This week has proven difficult for Bitcoin and the broader crypto market. After nearly reaching the $60,000 mark, Bitcoin’s price has dropped about 5%, currently trading at approximately $56,400.

Significant outflows from spot Bitcoin Exchange Traded Funds (ETFs) notably influenced the downturn.

Crypto Market Enters Extreme Fear as Bitcoin Struggles

Although US markets were closed on Monday, substantial withdrawals resumed thereafter. On Tuesday, spot Bitcoin ETFs saw a net outflow of $287.78 million.

Subsequently, on Wednesday, ETFs recorded a further withdrawal of $37.29 million, followed by $211.15 million on Thursday. Therefore, spot Bitcoin ETFs recorded a total outflow of $536.22 million this week.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

In light of these outflows, several industry leaders have voiced a bearish perspective on Bitcoin. Arthur Hayes, co-founder of the BitMEX crypto exchange, openly announced his short position on Bitcoin, targeting a fall below $50,000.

“BTC is heavy, I’m gunning for sub $50,000 this weekend. I took a cheeky short. Pray for my soul, for I am a degen,” Hayes shared on X (formerly Twitter).

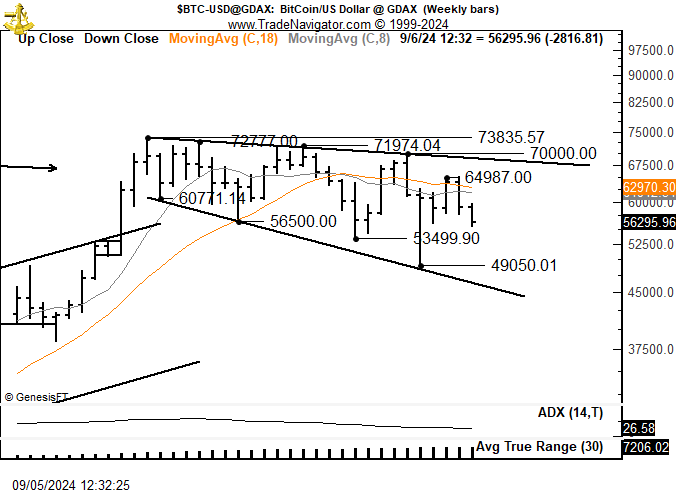

Similarly, veteran trader Peter Brandt suggested that Bitcoin might decline to the $46,000 level.

“This is called an inverted expanding triangle or a megaphone. A test of the lower boundary would be to $46,000 or so. A massive thrust into new all time highs is required to get this bull market back on track for Bitcoin. Selling is stronger than buying in this pattern,” Brandt detailed.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Moreover, the US jobs non-farm payroll report is due today. This data is crucial as it might influence the Federal Reserve’s rate decision. A particularly weak jobs report last month already triggered global market instability, impacting cryptocurrencies as well.

“The upcoming release of the US payroll data is eagerly anticipated by investors, as it could influence the Federal Reserve’s decision on the potential size of the interest rate cut this month. The market’s volatility reflects the uncertainty surrounding this crucial economic indicator,” Avinash Shekhar, CEO of crypto derivatives exchange Pi42, told BeInCrypto.

Consequently, the cryptocurrency market has plummeted into an “extreme fear” zone, as per the Crypto Fear & Greed Index, which measures market sentiment. On September 6, the index fell to 22, indicating “extreme fear”—a stark contrast from the previous day’s score of 29, labeled “fear.” This marks the lowest score since August 8, when the index hit 20.

Read more: What Is the Crypto Fear and Greed Index?

Despite the pervasive negative sentiment, some traders spot potential opportunities. Quinten Francois, a well-known crypto investor, highlighted that market sentiments mirror those when Bitcoin last hit a low of $16,000 in November 2022. Hence, he advised the investors to act accordingly.

Nonetheless, it is crucial to acknowledge that extreme fear can persist, potentially leading to extended periods of market uncertainty.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Harsh Notariya

https://beincrypto.com/arthur-hayes-peter-brandt-bitcoin-target/

2024-09-06 09:29:02