August has seen a market downturn, leading to price dips for many assets. Whales, aiming to capitalize on the current conditions, have started accumulating certain altcoins in anticipation of potential gains in the coming month.

The assets seeing increased interest from whales include Toncoin (TON), Uniswap (UNI), and Lido (LDO).

Toncoin (TON)

The value of Toncoin (TON) has dropped by 21% since August 24, following the arrest of Telegram CEO Pavel Durov. TON whales have taken advantage of this price decline to boost their holdings, as reflected by a 307% surge in its large holders’ netflow, according to data from IntoTheBlock.

A large holder is defined as an address holding over 0.1% of an asset’s circulating supply. The large holders’ netflow metric tracks the buying and selling activity of these significant holders.

Read more: 6 Best Toncoin (TON) Wallets in 2024

When the metric skyrockets like this, it indicates that whales are buying more coins. This bullish signal often encourages retail investors to increase their holdings as well. If whale accumulation continues, it could spark a broader market demand for the altcoin, potentially leading to a price rebound.

Uniswap (UNI)

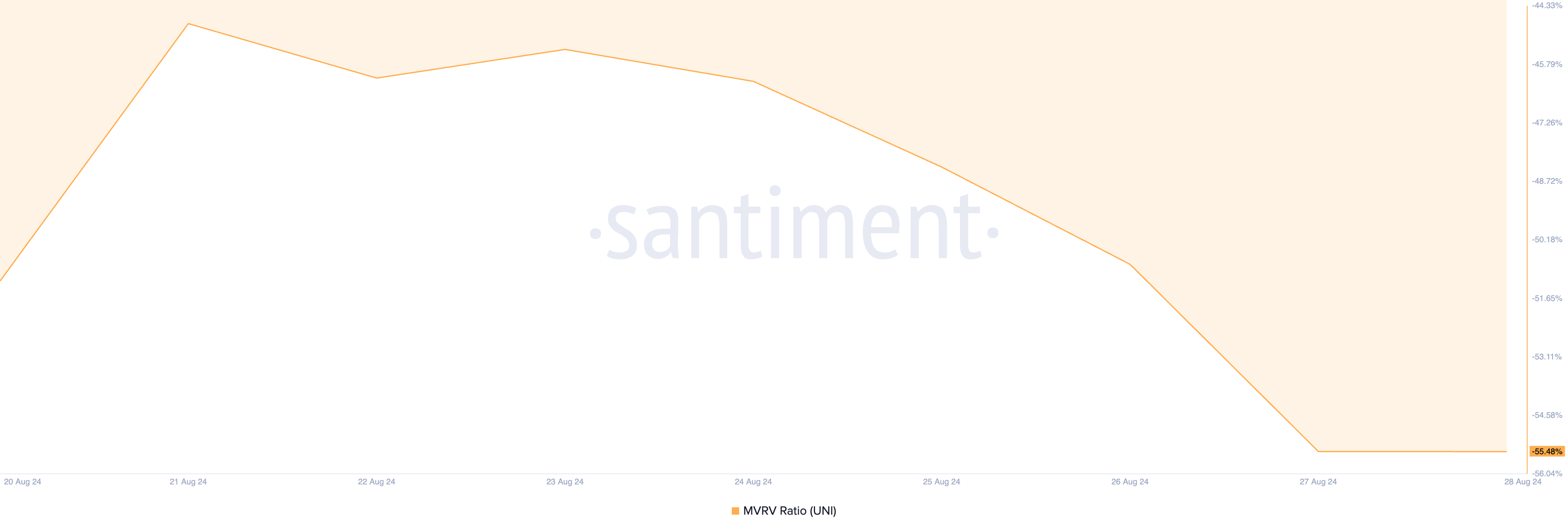

Over the past month, Uniswap native token’s value has fallen by 27%, with the altcoin currently trading at $5.71. Despite this decline, the drop presents a potential buying opportunity, as indicated by its negative market value to realized value (MVRV) ratio.

When an asset’s MVRV ratio is below zero, it indicates that the asset is undervalued. This means its current price is lower than the average price of all its tokens in circulation, offering a potential opportunity for investors looking to “buy the dip.”

Recognizing UNI’s undervalued status, whales have increased their accumulation of the token.

Data from Santiment reveals that the number of UNI whales holding between 1,000 and 1 million UNI tokens has increased by 1% over the past month. As of now, this group consists of 5,595 addresses, marking its highest count since January 10.

Lido (LDO)

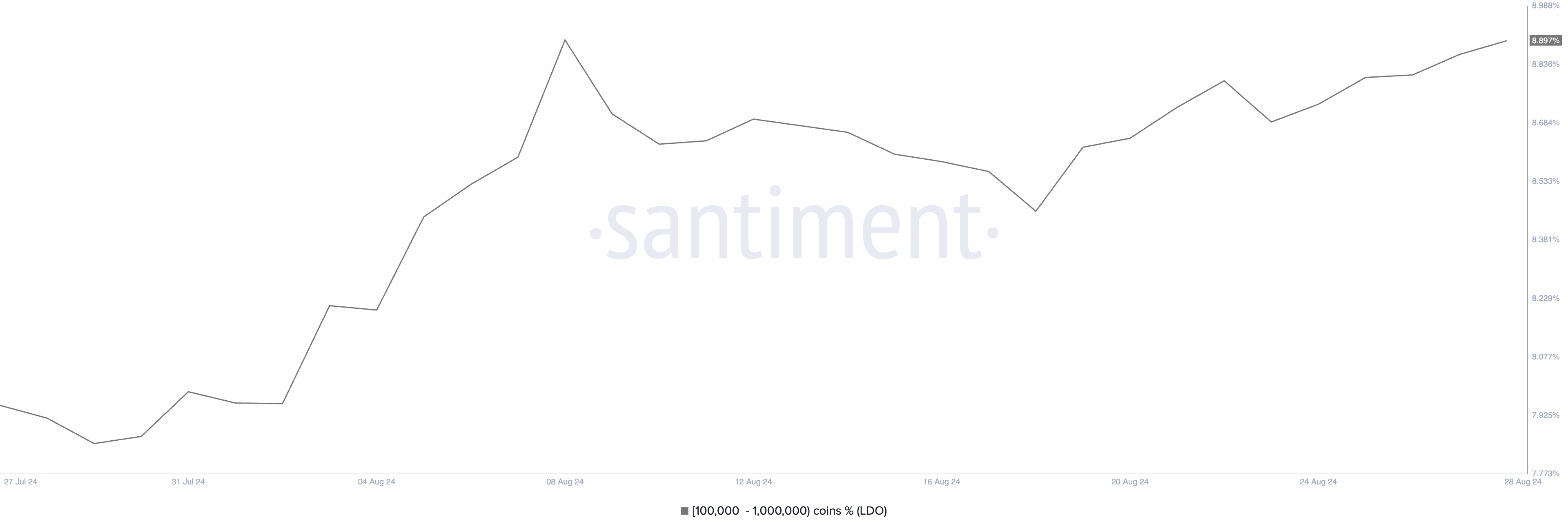

LDO, the token powering the leading decentralized finance (DeFi) protocol Lido, has also attracted increased attention from whales in recent days. According to Santiment, whales holding between 100,000 and 1,000,000 LDO tokens now control 9% of the total circulating supply of the altcoin.

Read more: 11 Best DeFi Platforms To Earn With Lido’s Staked ETH (stETH)

The platform’s data shows that the number of addresses holding between 100,000 and 1,000,000 LDO tokens has surged by 4% over the past month. This increase indicates that more large investors are accumulating LDO, signaling growing confidence in the token’s potential.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/what-crypto-whales-are-buying-for-september-gains/

2024-08-28 16:00:00