After shedding a large part of its value for some time, PEPE could be set for a significant price increase this month. Currently, the frog-themed meme coin is trading at $0.0000074.

If the anticipated trends play out as expected, PEPE might move closer to the peak it last reached in May. This on-chain analysis explores the factors that could drive this potential price recovery.

On-chain Data Reveals Bullish Signs for Pepe

According to on-chain data from Santiment, the Market Value to Realized Value (MVRV) Long/Short Difference dropped from 55% to 36% between August 24 and 31. Decreasing values of this metric suggest that short-term holders will realize more profits than long-term holders if they sell at the current price.

When this lingers, it implies that the market could be shifting toward a bear market. Increasing values, on the other hand, indicate that long-term holders are realizing more profits.

For PEPE’s price, the MVRV Long/Short Difference quickly turned toward 39.87%. This increase aligns with the latter interpretation mentioned above. Should this continue, the token could kick off another round of the bull market, which appears to have taken a break.

Read more: 5 Best PEPE Wallets for Beginners and Experienced Users

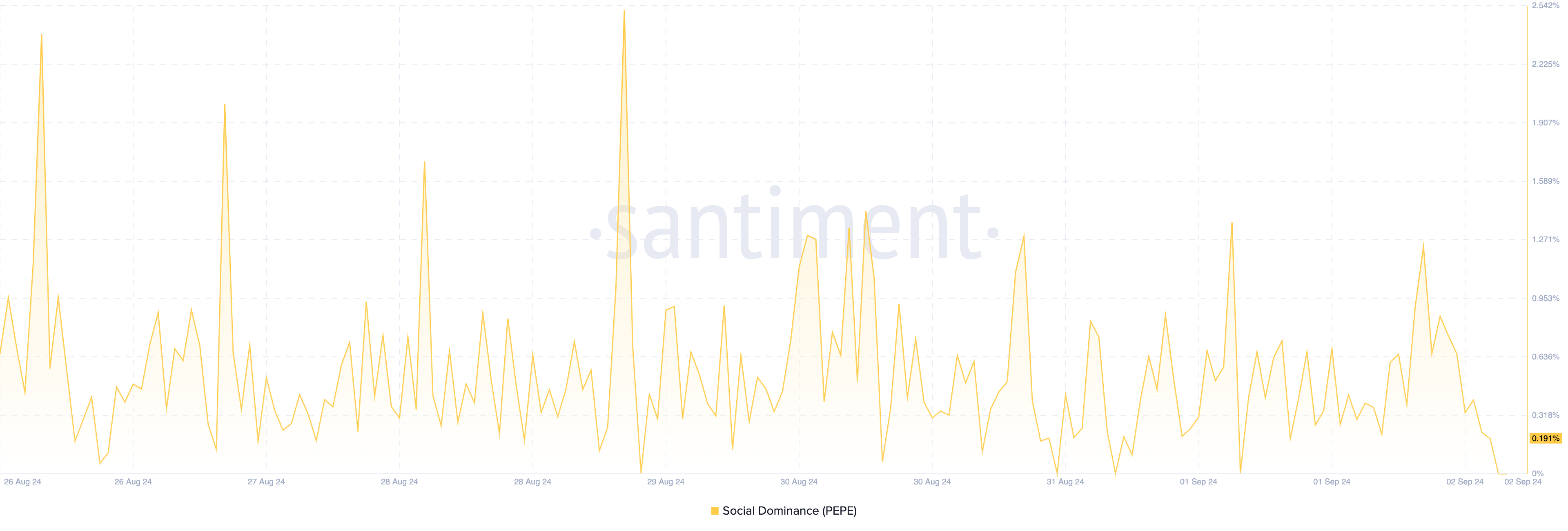

Furthermore, data from the same analytic platform indicates that PEPE might have reached its bottom. This conclusion is drawn from the social dominance metric, which tracks how much a cryptocurrency is being discussed.

Typically, when social dominance is very high, it signals a local price top. However, in PEPE’s case, the metric has dropped to a level that historically precedes a significant price rebound. If history repeats itself, the meme coin could be poised for a bullish run.

PEPE Price Prediction: $0.000010 Before This Month Ends?

Based on the daily chart, the potential rebound depends on maintaining a price above $0.0000070. If it stays above this level, the meme coin could recover some recent losses.

Historically, dropping below this point has led to a decline between $0.0000058 and $0.0000063. However, if buying pressure increases, the price could rise toward $0.0000087 and possibly revisit the $0.000010 resistance level. The fact that PEPE has broken above the descending triangle supports this outlook.

Read more: PEPE Price Prediction 2024/2025/2030

However, this forecast might not come to pass if the token slips below $0.0000070. Should this happen, the cryptocurrency might slide to $0.0000063.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/pepe-price-hints-at-gains-and-bull-market/

2024-09-02 19:30:00