Uniswap (UNI), the governance token of the decentralized finance protocol on Ethereum, has posted impressive gains over the past seven days. The recent settlement with the Commodities Futures Trading Commission (CFTC) further contributed to the overall positive outlook.

However, despite Uniswap’s recent gains, data indicates that a short-term pullback may be on the horizon as the broader market experiences challenging conditions.

Uniswap Surge Causes Greed in the Market

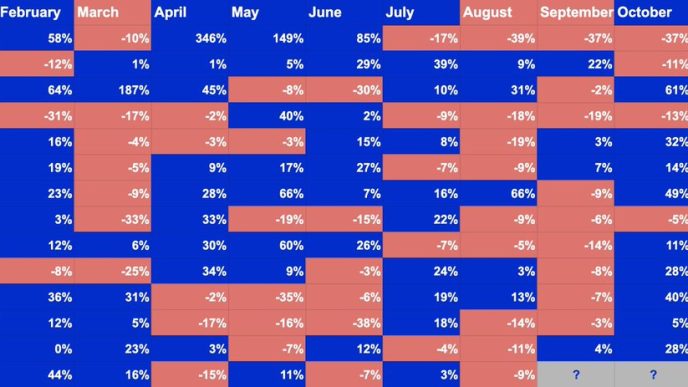

An overview of the top 20 cryptocurrencies shows that nearly all have posted negative returns over the past week. However, Uniswap (UNI) has bucked this trend with an 8.57% price increase. Following this development, on-chain data from Santiment revealed a notable spike in Uniswap’s social dominance.

Social dominance refers to the percentage of discussions about a specific asset compared to other top 100 cryptocurrencies. A higher ranking means more posts or messages are being shared about that asset.

In Uniswap’s case, social dominance surged to 4%, indicating that conversations around the altcoin are among the most prevalent today. Importantly, social dominance is often linked to price movements, with increased attention potentially influencing market behavior.

Read more: How To Buy Uniswap (UNI) and Everything You Need To Know

From a price perspective, the surge in Uniswap’s social dominance signals a potential Fear of Missing Out (FOMO), as late buyers tend to enter the market during these periods. Historically, this often precedes a price decline.

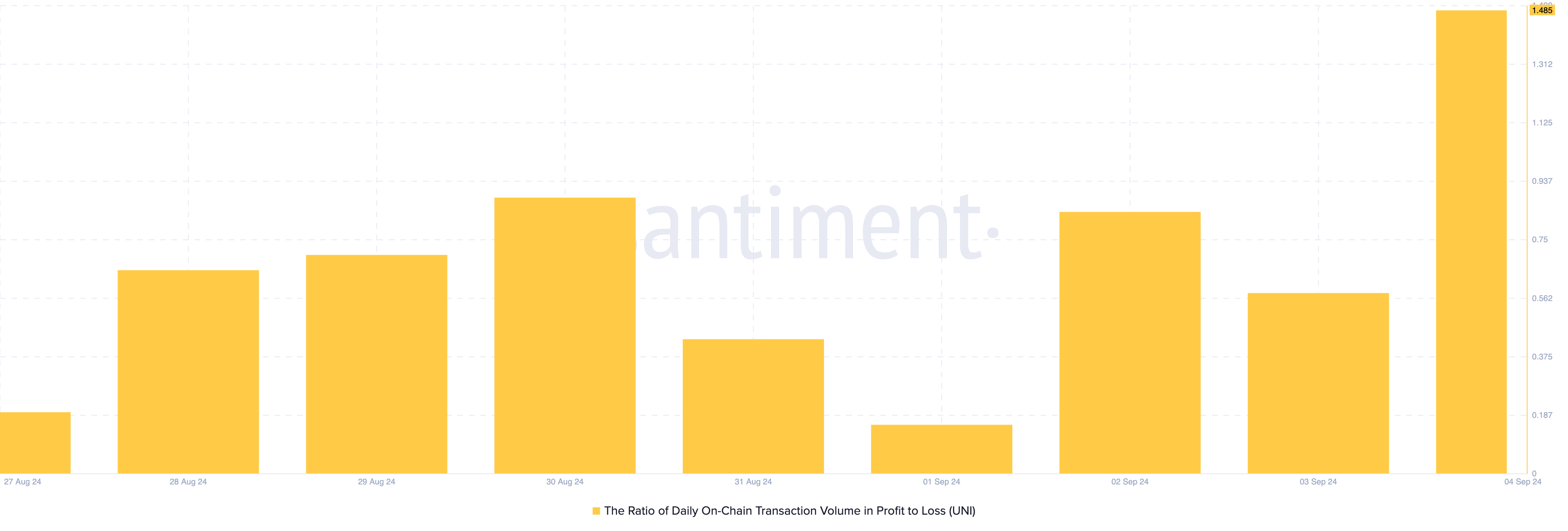

Additionally, the ratio of daily on-chain transaction volume in profit to loss has risen to 1.48, meaning more market participants are realizing gains than losses. Typically, a negative reading suggests high realized losses.

However, in Uniswap’s case, the massive rise in the positive region indicates that market participants are making more profits. Should this continue, UNI’s price might drop below the height it has recently released.

UNI Price Prediction: The Token Is Set to Fall Below $6

According to the 4-hour UNI/USD chart, the token has formed higher lows. This indicates that it might have a good chance of reaching a higher value. However, as the price increased, so did the Relative Strength Index (RSI).

The RSI is a technical oscillator measuring momentum, and vital in spotting overbought and oversold conditions. Ratings over 70.00 mean a cryptocurrency is overbought, while those at 30.00 or below mean it is oversold. At press time, UNI is trading at $6.45, with a Relative Strength Index (RSI) of 64.77, indicating it is nearing the overbought zone.

Read more: Uniswap (UNI) Price Prediction 2023/2025/2030

If Uniswap enters this region, a reversal could occur, potentially driving the token’s price down to $5.64. However, if buying pressure increases, this forecast could be invalidated, and UNI’s price may rise to $6.67 instead.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/uniswap-rises-as-highest-altcoin-gainer/

2024-09-04 18:55:27