Recent price movement reveals that BNB has surged past a critical barrier, clearing the 100-day Simple Moving Average (SMA) and signaling renewed bullish momentum. With this breakout, BNB bulls are setting their sights on the $605 resistance level, as market sentiment strengthens around the potential for further gains. The move above the 100-day SMA has sparked optimism, hinting at the possibility of a sustained rally as BNB looks to capitalize on this momentum and break through key price targets.

The goal of this analysis is to highlight BNB’s recent surge above the 100-day Simple Moving Average (SMA) and evaluate the potential for continued positive movement toward the $605 resistance level. By examining current market dynamics and technical signals, this analysis aims to provide insight into whether BNB can maintain its upward momentum and achieve a significant breakout in the coming sessions.

Rallying Strength: Analyzing BNB’s Surge Above The 100-Day SMA

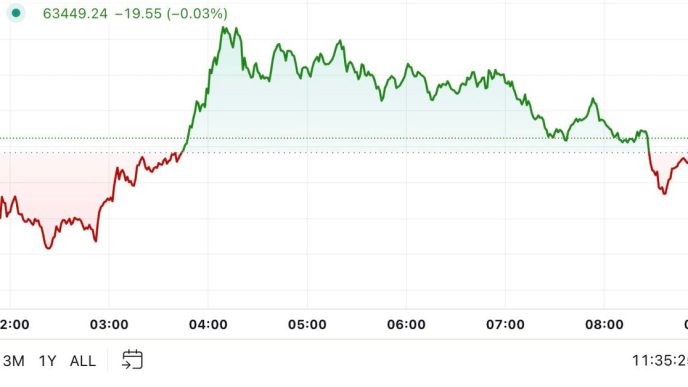

On the 4-hour chart, BNB has demonstrated sustained positive momentum after successfully breaking above the 100-day Simple Moving Average (SMA). This significant breach has not only triggered a shift in market sentiment but set the stage for a bullish trajectory as BNB rises toward the $605 mark. BNB’s ability to maintain above this key technical level reflects growing confidence among traders, suggesting that the upward movement may continue.

Additionally, the Relative Strength Index (RSI) on the 4-hour chart has climbed above the 50% threshold, currently sitting at 69%. This upward movement in the RSI indicates that bulls are firmly in control, as the index approaches overbought territory. If selling pressure remains subdued, there is potential for an extended increase in BNB’s price, signaling a strong bullish trend ahead.

On the daily chart, BNB is maintaining an upswing toward the $605 resistance level while trading above the 100-day Simple Moving Average (SMA). The price has printed multiple candlesticks above this key indicator, underscoring the strong buying pressure from investors and indicating a solid sentiment in BNB’s potential for continued growth.

Finally, on the 1-day chart, a careful examination of the formation of the 1-day RSI reveals that BNB could sustain its bullish trend toward the $605 resistance mark as the signal line of the indicator has risen above 50% and is currently attempting a move towards the 70% threshold.

What’s Next For BNB As Resistance Beckons

With strong buying interest and positive market sentiment, BNB is gearing up to reach the $605 resistance level. When BNB breaks above this point, it could lead to more gains, aiming for the $635 resistance zone and beyond.

However, the altcoin may face a pullback toward the $537 support mark if the momentum falters and fails to surpass this level. A decline below this support could lead to additional drops, with the price potentially testing the $500 support range and other lower levels.

At the time of writing, BNB was trading at approximately $575, reflecting a 3.05% increase over the past day. Its market capitalization was around $84 billion, with trading volume surpassing $1.9 million, showing increases of 3.05% and 9.81%, respectively.

Source link

Godspower Owie

https://www.newsbtc.com/analysis/bnb/bnb-rides-bullish-wave-eyes-605/

2024-09-20 11:30:02