XRP price rise delay is resulting in investors eyeing a price surge that could break a five-month resistance level, signaling a significant bullish momentum.

The outcome of this move could determine the token’s near-term trajectory, influencing market sentiment.

XRP Has a Bullish Setup Amidst Market Volatility

The micro outlook for XRP’s price remains positive. The token has managed to avoid a Death Cross, a technical pattern that usually signals a bearish trend. Instead, the Golden Cross that appeared at the end of July continues to suggest potential upward momentum.

This Golden Cross occurs when the 50-day exponential moving average (EMA) crosses above the 200-day EMA, signaling a bullish trend. This pattern has boosted investor confidence, helping keep the XRP price above the important $0.50 level.

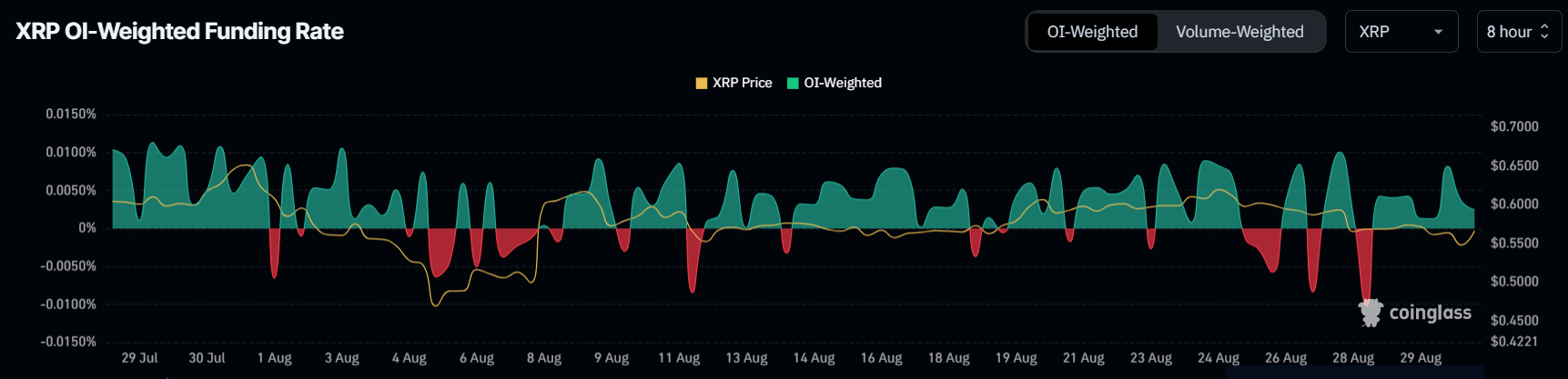

Additionally, XRP’s funding rate has shown consistent positivity over the past month, reflecting a bullish sentiment among investors. A positive funding rate typically indicates that traders are willing to pay a premium to hold long positions, betting on the price to rise.

With long contracts dominating the market, traders are expecting a price increase and are also actively positioning themselves to benefit from it. This dynamic creates a favorable environment for potential upward price movements, making the possibility of a breakout more likely if market conditions remain supportive.

Read more: XRP ETF Explained: What It Is and How It Works

This optimism is crucial as XRP hovers above the 23.6% Fibonacci Retracement line, a key level that has provided support in recent weeks.

The Crucial XRP Price Barrier

XRP price’s next major challenge lies in breaking the $0.64 resistance level, which aligns with the 50% Fibonacci Retracement line. This barrier has proven formidable, keeping the token from advancing since mid-March.

However, XRP would need to breach $0.60 to get there successfully. Flipping this level into support would also turn the 38.2% Fib line into a strong support zone, potentially paving the way for further gains.

If XRP price can achieve a 12% price increase, it could decisively overcome this resistance. This would mark a significant breakout that could lead to a sustained rally beyond the five-month-old resistance of $0.64.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Nevertheless, failing to break through $0.64 could result in another period of consolidation. XRP would still keep above the critical support of the 23.6% Fib line, but this would invalidate the current bullish thesis, leaving investors waiting for recovery and profits.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/xrp-price-eyes-breaking-barrier/

2024-08-31 13:00:00