With the market at an extremely volatile position, SUI bears pushed their advantage forcing losses on the token’s holders. Despite strong developments on-chain, SUI still flashed red with over a whopping 23% losses since last week.

On-chain, SUI continues to solidify its position in the world of DeFi. However, with the market’s sway on the token, its short-term performance might be clouded by the fear, uncertainty, and doubt present in the market.

Related Reading

NFTs And Gaming Fuel Sui Development

DARKTIMES, an MMORPG game built on Sui, has announced that it will launch the game’s Alpha state will release later this year. The game has been in stealth development since 2021 according to the founder and CEO of DARKTIMES, Lucien Dormann, in an interview. Users will catch the playtest of the game at Korea Blockchain Week which will occur September 3-4 this week.

The battle draws nigh! 🛡️

36 combatants will enter. Only one can win.

Feast your eyes on the rich world of @playDARKTIMES 👀

Featuring seven medieval realms. Five deadly characters. And a trove of ownable assets.

All powered by Sui, for fast-paced action that never… https://t.co/28Hsjc8tza

— Sui (@SuiNetwork) August 30, 2024

This development came hand in hand with the recent announcement that SuiPlay OX1, the platform’s handheld gaming console, will officially be open to pre-order in the next ten hours. No spec sheet has been released yet, but the console will be available in 2025.

In the realm of NFTs, the platform has been chosen by Artifi, an art investment company, which is “to turn high-end art into another asset class that’s accessible to the masses.”

Ready / Sui // Play ➡️

😎”A gaming revolution”

Pre-orders for the #SuiPlay0X1 coming 👀very 👀 soon.👀 pic.twitter.com/LLIhTumWa6

— SuiPlay (@SuiPlayOfficial) August 29, 2024

The resurgence of NFTs on Sui came despite the asset class being under the scrutiny of the Securities and Exchange Commission (SEC) which alleged that NFTs are securities and is willing to bring the regulatory hammer down on Opensea. How will this affect the future of NFTs and NFT-based developments on Sui in the long term remains to be seen.

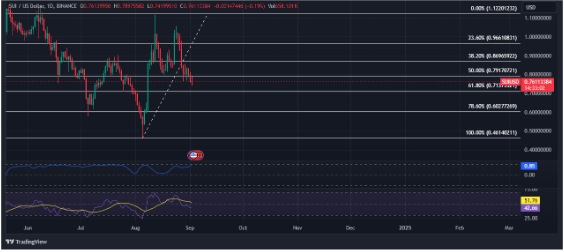

SUI To Return To Manageable Levels After Market Pressure

Despite the overall bearishness plaguing the broader market, investors and traders should remain optimistic. SUI is currently trading right between the $0.71-$0.79 trading range which lies well on the 61.80% level of the Fibonacci retracement tool, marking the significance of the range when it comes to the long-term performance of the token.

Related Reading

The token’s relative strength index (RSI) still signals that the bears overwhelm the market. However, SUI’s return to this level remains a bullish signal as the 61.80% level will provide the bulls with a strong support level to aid future price movement.

SUI’s strong correlation with major cryptocurrencies like Bitcoin and Ethereum will give the token the momentum it needs to recover in the medium term; that is if market sentiment flips to bullish within this timeframe. If the token stabilizes in its current trading range, SUI bulls should have the opportunity to retest and potentially break $0.96 in the long term.

Featured image from Chainwire, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/sui-crashes-23-as-september-unleashes-market-panic-is-a-comeback-possible/

2024-09-02 21:30:21