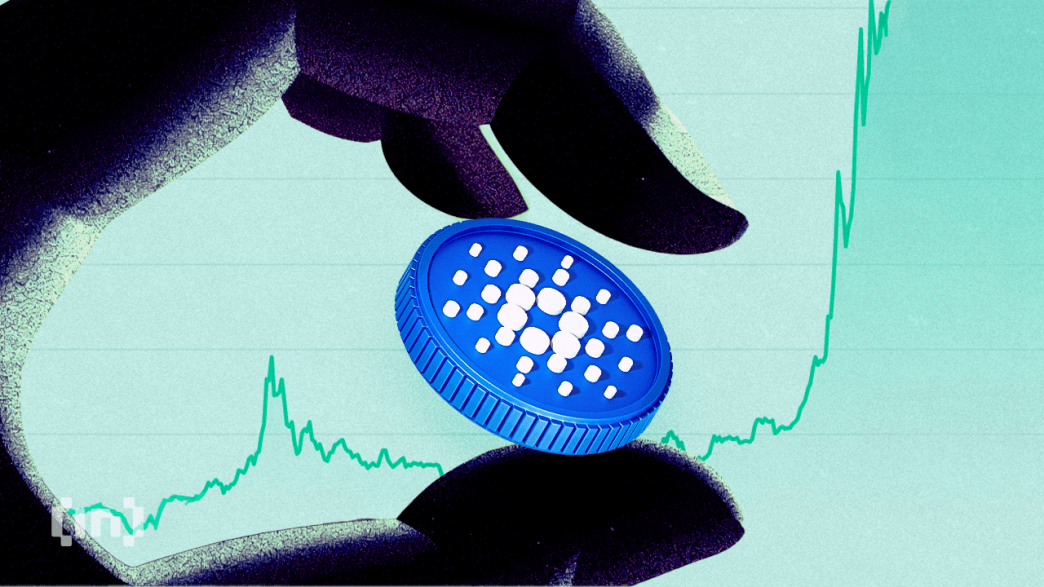

Cardano (ADA) has been trading below a descending trend line since May 20. Currently priced at $0.37, the altcoin’s value has fallen by 24% during this period.

However, ADA has experienced a resurgence in demand over the past week, driving its price closer to the trend line. The technical setup on the one-day chart indicates a potential breakout above this resistance level.

Cardano Makes a Move Toward the Trend Line

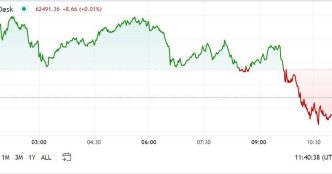

ADA’s price has risen by 8% in the past seven days, aligning with the broader market growth, reflected in a 5% increase in global cryptocurrency market capitalization during the same period. The coin’s rising On-Balance-Volume (OBV) suggests strong market demand has fueled ADA’s price growth.

The OBV indicator measures buying and selling pressure; when it increases, it indicates that buying pressure is outpacing selling, signaling a bullish trend. At press time, ADA’s OBV stands at 42.54 billion.

Further, ADA’s positive Elder-Ray Index further supports the bullish trend. The indicator has consistently posted positive values since the uptrend began seven days ago. Currently, ADA’s Elder-Ray Index is above zero at 0.0088.

The Elder-Ray Index gauges the balance of power between buyers and sellers. A positive value indicates that buyers are in control, signaling strong bullish momentum in the market.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

Since August 25, ADA’s Awesome Oscillator (AO) has been displaying upward-facing green histogram bars. This indicator tracks market momentum. When the AO shows green, upward-facing bars, it usually indicates the oscillator is above the zero line, confirming bullish momentum in the market.

ADA Price Prediction: Demand Will Push Coin Above Trend Line

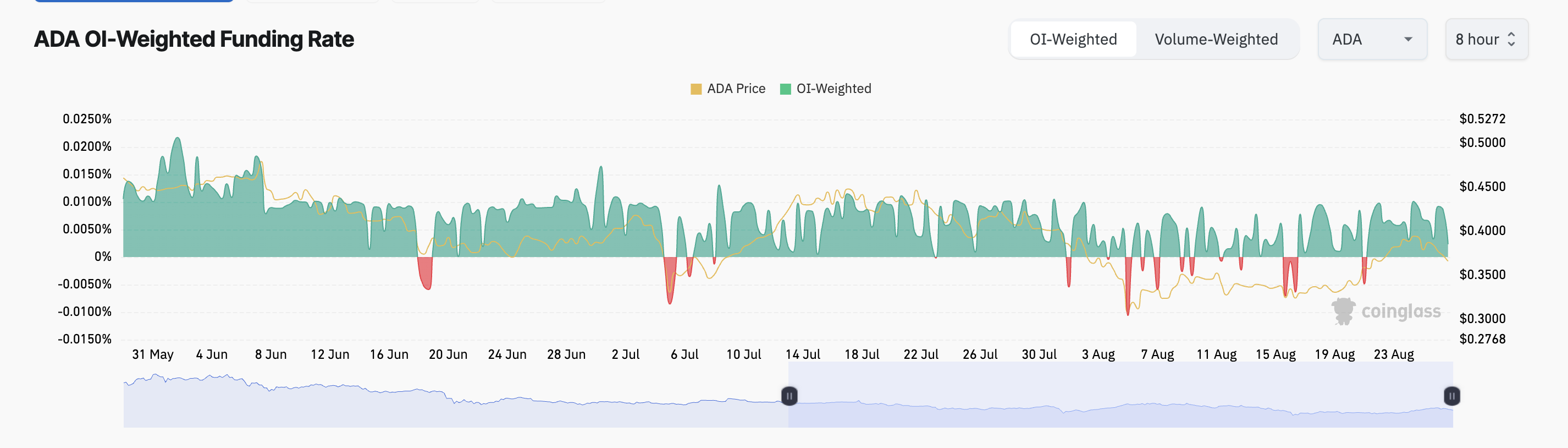

Bullish sentiment also remains strong among ADA’s futures traders, as indicated by its positive funding rate. As of this writing, the altcoin’s funding rate is 0.0023%.

Funding rates in perpetual futures contracts help maintain the contract price near the spot price. A positive rate suggests higher demand for long positions than short ones, indicating more traders are betting on a price rally than a decline.

If ADA continues to see accumulation from market participants, it could break above the descending trend line and reach $0.39.

Read more: Who Is Charles Hoskinson, the Founder of Cardano?

However, if the market trend shifts and sell-offs increase, the altcoin’s value could drop to $0.27.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ada-attempts-to-break-above-trend-line/

2024-08-27 12:00:00