This week, we take a closer look at Ethereum, Ripple, Cardano, Binance Coin, and Solana.

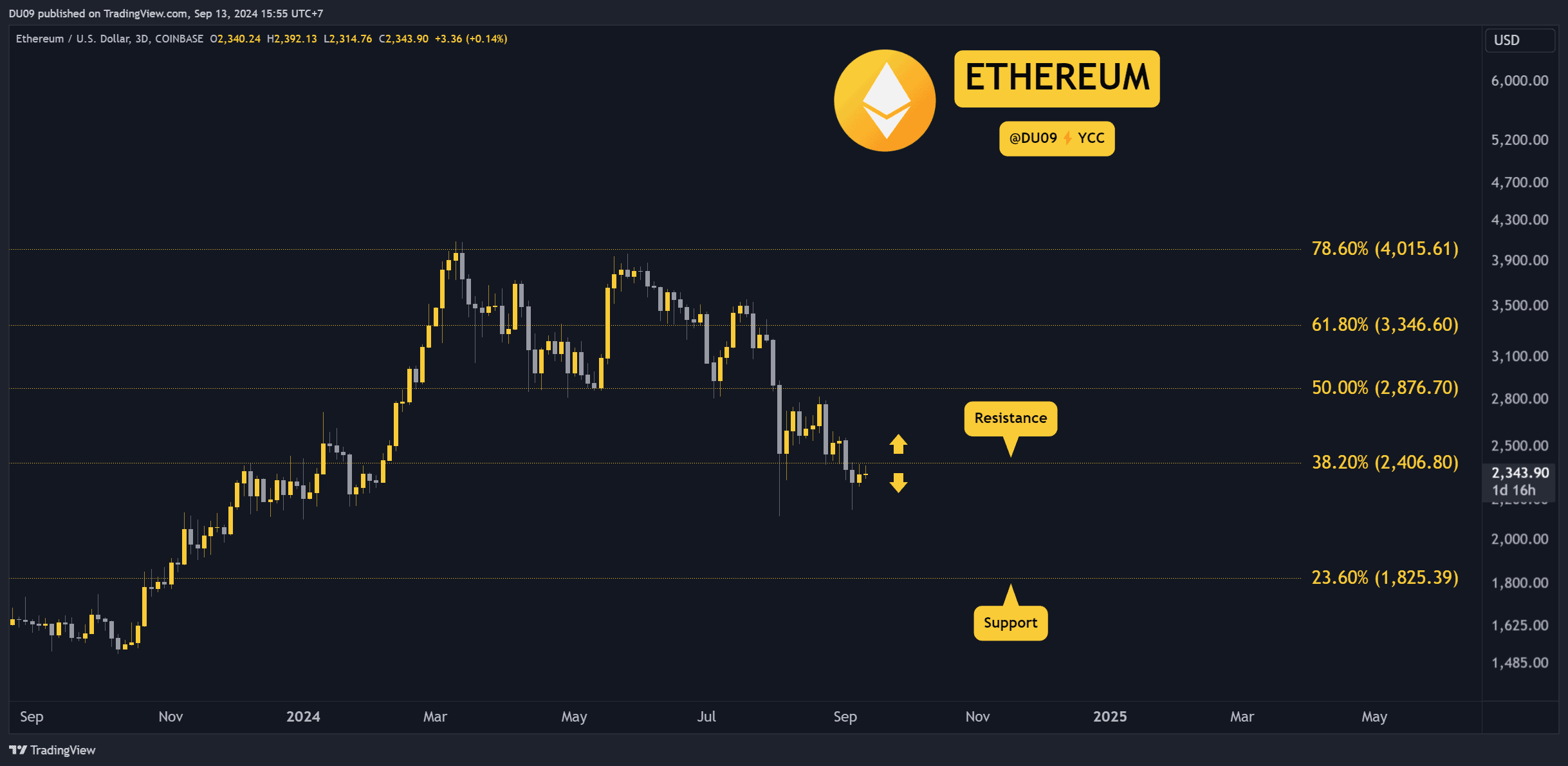

Ethereum (ETH)

Since last week, Ethereum’s price has remained close to the key resistance at $2,400. Buyers are still trying to reclaim that level as support, but they lack momentum right now, which is why the asset hasn’t moved much since our last update.

Sellers continue to have a hold over the price at the time of this post. However, they failed to make a lower low last week, which gives hope that bulls will eventually push Ethereum higher.

Looking ahead, ETH has to break the current resistance in the coming days if it wants to stop this downtrend. The alternative is a quick fall to the next support levels at $2,100 and $1,800.

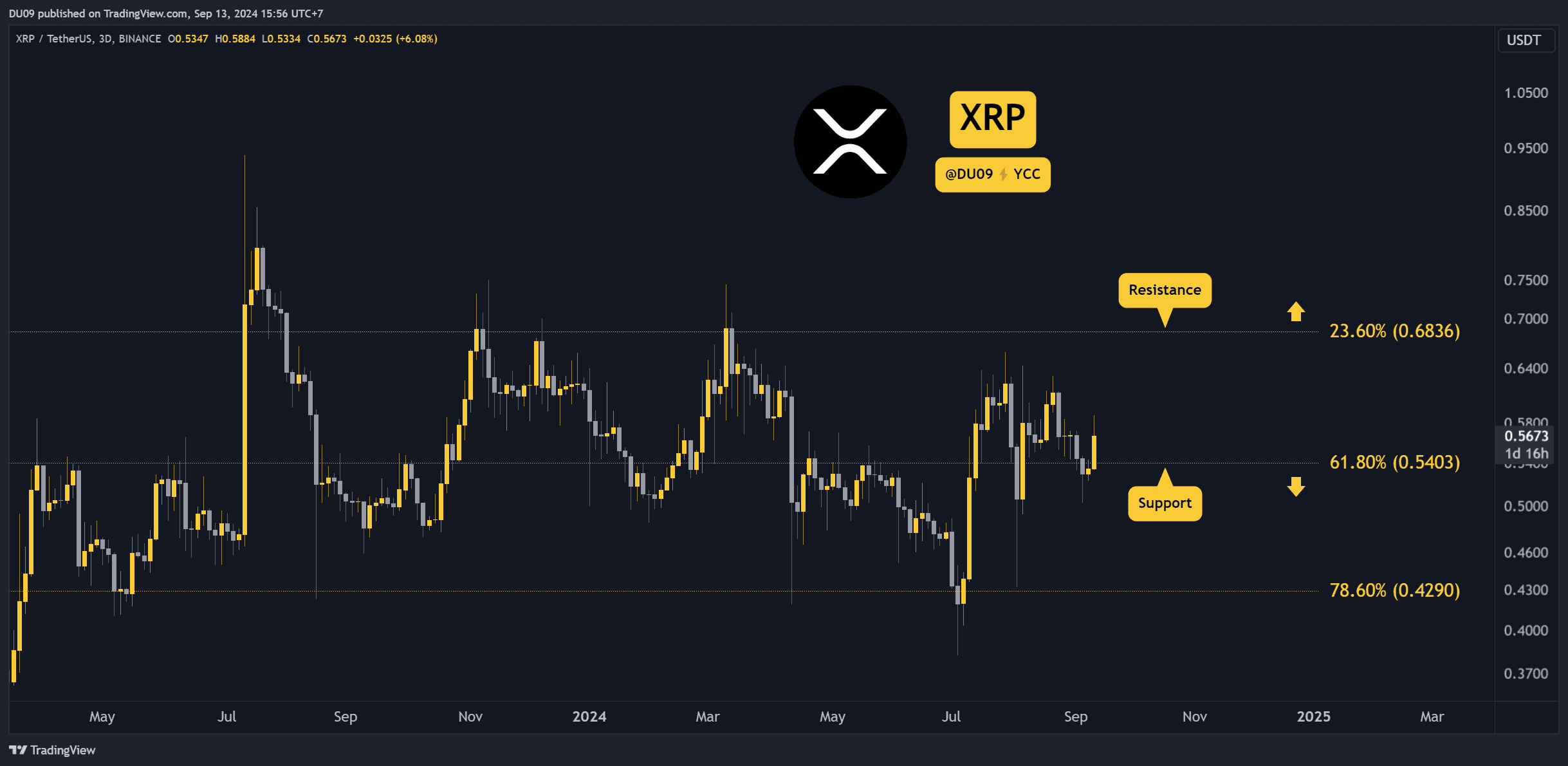

Ripple (XRP)

Surprisingly, XRP had a good week and closed with a 6% price increase. It also managed to turn the $0.54 level into support. This gives bulls the advantage and shows that the market may be keen to move higher again.

The current resistance is found at $0.68 and could be re-tested if the buying momentum continues. In the past week, buyers have dominated in terms of volume in six our of seven days. This shows demand for this cryptocurrency is strong.

Looking ahead, XRP may soon break into $0.6 and aim to reach the current resistance. A pullback is likely if that level is hit.

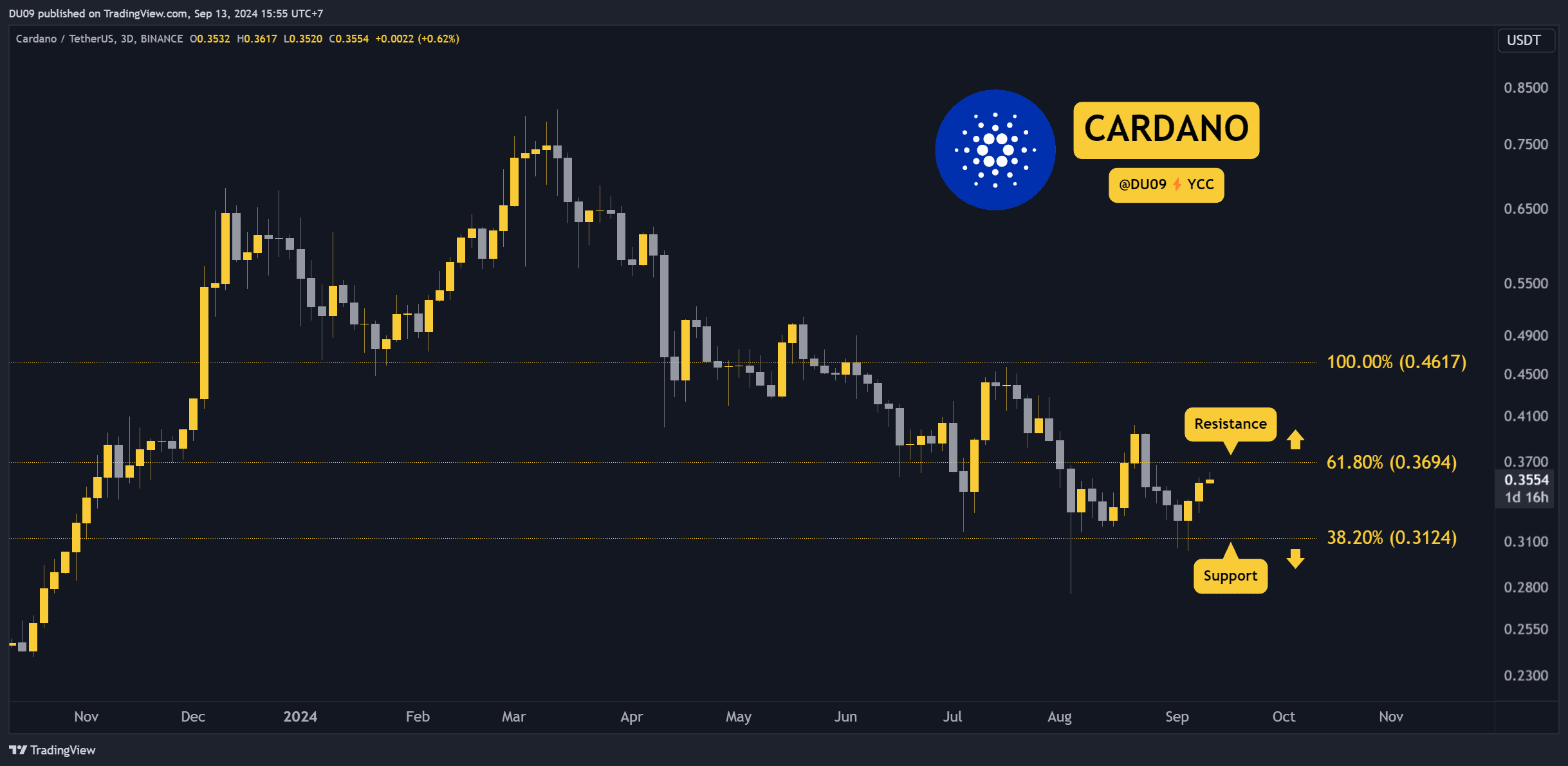

Cardano (ADA)

ADA had a great week, closing it with an 11% price increase. This is a refreshing change after a long downtrend that lasted since March. However, the price has to make a higher high to get confirmation that the worst is behind us.

Until the price moves above $0.4, it is too early to say if the downtrend is over. The current price action is promising and the first test will be found at the $0.47 resistance. If bulls manage to break above that level, then there is a good chance ADA will tap a higher high.

Looking ahead, optimism is increasing around this asset, and buyers appear to be returning after they dominated in the past week. Watch closely the resistance at $0.37 in the coming days as it will be decisive on where ADA goes next.

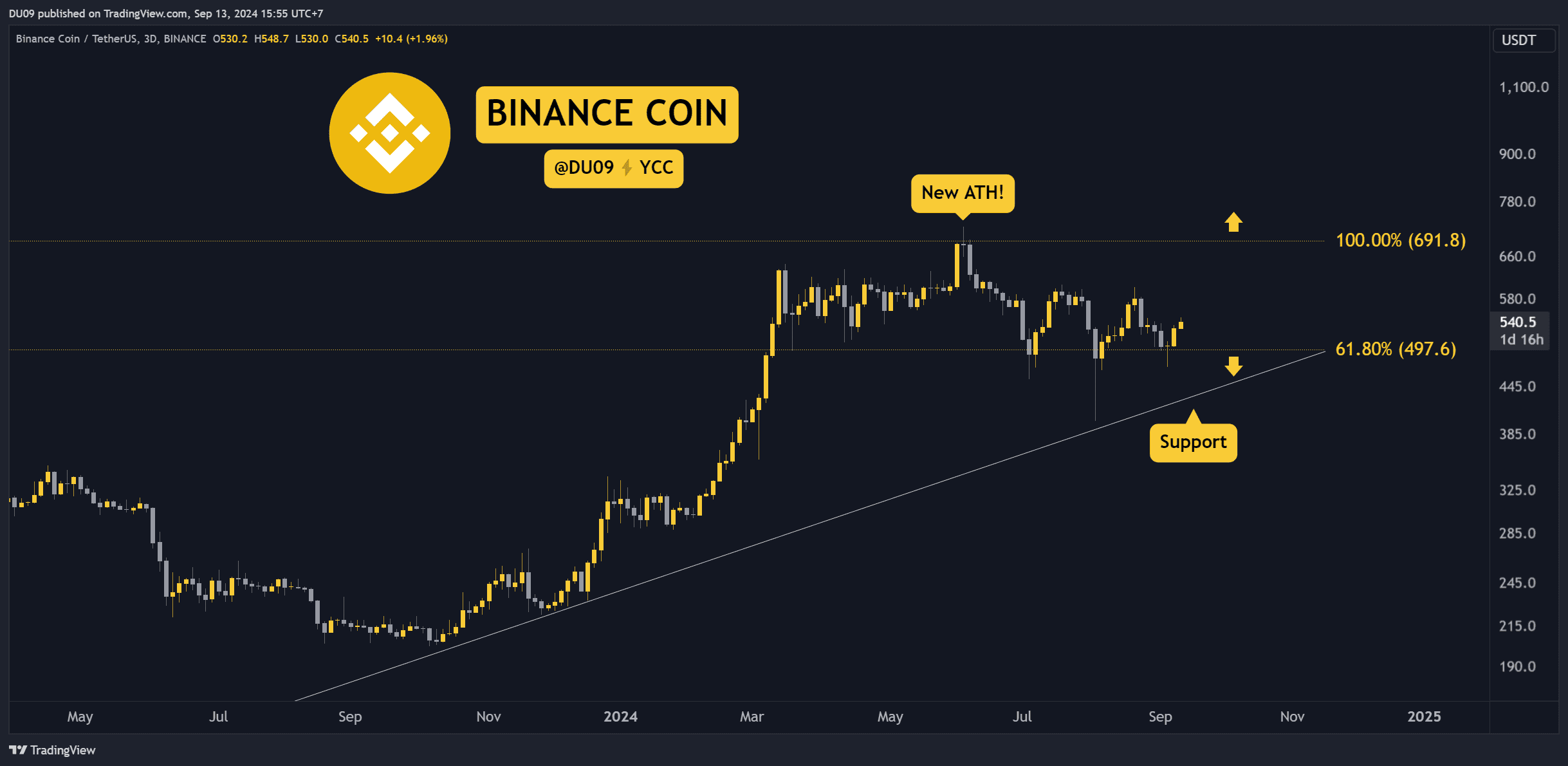

Binance Coin (BNB)

Binance Coin continues to show resilience and has managed to successfully defend the support at $500 for a third time. This is both impressive and a sign of strength. Buyers are back and the price closed the week with an 8% increase.

Hopefully this will be the last test of this key support and BNB can look to higher levels. The current targets are found at $600 and $700 which will likely attract sellers and profit taking if they are reached.

Looking ahead, BNB is well positioned to return on an uptrend and perhaps even aim for the current all-time high at $721 by the end of this year.

Solana (SOL)

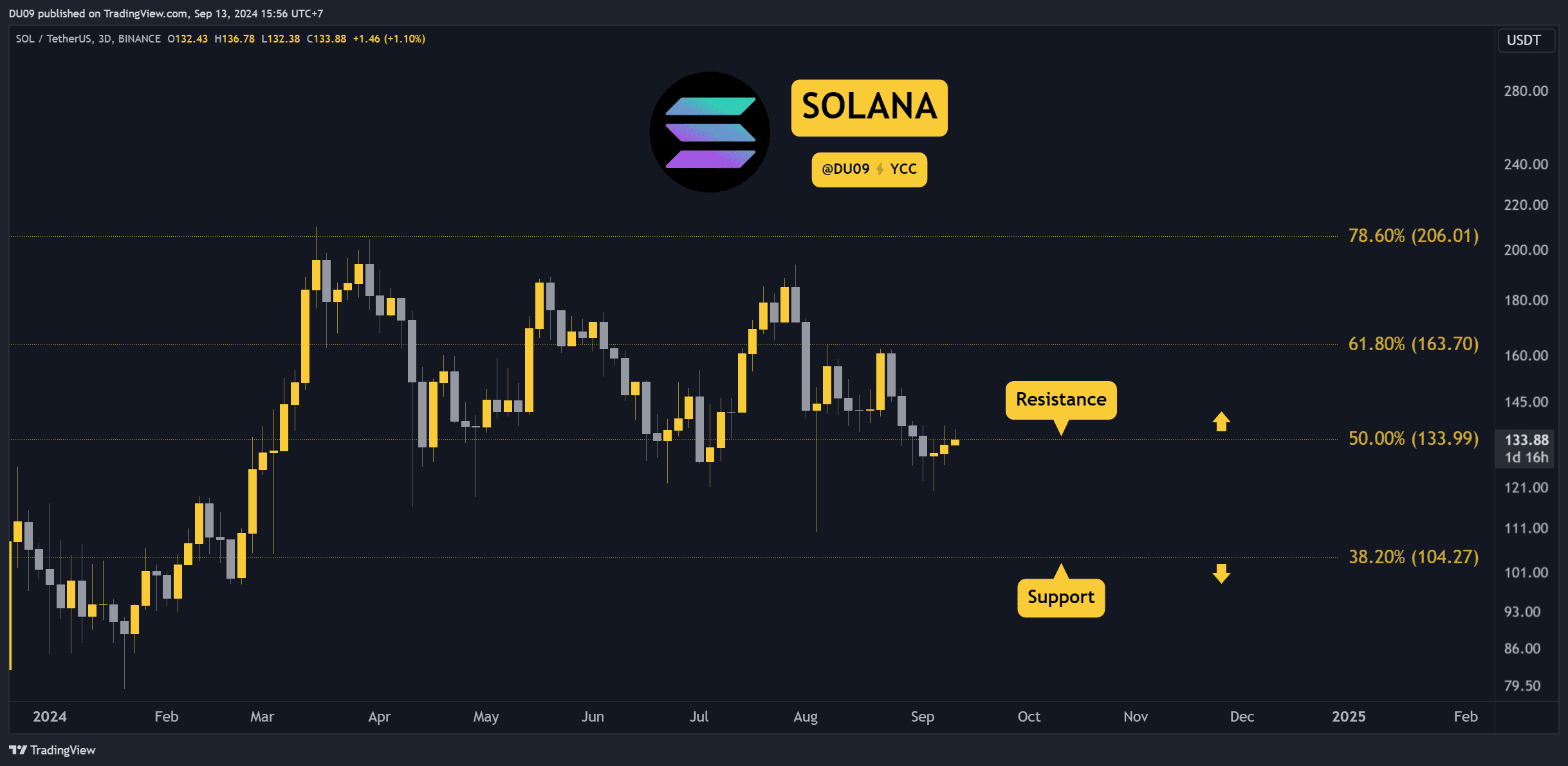

This week, Solana tried to break the resistance at $134 but failed, which is holding the price back. Nevertheless, the asset still managed to book a 5% price increase, which shows promise.

Buyers appear undecided, and this price action looks similar to Ethereum, which is also struggling under the key resistance. If the overall market turns bullish, Solana will likely break above its current resistance and return on an uptrend.

Looking ahead, Solana has to turn the resistance at $134 into support to see the price aim for the next key target of $164.

The post Crypto Price Analysis September-13: ETH, XRP, ADA, BNB, and SOL appeared first on CryptoPotato.

Source link

Duo Nine

https://cryptopotato.com/crypto-price-analysis-september-13-eth-xrp-ada-bnb-and-sol/

2024-09-13 11:11:36