Toncoin (TON), the native cryptocurrency of The Open Network, has experienced a challenging few weeks, with its price dropping 15% over the last 30 days to $5.21. This decline has resulted in unrealized losses for many short-term holders.

However, these same holders could play a crucial role in TON’s potential recovery, as they may seek to capitalize on future price rebounds.

The Market Begins to Work Toncoin’s Bounce

On September 2, IntoTheBlock data revealed a 53% hike in the number of traders. Traders, in this context, represent addresses that have been holding the token for the last 30 days.

There is also a 20% increase in the number of Cruisers — a terminology used to describe addresses that accumulated between the last 30 and 365 days. Long-term holders, however, saw only a slight increase.

Typically, a rise in short-term holders suggests strong confidence in price recovery. If this trend continues, TON may see reduced selling pressure, which could improve its chances of bouncing back from recent lows.

Read more: What Are Telegram Bot Coins?

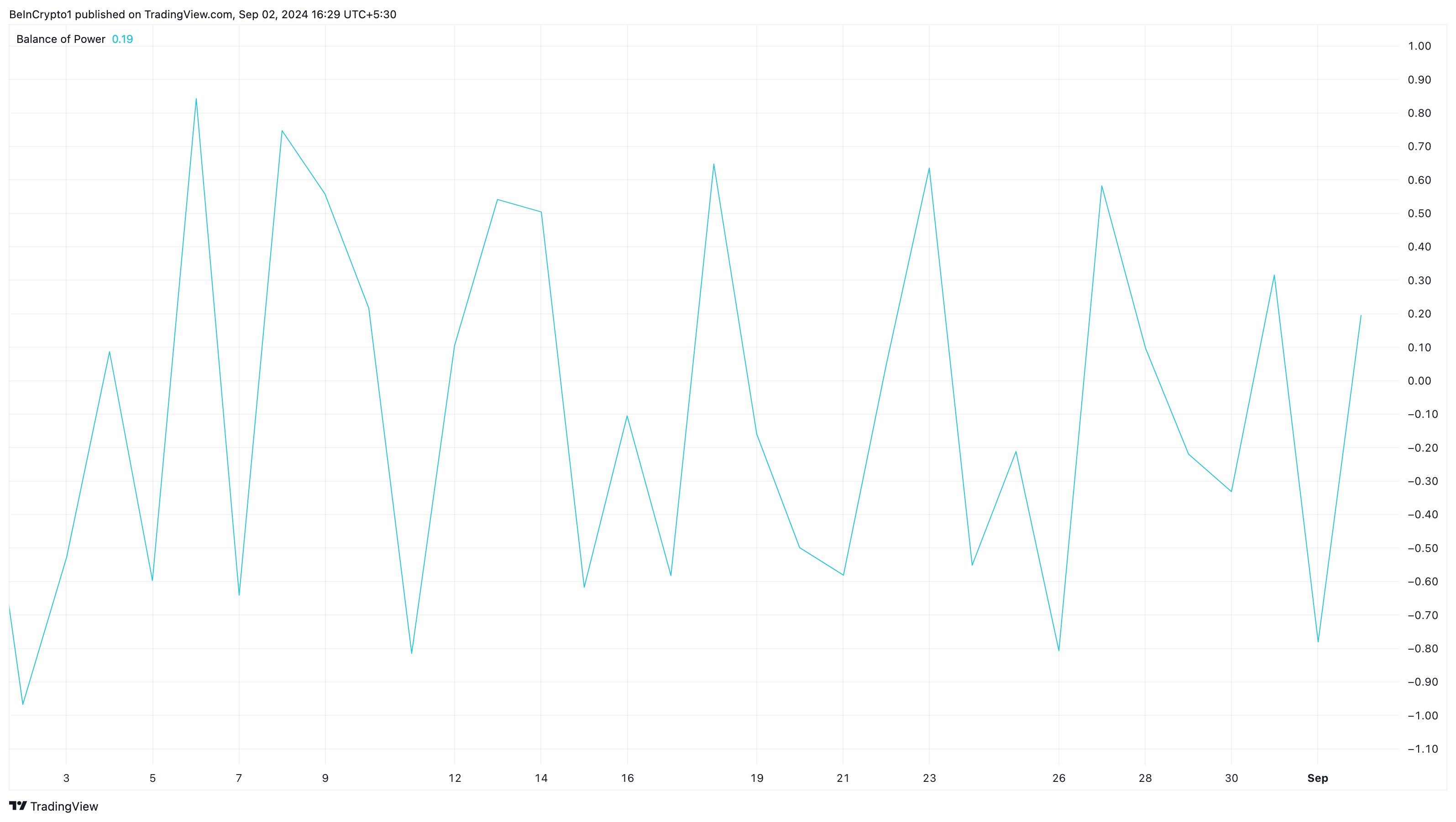

The daily chart indicates that the Balance of Power (BoP), a technical tool that measures the market strength of buyers versus sellers, supports a potential price rebound for Toncoin.

A higher BoP reading reflects increased buying pressure, while a drop suggests that sellers are in control and a price decline may follow. Currently, the BoP has spiked, indicating that Toncoin’s price could be set for a rebound.

TON Price Prediction: Hopes Not Yet Dashed

According to the daily chart, TON is currently trading around the $5.23 region, which previously led to a rally and now serves as a crucial demand zone, signaling a potential buy opportunity. However, for this bullish potential to be confirmed, other indicators like the Relative Strength Index (RSI) are needed.

As of now, the RSI indicates that momentum remains uncertain. If buyers return and start purchasing the dip, Toncoin could see a 10% increase, pushing it toward $5.76, but it may face resistance around $5.55.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

If TON breaks above $5.55, it could validate a run toward $5.76. However, if the token fails to surpass $5.55, it might drop below $5, with the next support level around $4.86.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/bulls-stop-toncoin-from-going-underwater/

2024-09-02 18:00:00