The richest men in American history once basked in the quiet luxury of the Jekyll Island Club off the coast of Georgia. But on Wednesday morning, a vista of shady oak trees and meticulously preserved architecture from the 19th century was disturbed by a seven-foot-tall inflatable rat.

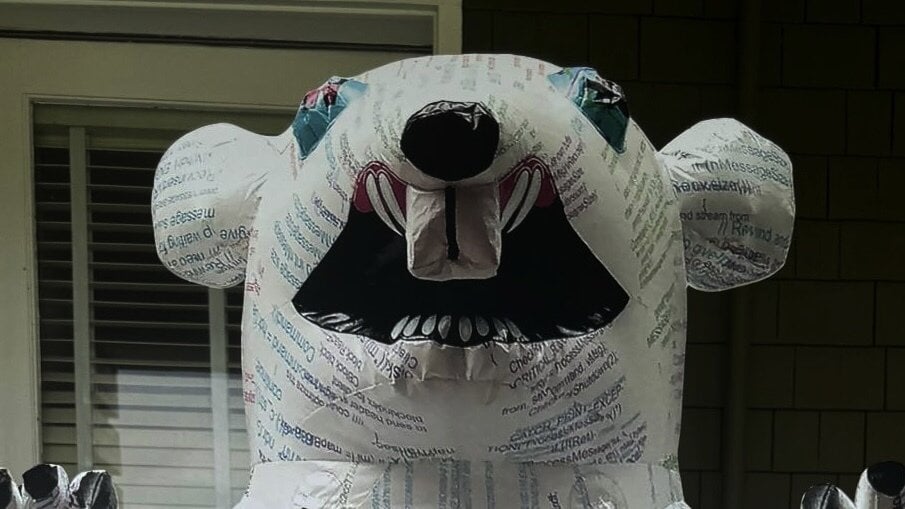

Situated on a balcony at Sans Souci Cottage, a building partly owned by J.P. Morgan, the pale rodent bore the markings of Satoshi Nakamoto. Lines of code written by Bitcoin’s pseudonymous creator covered its skin, clashing against the cottage’s time-weathered exterior.

A staff member at the Jekyll Island Club told Decrypt that the resort had been notified of the rat’s presence, but the blow-up rodent had likely been removed by the time staff had scoped out the building.

The Jekyll Island Club is known as the birthplace of the Federal Reserve. A series of covert meetings were held there by powerful American bankers in 1910, who outlined draft legislation leading to the formation of America’s modern banking system following the Panic of 1907.

The rat was erected by the mathematical artist Nelson Saiers, who staged a similar tribute to Nakamoto outside the New York Federal Reserve building in 2018. This time, the rat was slightly smaller and noticeably brighter, but the message behind it was just as large.

“At times, some people feel the banks are treated better than the average guy,” Saiers told Decrypt in an interview. “When one hears that the Fed was essentially created by bankers in secret, I think it makes people suspicious that the game may not be as fair as they’d like.”

Saiers, who earned a PhD in mathematics at the age of 23, has been referred to as the “Warhol of Wall Street.” The former derivatives trader and hedge fund manager left a successful career in finance behind in 2015, mixing math and paint as a full-time artist based in New York.

When the first Bitcoin block was mined by Nakamoto in 2009—not long after the 2008 financial crisis—the crypto pioneer embedded a message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Referencing an article in the The Times that stated the UK government was preparing to bail out banks again, Nakamoto’s message is widely viewed as a subtle dig toward central banks. Bitcoin’s first known reference also took place within a mailing list for the Cypherpunks, a group of political activists and tech enthusiasts who believed cryptography could keep governments in check.

Saiers’ stunt came as the Fed is set to ease borrowing costs for the first time in years, with its FOMC meeting set to conclude Wednesday. At the same time, the rat’s unveiling aligned with other moments in the history of central banking. Wednesday marked the 111-year anniversary of the Federal Reserve Act’s passing in the U.S. House of Representatives.

Saiers’ rat carries Bitcoin references beyond lines of code. Within one of the rodent’s eyes, viewers can observe “POW.” It’s an acronym for the proof-of-work mechanism underpinning Bitcoin’s security that also references work done by the artist Roy Lichtenstein, Saiers said.

In 2018, Warren Buffet referred to Bitcoin as “probably rat poison squared,” warning investors to stay away from the digital asset. In some ways, Saiers’ artistic endeavor parallels Warren’s description, but that hinges on what the inflatable rat is meant to represent.

“A white rat, to me, reminds you of a lab rat,” Saiers said. “The stuff [the Fed] did in 2008 was pretty unprecedented […] the size, scope, and strategy of the bailouts was really an experiment.”

From Saiers’ perspective, Bitcoin is addressing a sense of angst that many have toward the existing financial system. He described the United States’ ballooning national debt and distrust toward financial institutions as forces driving people toward the digital asset, despite industry headwinds and high-profile company collapses.

“Many people feel our system is pro-banker and not for the little guy,” he said. “Bitcoin is showing it’s been very resilient, even after issues like FTX.”

Like the wealthy bankers that traveled to Jekyll Island under the guise of a duck-hunting trip over a century ago, Saiers kept his intentions close to his chest. The resort staff were unaware that an inflatable rat would overlook Georgia’s coast in the run-up to Saiers’ stay.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

André Beganski

https://decrypt.co/250075/why-giant-inflatable-bitcoin-rat-stands-birthplace-fed

2024-09-18 15:08:56