Telegram, the popular social messaging app, is increasingly dependent on cryptocurrency, particularly through its integration with TON blockchain. This crypto activity now drives a significant portion of the platform’s revenue.

This revelation comes as its founder and CEO, Pavel Durov, faces legal scrutiny in France. Last week, a French court charged him over allegations that the app was used to facilitate illicit activities.

Telegram’s Revenue Heavily Reliant on Crypto

A recent Financial Times report reveals that Telegram generated $130 million from its integrated wallet services. This amount surpasses its earnings from advertising and premium subscriptions.

In September 2023, Telegram introduced a self-custodial wallet targeting crypto enthusiasts. This feature enables users to store, send, receive, and trade crypto assets within the app, bypassing other popular wallet providers like MetaMask.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

Further, the company also earned $17.8 million from selling digital collectibles, such as usernames and virtual phone numbers, with payments made in Toncoin, the native token of the TON blockchain. Together, these crypto-related activities brought in nearly $148 million, accounting for around 40% of Telegram’s annual revenue.

“Aside from purchasing $64 million of Telegram’s convertible bonds last year, Durov also purchased $300,000 worth of Telegram Premium subscriptions for a giveaway, paying the company in Toncoin,” the report added.

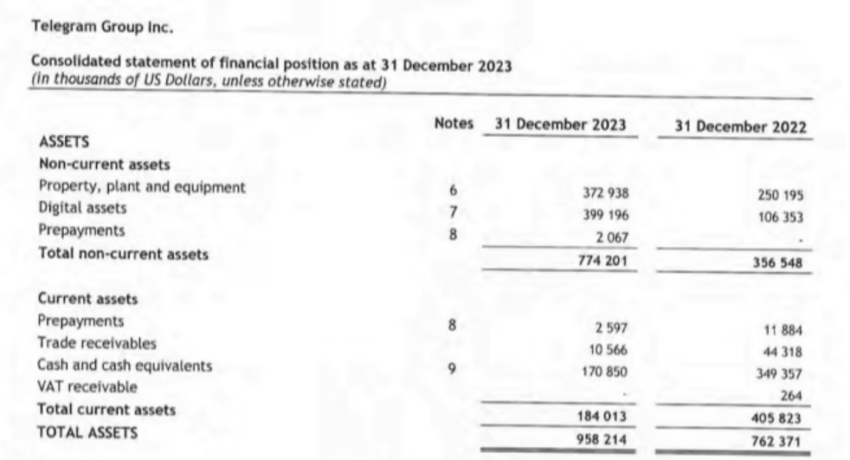

Telegram’s financial reports also show that the company holds $399.2 million in crypto assets, a sharp increase from $106.35 million in 2022. In contrast, its cash and cash equivalents for 2023 amounted to only $170.85 million, while real estate and equipment assets were valued at $372.94 million. This data suggests that crypto is now Telegram’s most valuable asset.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Meanwhile, the report did not specify which cryptocurrencies Telegram holds, but community speculation points to Toncoin as the primary asset due to its central role in the platform.

Despite its substantial crypto holdings and revenue, Telegram is operating at a loss. The company reported $108 million in losses for 2023 despite generating $342.5 million in revenue, indicating that its expenses reached $450.5 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Oluwapelumi Adejumo

https://beincrypto.com/telegram-crypto-revenue-report/

2024-08-31 13:08:17