On Tuesday, BlackRock’s iShares Bitcoin ETF recorded another day of zero inflows, while US spot Bitcoin (BTC) ETFs continued their streak of negative flows.

At the same time, US authorities issued a warning about an imminent threat from North Korean hackers targeting crypto firms, particularly those involved in the expanding Bitcoin ETF market.

BlackRock Records Zero Flows in 4 of 5 Trading Days

According to Farside Investors, BlackRock’s spot Bitcoin ETF has recorded no inflows since August 27, except for August 29, when it saw $13.5 million in outflows. Despite this, the ETF’s cumulative net inflows since its launch on January 11 are nearing $21 billion.

Meanwhile, SosoValue data shows that 12 spot Bitcoin ETFs recorded net outflows totaling $287.78 million on Tuesday, the largest since May 1. Fidelity led the outflows with $162.3 million, followed by Grayscale at $50.4 million.

Additionally, total trading volume remains stagnant, hitting $1.56 billion on Tuesday, just slightly above Friday’s $1.54 billion, following the US Labor Day.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

On the other hand, Ethereum ETFs extended the chain of outflows with up to $47.4 million in negative flows on Tuesday. Notably, this marked the most significant daily negative flows since August 2. However, ETF analyst Eric Balchunas remains optimistic, saying there is light at the end of the tunnel.

“Ether ETFs went backward in the first month.. flows -$476 million as the newbies couldn’t overcome the ETHE unlock, too powerful a force (this is why I reiterated how heroic the New Nine bitcoin ones were) but the good news is the unlock will end, there’s light at end of the tunnel,” Balchunas wrote.

North Koreans Targeting US Bitcoin ETF Firms, FBI Says

Balchunas’s statement comes amid ongoing customer redemptions from Grayscale. At the same time, the US Federal Bureau of Investigations (FBI) has raised concerns about North Korean criminals targeting the US Bitcoin ETF market, adding further pressure to the crypto space.

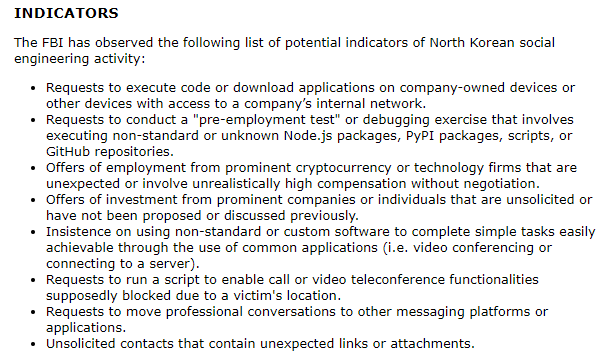

According to the FBI, North Korean criminals are using sophisticated technical tactics to target employees in the crypto industry, particularly those in Bitcoin ETF firms and DeFi companies. The criminals are engaging in “difficult-to-detect social engineering campaigns,” according to the agency’s official announcement.

These tactics include extensive pre-operational research, personalized fake scenarios, and impersonations. The FBI’s announcement also outlined several warning signs of the threat and provided a list of potential mitigations to help protect against these attacks.

In hindsight, North Korean hackers have a long history of targeting crypto-related firms and protocols. The Lazarus Group, one of the most notorious state-sponsored hacking organizations, has been linked to numerous attacks. It often uses tools like Tornado Cash to obscure the movement of stolen funds.

Blockchain data firm Chainalysis recently reported that the Lazarus Group steals hundreds of millions of dollars in crypto each year by attacking exchanges and DeFi platforms. Notable incidents include the $117 million Poloniex hack and the $37.3 million CoinsPaid attack.

Read more: Top 7 Tornado Cash Alternatives in 2024

Given the ongoing threat from North Korean cyber actors, especially against companies managing large volumes of crypto, firms must strengthen security measures. Investors should also remain vigilant, as hackers increasingly target individuals with tailored attacks.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/blackrocks-ibit-extends-streak-of-zero-flows/

2024-09-04 18:43:07