increased by 5% and retested $5.66. The Fibonacci retracement series on the daily chart also gives insights into TON’s next movement.

Given the activity revealed on the hourly chart, TON’s price could be set for a notable rebound. If buying pressure continues to increase, TON could head to the 61.8% golden ratio. Should this be the case, the cryptocurrency’s value might hit $6.13.

Read more: Top 7 Telegram Tap-to-Earn Games to Play in 2024

Additionally, TON could see a faster-than-expected recovery if Durov is released within the next few days. However, this outlook might change if French authorities hold the Telegram CEO for an extended period. In that case, TON could face renewed selling pressure, potentially driving its price down to $5.55.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/toncoin-open-interest-jumps-following-durov-arrest/

2024-08-25 16:00:00