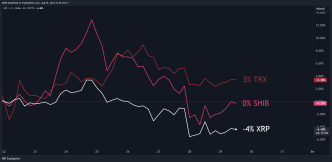

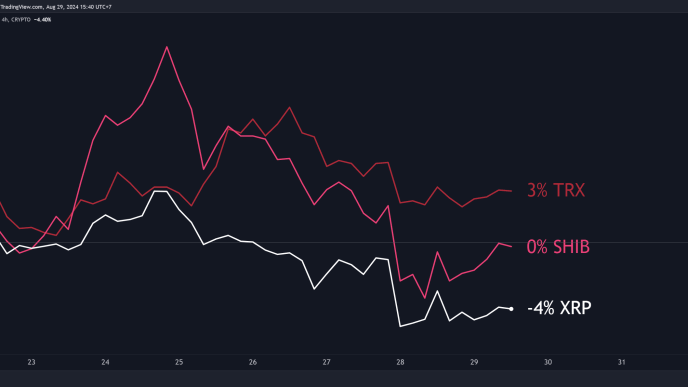

Ripple’s native token, XRP, has maintained a relatively stable trading pattern over the past month, moving within a narrow price range. Although it dipped below its horizontal channel during the market decline on August 5, XRP managed to recover and resume its sideways movement.

Despite the limited price fluctuations, most daily transactions involving XRP have been more profitable than not, indicating a resilience in its trading behavior.

Ripple Holders Smile to the Bank

The daily ratio of XRP’s transaction volume in profit to loss, assessed using a 30-day moving average, shows that more transactions have been profitable than those resulting in a loss over the past month. As of this writing, this stands at 1.2, suggesting that for every XRP transaction that ends in a loss, 1.2 transactions result in a profit.

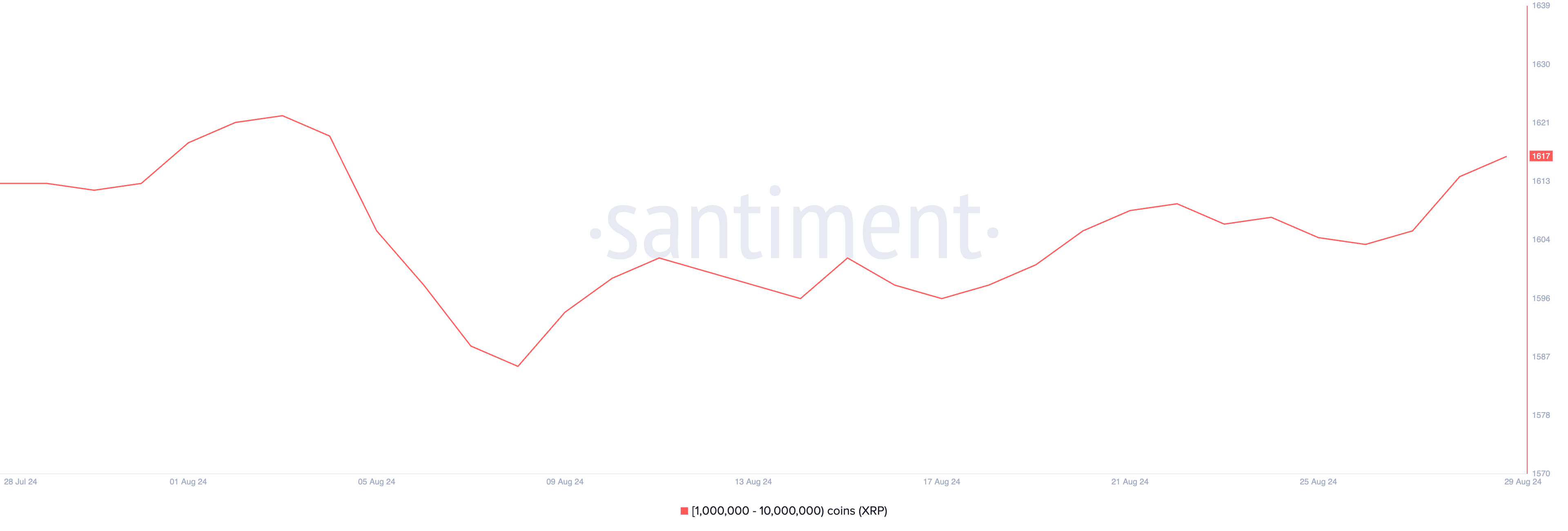

Within the review period, XRP whales have increased their trading activity. Santiment’s data shows a spike in the number of XRP whale addresses that hold between 1,000,000 and 10,000,000 XRP tokens. At press time, this cohort is comprised of 1617 addresses, with its count surging by 2% since August 9.

Read more: XRP ETF Explained: What It Is and How It Works

The rise in the number of whales holding an asset is a bullish signal. It indicates a strong demand for the asset and may boost the confidence of retail traders, leading to more buying activity, which may occasion an asset’s price rally.

XRP Price Prediction: Trouble Lies Ahead

As of now, XRP is trading at $0.57 and has been moving within a horizontal channel since July 17. When the asset’s price fluctuates within a specific range, it creates a channel that reflects a balance between buying and selling pressures, preventing the price from making a strong move in either direction.

In this case, the upper boundary of the channel acts as resistance, while the lower boundary serves as support. XRP has encountered resistance at $0.63 and found support at $0.54.

Currently, a bearish bias is evident, with selling pressure outweighing buying activity. This is reflected in the declining Chaikin Money Flow (CMF) for XRP, which is trending downward and currently sits at -0.08. The CMF indicator measures the flow of money into and out of an asset. Its negative value suggests market weakness, indicating that selling pressure is high.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

If this trend continues, XRP’s price may move toward the support line of its horizontal channel. Should the bulls fail to defend this level, the downtrend could push the token’s price down to $0.50.

On the other hand, if the bulls regain control, XRP could climb towards the resistance level and attempt to break through it. Success in breaching resistance might see XRP trading at $0.66.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-holders-turn-profits-despite-muted-performance/

2024-08-29 08:18:30