Dogecoin (DOGE) has remained largely unaffected after US District Judge Alvin Hellerstein dismissed a lawsuit against Elon Musk and Tesla, which alleged that they manipulated the coin’s price.

As of press time, DOGE is trading at $0.10, showing a 0.18% price decline and a 24% drop in trading volume over the past 24 hours.

Dogecoin Seeks to Extend Decline

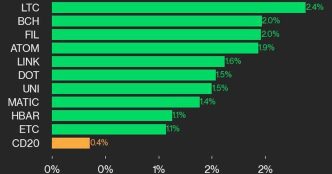

DOGE’s muted reaction to Judge Hellerstein’s ruling can be attributed to the bearish pressure currently weighing on the altcoin. Its technical setup on a 12-hour chart indicates that bears are dominating the market, pushing to extend its month-long decline.

For instance, DOGE’s Directional Movement Index (DMI) shows the positive directional indicator (+DI) in blue lying below the negative directional indicator (-DI) in red, signaling continued bearish control.

An asset’s Directional Movement Index (DMI) measures the strength and direction of a trend. When the +DI falls below the -DI, it signals a strong downtrend, indicating bearish market conditions where selling pressure dominates and a continued price decline is likely.

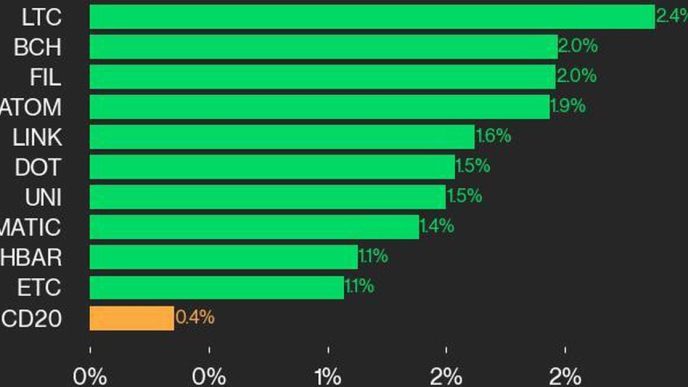

Additionally, DOGE’s Chaikin Money Flow (CMF) recently crossed below its zero line, signaling weakening buying pressure. Currently, the indicator stands at -0.05.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

The CMF measures the flow of money into and out of an asset’s market. A CMF value below zero suggests market weakness and liquidity outflow, which traders often interpret as a precursor to a sustained price decline during a downtrend.

DOGE Price Prediction: Coin Risks Falling to August 5 Low

DOGE’s derivatives market has also seen a decline in trading volume over the past 24 hours, dropping by 24% to $650 million.

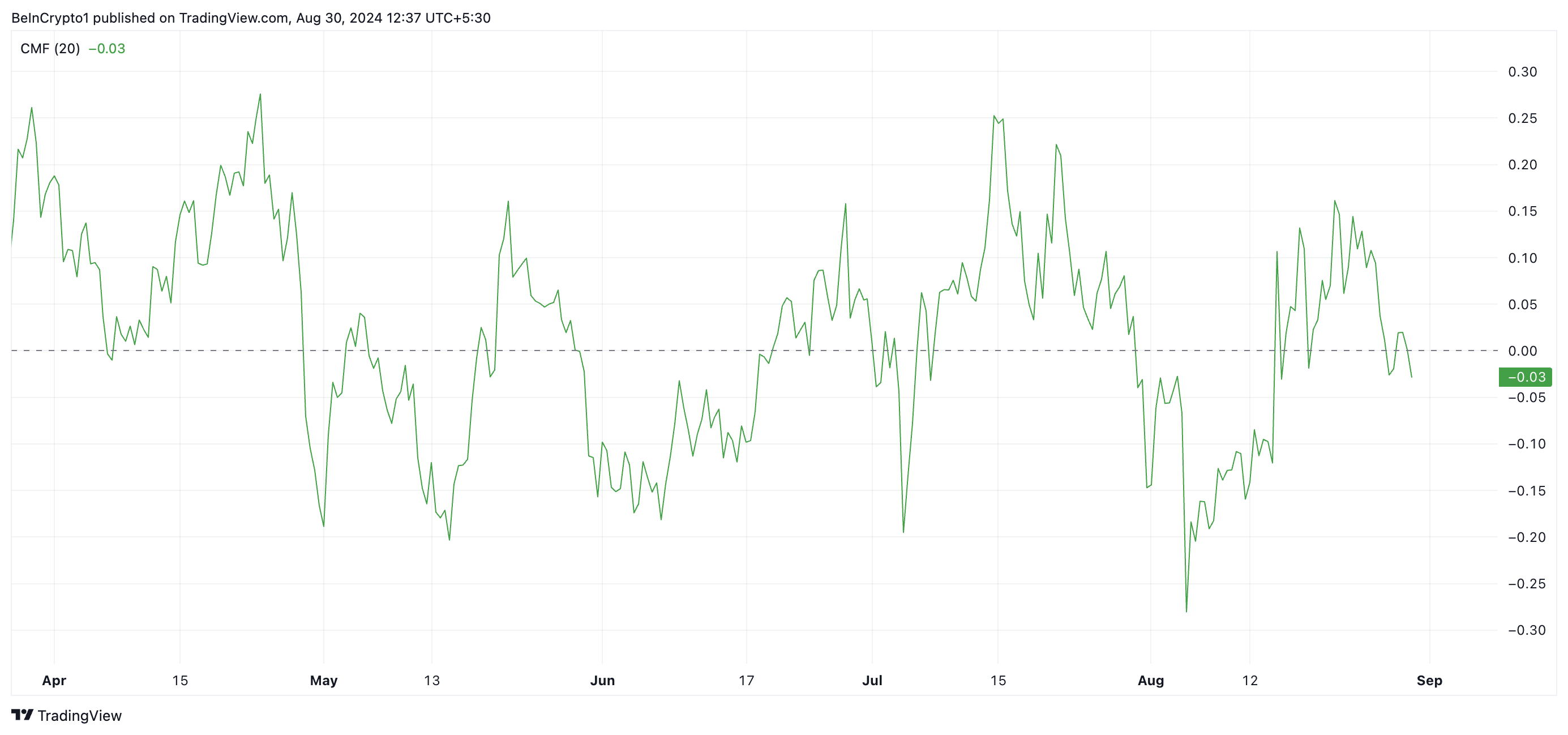

Despite DOGE’s technical indicators suggesting an extended downtrend, futures traders continue to open long positions, as shown by its positive funding rate across cryptocurrency exchanges. Currently, DOGE’s funding rate stands at 0.008%.

A positive funding rate indicates that there is more demand for long positions, meaning more traders are betting on a price rally than on a decline.

However, if selling pressure increases and DOGE continues its downward trajectory, its value could drop toward its August 5 low of $0.08, risking the liquidation of several long positions.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

Conversely, a bullish shift in market sentiment could lead to a 10% price surge, pushing DOGE to $0.11.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/dogecoin-elon-musk-court-win-reaction/

2024-08-30 13:00:00