Outspoken Cardano (ADA) founder Charles Hoskinson is in the news again. This time, Hoskinson responded to some misinformation about the project, noting that the rumors are nowhere near accurate.

Even though the founder clarified the situation, ADA’s price did not react positively to the incident.

The Cardano Founder Calls Out Misinformation

On September 11, well-known crypto analysts, including MartyParty, InvestAnswers, Mando, and CTO Larson, attended a podcast posted on X. During the conversation, InvestAnswers asked why projects like Cardano and Ripple (XRP) still have huge market capitalizations despite underwhelming price action.

In response to the question, Mando alleged that some Cardano had restricted investors from unstaking their ADA holdings. As a result, the market cap has failed to tank. Hours after the video went public, Hoskinson quoted it, saying the comments were untrue and the Fear, Uncertainty, and Doubt (FUD) around the token had reached epic levels.

“The lies and misinformation about Cardano have reached epic levels. Stake isn’t locked, but they still lie. Why does anyone trust these people anymore?” he asked.

Despite the clarification, ADA’s price fell from $0.35 to $0.33, indicating that Hoskinson’s post was not enough to help the token swing upwards.

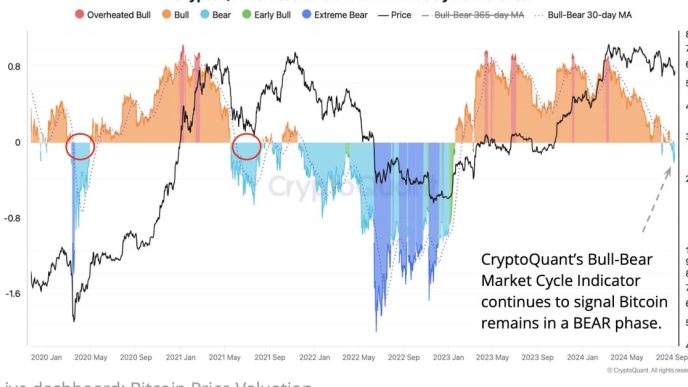

Meanwhile, on-chain data from Santiment shows that the Market Value to Realized Value (MVRV) Long/Short Difference sits at -19.93 %. This negative reading implies that short-term Cardano holders have more unrealized profits than long-term counterparts.

Read more: How To Stake Cardano (ADA)

When this happens, it means that the market condition around the cryptocurrency is bearish. Assuming long-term holders have more gains, it would have been bullish.

ADA Price Prediction: No Recovery Yet

A look at the daily ADA/USD chart shows that the token has formed a head-and-shoulders pattern, a technical pattern signifying a bullish-to-bearish trend.

The head-and-shoulders pattern consists of three parts: the left shoulder, the head, and the right shoulder. As seen in the image below, ADA’s price rose to a peak and subsequently fell to the neckline of the left shoulder.

Later on, Cardano’s price rose substantially above the first crest (head) but also dropped to the neckline. ADA’s price jumped again, but this time, the peak reached the same level as the first shoulder to form the right one.

Read more: 6 Best Cardano (ADA) Wallets You Should Consider in September 2024

Notably, this pattern suggests the downtrend may persist. According to the Fibonacci retracement indicator, ADA’s price could fall to $0.31. However, if a broader market recovery occurs alongside strong accumulation, the trend could reverse, potentially pushing ADA’s price up to $0.39.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/cardano-charles-hoskinson-hits-back-at-fud/

2024-09-11 15:00:00