Toncoin (TON) and The Open Network blockchain are back in the spotlight, this time for positive reasons unrelated to an outage or price correction.

On Sunday, September 15, the value of the USDT stablecoin issued on TON surpassed $1 billion for the first time. While Toncoin’s price has yet to respond to this development, the increased liquidity could serve as a catalyst for the cryptocurrency to reach new highs. This analysis explores how the surge in liquidity might boost TON’s market performance.

Toncoin Attracts More Liquidity

According to Token Terminal, the USDT issued by Tether on TON was under $800 million on August 31. The surge to $1.03 billion as of now signals growing interest in Toncoin.

BeInCrypto’s findings suggest that this influx of capital into the ecosystem could provide a boost to the Telegram-native cryptocurrency. Increased stablecoin volume could lead to higher user engagement on TON, and as user activity rises, demand for Toncoin could follow, potentially driving its price up.

This milestone might even give the altcoin a chance to push back toward its all-time high of $8.24.

Read more: 10 Best Altcoin Exchanges In 2024

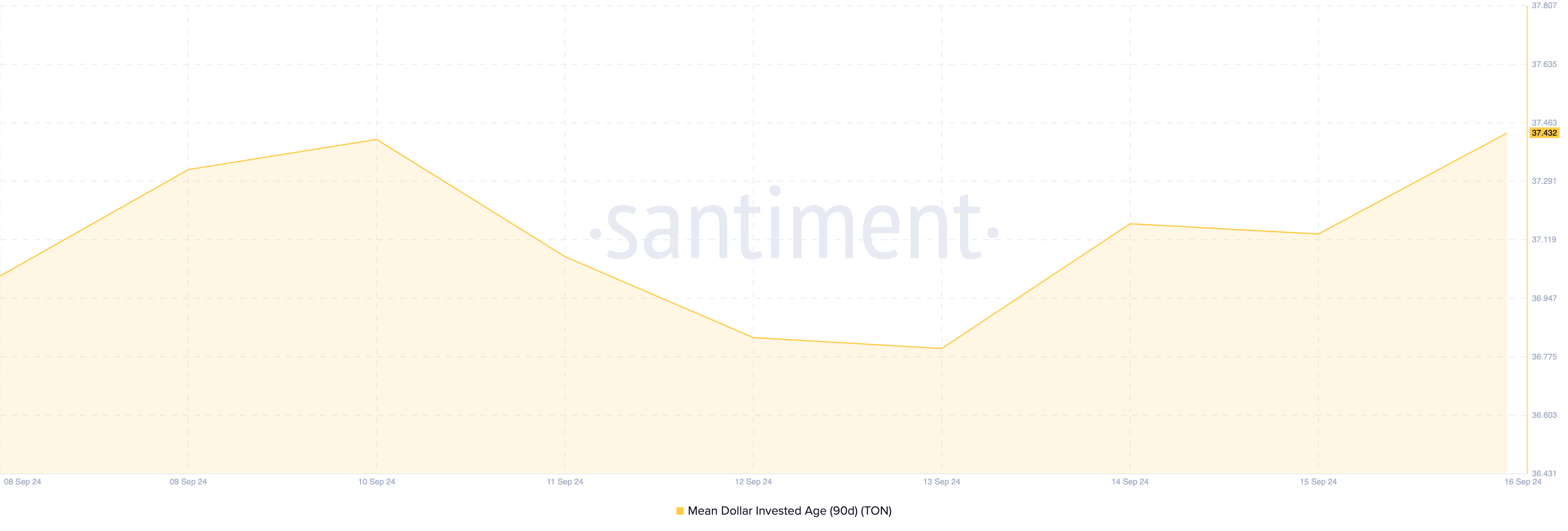

Currently, Toncoin is priced at $5.55, down 32% from its June peak. However, on-chain data from Santiment shows a notable rise in the Mean Dollar Invested Age (MDIA), a time-weighted metric that tracks the average age of each dollar invested in a coin.

A declining MDIA often signals that dormant addresses are becoming active and moving large amounts, typically supporting a short-term price upswing. However, the recent surge in MDIA indicates investments are becoming more stagnant, which could hinder Toncoin’s short-term price growth. Despite this, Toncoin has a strong chance of seeing a significant rally in the mid-term.

TON Price Prediction: Time to Retest June Peaks

On the daily chart, BeInCrypto noted that Toncoin has strong support at $5.20, which helped push the token’s price above the 20-day Exponential Moving Average (EMA). The EMA measures trend direction, and when the price rises above it, it signals a bullish trend. Historically, this setup played a key role in Toncoin’s run above $8 in June.

Currently, Toncoin faces resistance at $6, a key supply zone. However, if demand continues to grow, TON could surpass this level, potentially rallying to $8.32 by the fourth quarter of this year.

Read more: 6 Best Toncoin (TON) Wallets in 2024

On the contrary, a reversal might occur if TON fails to breach $6. In that scenario, the price might tumble to $5.09.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/toncoin-price-to-gain-from-stablecoin-influx/

2024-09-16 16:00:00