XRP price has struggled to sustain above the key $0.60 mark, coinciding with the 50% Fibonacci Retracement line. Despite multiple attempts, the altcoin has consistently failed to breach this resistance level.

If the pattern continues, XRP may find it difficult to recover and maintain any meaningful rally, with market conditions putting pressure on its price action.

XRP Token Notes Mixed Signals

The Ichimoku Cloud indicator currently exhibits bullish sentiment for XRP. Positioned below the candlesticks, the indicator suggests that the altcoin could potentially rise or at least avoid significant corrections. This indicator offers short-term optimism, giving XRP some breathing room to try and reclaim the $0.60 mark.

However, market sentiment remains fragile. While the Ichimoku Cloud provides some protection against major declines, the broader market remains uncertain.

Read more: XRP ETF Explained: What It Is and How It Works

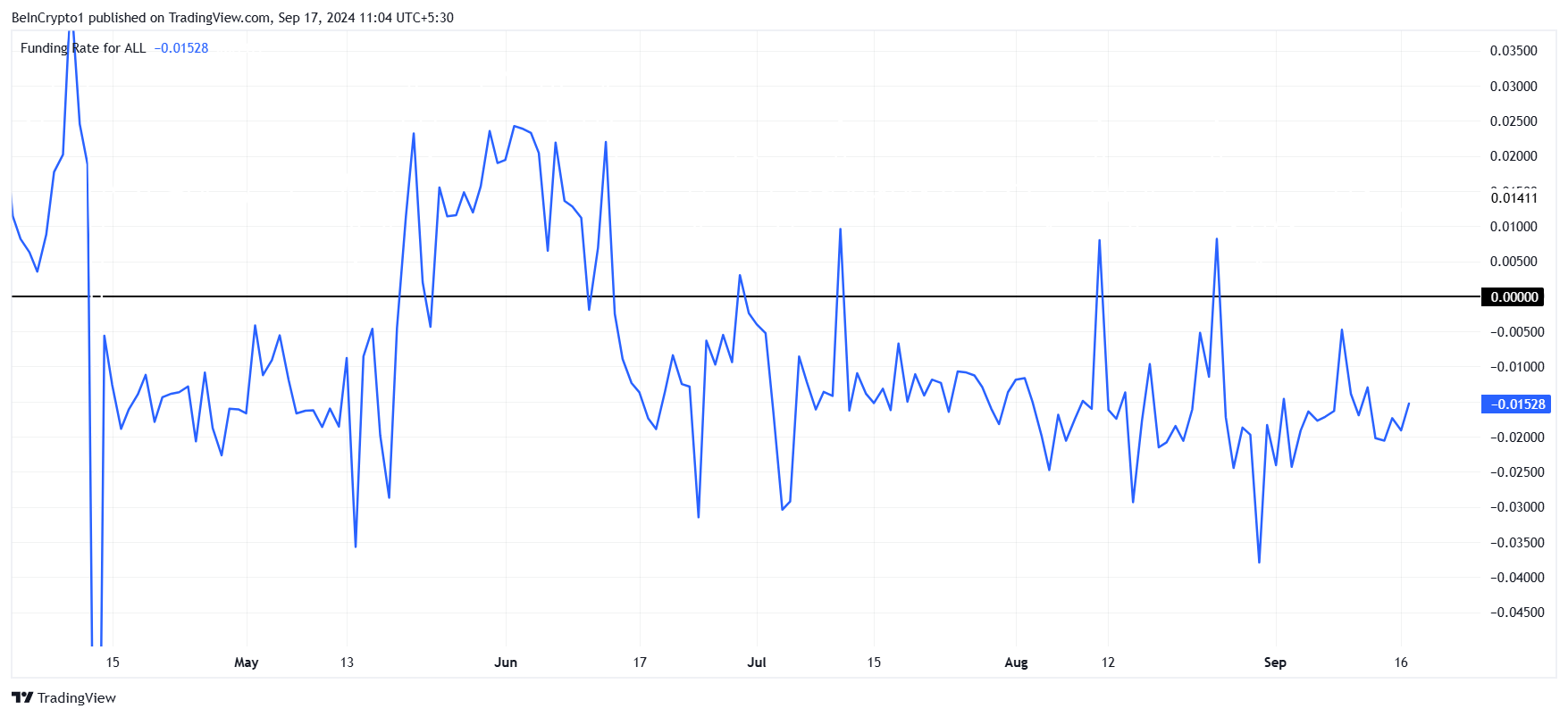

From a macro perspective, XRP’s momentum has been predominantly bearish. The funding rate has largely been negative since mid-June.

Only four instances saw the funding rate turn positive, showing that traders have mostly anticipated a price drop. Currently, XRP is experiencing similar negative sentiment, reflecting traders’ expectations of a continued decline.

This sustained negative funding rate suggests that a significant portion of the market is betting against XRP’s price rise in the short term. As traders continue to expect a drop, this bearish sentiment may make it more difficult for the cryptocurrency to hold any upward momentum.

XRP Price Prediction: Fighting for a Rise

XRP, trading at $0.58, is preparing to challenge the 50% Fibonacci line at $0.60. A brief rise above this level is possible, particularly if broader market cues continue to support an upward trend. However, this uptick may be short-lived, as bearish sentiment remains strong among traders.

If XRP breaks above $0.60, bearish pressure may soon pull the altcoin back down. Should the selling pressure remain manageable, XRP could bounce from the 38.2% Fibonacci line at $0.55, offering a slight recovery.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

However, a more sustained rally would only be possible if XRP flips $0.60 into a support level. Should that happen, the altcoin could aim for $0.65, coinciding with the 61.8% Fibonacci level, which would invalidate the current bearish outlook and fuel further gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/xrp-price-prediction-rally-may-not-last/

2024-09-17 06:43:15