Toncoin’s (TON) price saw a modest 2% increase in the last 24 hours. Despite the uptick, the cryptocurrency continues to face mounting pressure that could threaten its expected price recovery.

Currently trading at $4.72, TON is attempting to retest the $5 mark. This on-chain analysis suggests that market participants interacting with the Telegram-native coin might be responsible for hindering this upward move.

Toncoin Encounters Setback

Based on data from Santiment, the ratio of daily on-chain transaction volume in profit to loss has reached its highest level since February. This metric tracks the aggregate amount of tokens that have moved in a profit or loss.

When it spikes, there is a lot of profit-taking. A decline, on the other hand, indicates that market participants are on the sidelines and are deciding to HODL.

For Toncoin’s price, this sudden surge increases the risk of another downturn, especially as the token has recently shown signs of a sustained upswing.

Read more: 6 Best Toncoin (TON) Wallets in 2024

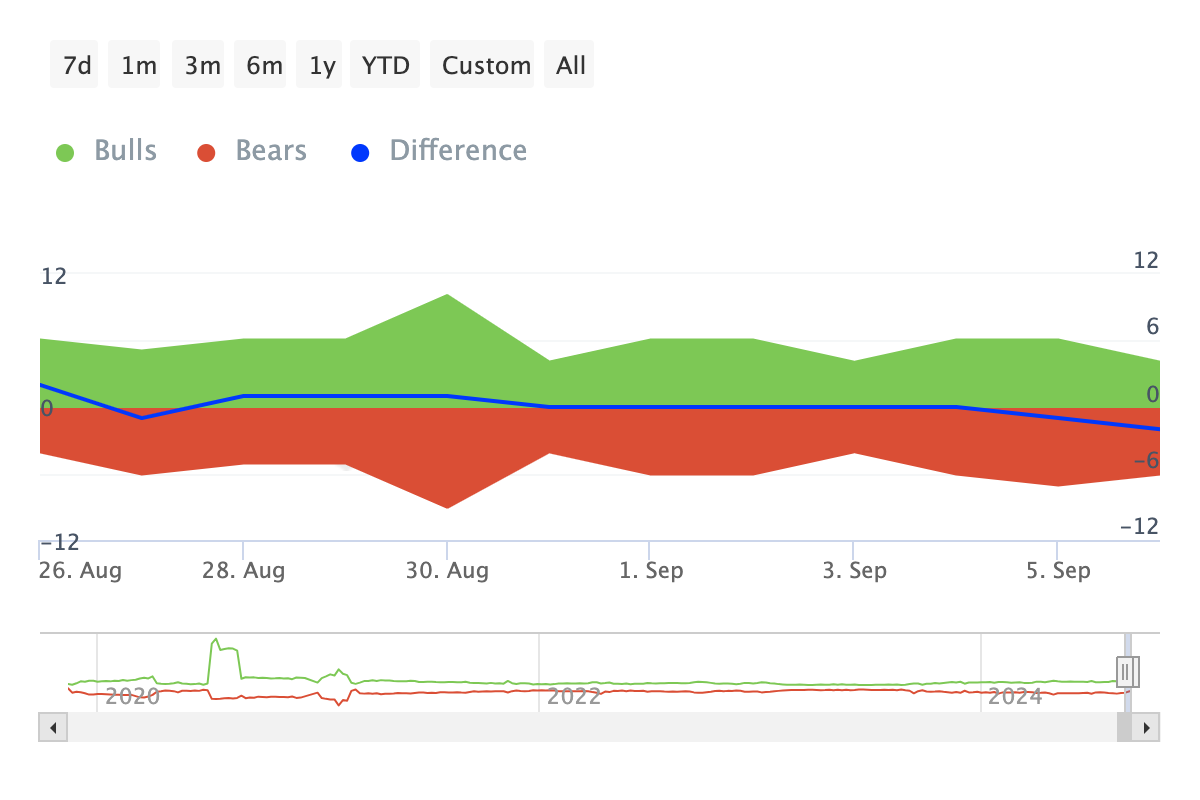

Adding to this outlook is the Bulls and Bears indicator, which tracks whether addresses trading about 1% of the total volume are buying or selling. Bulls represent addresses that purchased more than 1% of the volume. Bears are those that sold a similar amount.

A higher number of bulls usually signals a potential price increase, while more bears often lead to accelerated price declines. In Toncoin’s case, the rise in bears over bulls in the last 24 hours suggests that the recent uptrend may be nearing its end.

TON Price Prediction: Not Yet Time for $5

Toncoin’s price has recently bounced back from $4.61. Now trading at $4.90, the altcoin aims to climb above $5. However, the Stochastic Relative Strength Index (RSI) reveals that the attempt might not be fruitful.

Stoch RSI, as it is commonly called, compares the magnitude of recent gains to losses. This data allows the indicator to tell whether the momentum is bullish or bearish and whether an asset is overbought or not.

As seen in the image below, the Stoch RSI on the daily Toncoin’s price chart remains below the neutral line. If this stays the same, TON’s price might erase some or all of its recent gains. Should this be validated, Toncoin’s price might dump to support at $4.69.

Read more: 10 Best Altcoin Exchanges In 2024

Losing this support could send the price down to $4.47. However, TON’s price might escape this downturn if the realized profits decrease. If this happens, TON might slowly rise toward $5.25.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/toncoin-price-recovery-under-threat/

2024-09-08 20:12:05