Ethereum (ETH) whales, historically influential in driving the altcoin’s price, have been quiet since July. On-chain data reveals that these large holders stopped accumulating ETH during that time, which likely contributed to its sluggish price performance.

Now that September — a month known for heightened volatility — has arrived, the big question is whether these whales will resume buying and shift the market.

Ethereum Whale Activity Slows Down

Data from Glassnode reveals that addresses holding over 10,000 ETH last made a major purchase on July 5. Since then, these whales have either been selling or redistributing their holdings.

This shift appears to have influenced Ethereum’s price. Between July 8 and 16, ETH surged from $2,930 to $3,485. However, it struggled to break the $3,500 level afterward, suggesting that the large-scale distribution played a role in the price decline.

Recently, BeInCrypto suggested that Ethereum could face a prolonged downtrend. However, with September known for its volatility, there’s a chance that whales may resume buying toward the month’s end. The full impact on Ethereum’s price might not be seen until the anticipated “Uptober.”

Read more: 9 Best Places To Stake Ethereum in 2024

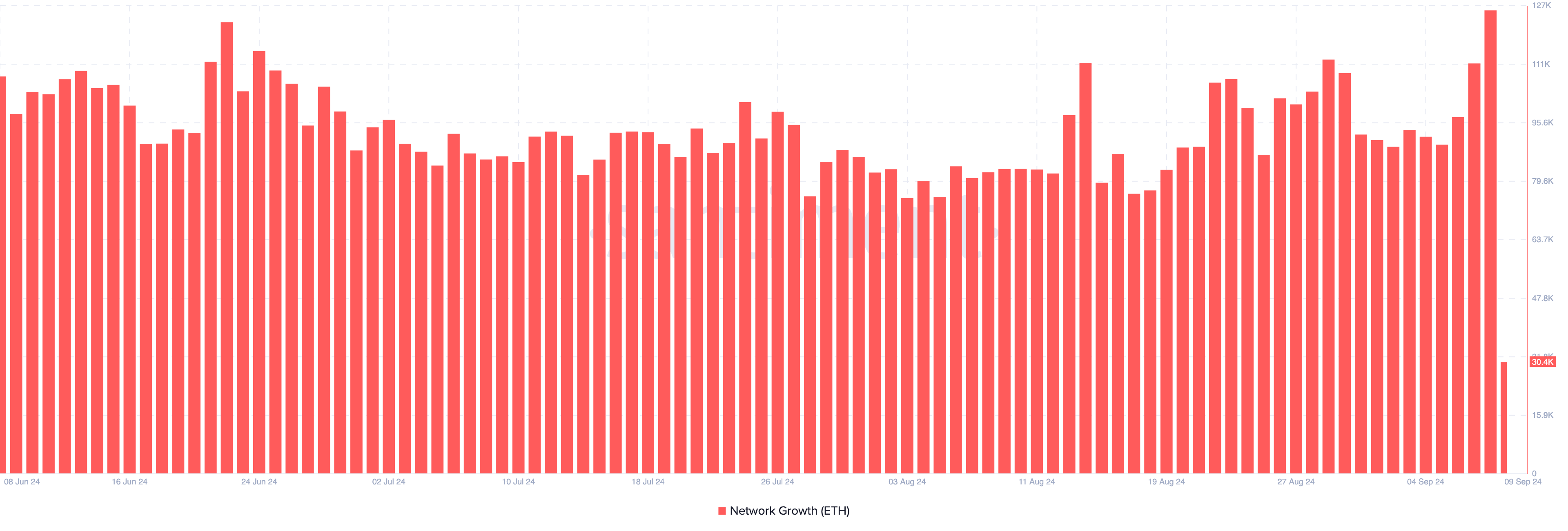

On the retail side, Santiment data shows a significant spike in new Ethereum wallets created on Sunday, September 9. Network Growth surged to 126,000, marking the highest level in nearly four months and indicating increased demand for ETH.

This spike contributed to ETH’s price rebound to $2,300. However, the figure has since dropped to 30,400, suggesting that the demand surge could be short-lived, and the price boost may not sustain.

ETH Price Prediction: Uptrend Likely Short-Lived

Ethereum is currently trading at $2,312, but faces potential resistance on the 4-hour chart at the 50%, 61.8%, and 38.2% Fibonacci retracement levels, starting at $2,384. While buyers may look to accumulate, ETH could struggle to break through these levels.

BeInCrypto also analyzed the Balance of Power (BoP) indicator, which measures the strength of buyers and sellers. At present, the BoP has turned negative, indicating stronger selling pressure. This divergence with Ethereum’s price suggests a possible reversal from the current uptrend.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

If sellers continue to dominate, Ethereum’s price could fall to $2,278, and further selling pressure could push it down to $2,149. It seems unlikely that Ethereum whales will resume significant buying in September.

However, this outlook could change if whales unexpectedly begin buying in large volumes. In that case, ETH could rally toward $2,645.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/ethereum-whales-stopped-buying-eth-in-july/

2024-09-09 12:14:04