Solana (SOL) is currently trading around $127, a critical level that could either support a recovery or lead to further declines. Throughout the year, this price point has frequently served as an important support for the altcoin.

However, the situation appears different this time, indicating that the aftermath of past events may not align with the potential outcome now.

Solana Goes Out of Touch

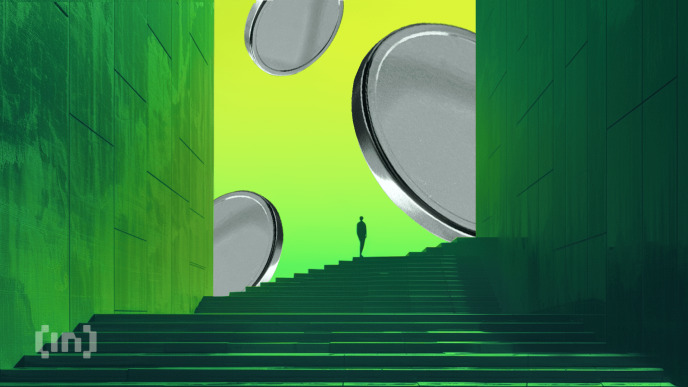

According to the daily chart, the $127 region has acted as a major support level for Solana at least three times this year. In March, for instance, Solana’s price bounced from $127 to $200 after bulls defended the support.

Fast-forward to May, and a similar thing happened: the token rallied to $187.58 after it reclaimed the $127 support. More recently, the price hit $184 a few weeks after it found itself in a similar situation.

However, almost every time this occurs, Solana’s price trades above the 200-day EMA (orange) to validate the bullish bias. As of this writing, that is no longer the case, as the value is significantly below the indicator.

Read more: 13 Best Solana (SOL) Wallets To Consider in September 2024

If Solana’s price drops below this region, it could fall further to $110. Adding to the bearish outlook, the On Balance Volume (OBV) indicator highlights the market’s negative structure.

Typically, an increase in OBV signals a price breakout as it measures demand and supply. However, in Solana’s case, the low OBV reading suggests distribution is occurring, indicating a potential for an accelerated downtrend.

SOL Price Prediction: Will Bears Prevail?

A closer assessment of the daily chart shows that the Awesome Oscillator (AO) is negative. The AO is a technical indicator that measures momentum, comparing recent price movements to historical ones.

A positive reading suggests increasing upward momentum and is vital to validating a price increase. Since the AO reading is negative, the momentum around SOL is bearish, and as such, the price is likely to decrease.

From the image below, Solana’s price might drop to $124.18. Should selling pressure intensify, the altcoin’s value could slide below $110.

Read more: Top 7 Projects on Solana With Massive Potential

However, if bulls successfully defend the $127 region, SOL’s price might jump to $136.61, nullifying the bearish prediction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/solana-sol-price-faces-critical-test/

2024-09-07 19:00:00