As anticipation builds for a better October, frog-themed meme coin Pepe (PEPE) could be one of the first cryptos to gain. Nicknamed “Uptober,” the historically bullish month appears to be coming at the right time for PEPE’s price.

Recently, PEPE’s price hit $0.0000078 after a quick 8% increase in the last 24 hours. But will the next few weeks bring more returns?

Pepe Lends Holders Its Hand

Between September 13 and 16, the meme coin’s Market Value to Realized Value (MVRV) Long/Short Difference plummeted from 33% to 26%. This drawdown coincided with PEPE’s price decline from $0.0000079 to $0.0000071.

The MVRV Long/Short Difference measures the profitability of short-term and long-term holders. If the reading falls, short-term holders have more unrealized gains than the other divides. Typically, this is a bearish sign.

However, as of this writing, the metric’s reading has increased to 28.36%, suggesting that the recent PEPE price increase has put long-term holders on the front foot once again. Historically, if this difference continues to rise, then the cryptocurrency might resist succumbing to bearish cues.

Read more: 5 Best Pepe (PEPE) Wallets for Beginners and Experienced Users

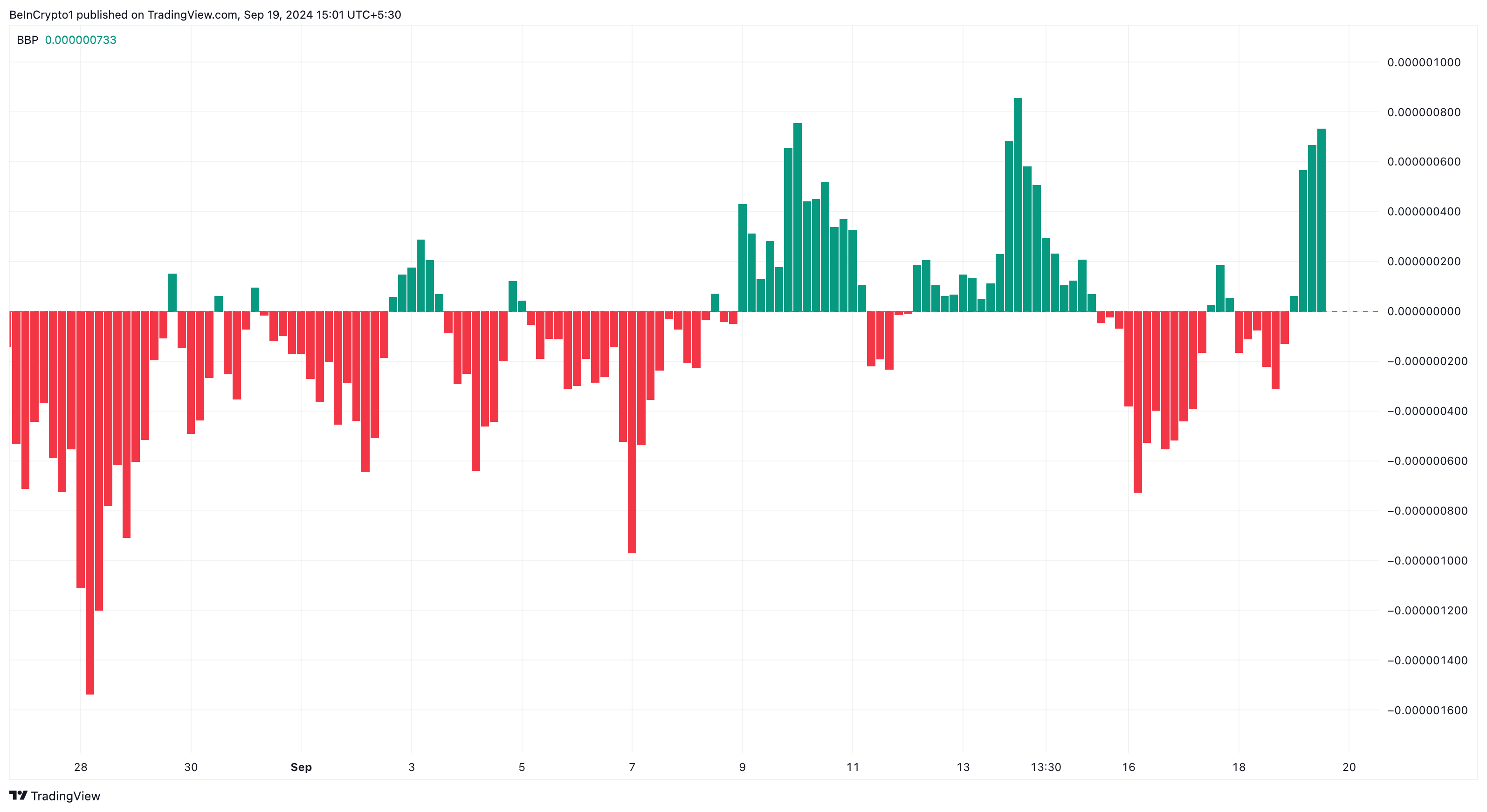

As such, PEPE appears to be back in time for the bull run and could begin “Uptober” on a strong note. Another indicator supporting this move is Bull Bear Power (BBP), a technical analysis tool that measures trend strength and detects divergences between momentum and price.

When the BBP is near zero, which is the 13-period Exponential Moving Average (EMA), the market is balanced. In this situation, neither buyers nor sellers are in full control. However, if the indicator is above or below the baseline, one market force is in the majority.

On the 4-hour PEPE/USD chart, the BBP is above the 13 EMA line. This indicates that buying strength clearly outweighs that of sellers. With this position, PEPE’s price might continue to appreciate into the last weeks of September and early “Uptober.”

PEPE Price Analysis: $0.000011 to Come in a Bit

In addition to the buying volume shown on the 4-hour chart, the daily PEPE/USD chart also presents a bullish picture. For instance, the meme coin formed a descending triangle between July 30 and yesterday.

Fortunately, PEPE’s price broke out of the triangle, suggesting that the token might not face an accelerated downturn. This breakout also coincided with the rise above the 20-day Exponential Moving Average (EMA).

From a trading perspective, a rise above the 20 EMA (blue) is generally considered to confirm an uptrend. Therefore, as long as the price trades above this indicator, the PEPE might rally by 50%, possibly hitting $0.000011 by October.

Read more: 10 Best Crypto Exchange Reviews for September 2024

While this optimistic forecast looks likely, investors should be careful. Notably, if PEPE drops below the EMA again, the prediction might not come to pass. Instead, the price could decrease to $0.0000063.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/what-to-expect-from-pepe-price-in-october/

2024-09-19 11:38:17