Toncoin’s (TON) price has managed to hold above the $5 mark following a broader market bounce. This resilience usually signals confidence that the cryptocurrency could sustain its upward momentum.

However, amid growing uncertainty, BeInCrypto notes that many traders are taking short positions. On-chain data, though, indicates that they may soon be forced to exit their trades. Here is why.

Toncoin Traders Shift from Bullish to Bearish

On Monday, September 9, Toncoin’s Long/Short ratio jumped to 1.15. This initial rise indicates that most traders in the derivatives market turned to open long positions while expecting a price increase.

However, as of this writing, the Long/Short ratio is down to 0.36, showing that about 73% of traders have decided to short the token despite the uptrend. On the other hand, 26% still believe that TON’s price would increase as they chose long positions.

In simple terms, this ratio gives an overview of investor sentiment. When the value is above 1, most positions are long, and the average trader expects a bullish outcome. Therefore, the recent plunge indicates that many Toncoin traders do not expect the price to continue swinging high.

Read more: 6 Best Toncoin (TON) Wallets in 2024

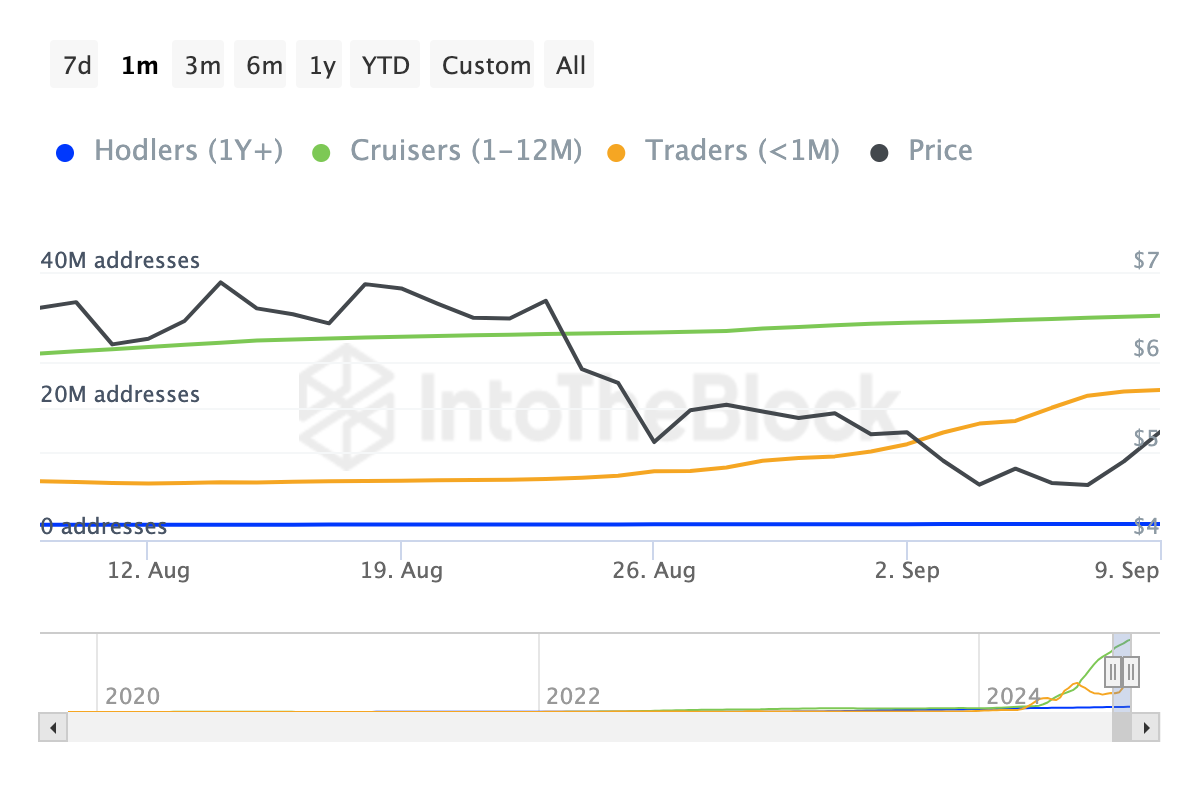

Despite the bearish trends, findings from IntoTheBlock reveal that many addresses that purchased Toncoin (TON) in the last 30 days are still holding onto the cryptocurrency.

Although these holders are considered short-term investors, their decision to refrain from selling during periods of high volatility is often viewed as a bullish signal. If these passive investors continue to HODL, the token could avoid a notable price decline.

Instead, Toncoin’s price might rise, potentially triggering a short squeeze. In this context, a short squeeze occurs when investors who bet on a price decrease are forced to close their losing positions as the price moves against them, further driving the price up.

TON Price Prediction: The Token Could Close In on $7

At press time, Toncoin (TON) is trading at $5.26, marking a 13% increase from its swing low on September 5. The token is now in a critical demand zone that, in mid-August, sparked a rally toward $7.

On the daily chart, the strong support level at $4.88 played a key role in the recent price recovery. Additionally, the Chaikin Money Flow (CMF) indicator suggests further potential gains.

The CMF, which tracks money flow and indicates whether an asset is in an uptrend or downtrend, has moved out of negative territory. Breaking into positive territory implies that TON’s price could continue rising, potentially by another 9% to reach $5.83.

Read more: Which Are the Best Altcoins To Invest in September 2024?

In a highly bullish scenario, the token’s value might rally toward $6.90, a notable point of interest. However, if the bullish momentum around TON subsides, the price might fall below $5 again.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/toncoin-traders-are-bearish-short-squeeze-looms/

2024-09-10 13:37:44