While Pepe’s (PEPE) price has increased by 10.87% in the past seven days, something else has happened that is likely to derail the meme coin’s bullish potential. This notable signal raises concerns about a sudden sell-off or profit-taking.

Currently trading at $0.0000080, PEPE faces challenges in reaching $0.000013. Although investors may anticipate a swift run, this on-chain analysis explains why a gradual retracement seems more likely.

Pepe Holders Distribution Spells Trouble

On September 21, the frog-themed token reached a month-to-date high of $0.0000083. This was after bulls ensured that it did not slide below $0.0000071 five days earlier. However, data from Santiment shows that on Monday, Pepe’s daily on-chain transaction volume in profits jumped to 4.48 trillion.

This on-chain metric tracks the number of tokens involved in realized gains within a set period. A significant decrease in realized gains typically boosts the likelihood of price appreciation, as it suggests investors are holding their positions rather than cashing out. Conversely, a notable increase in realized gains often leads to a price decrease due to rising selling pressure.

For PEPE, at current prices, the figure above means that investors have taken profits amounting to over $35 million. This suggests that some investors are locking in their gains, which could introduce downward pressure on the price if profit-taking continues.

Read more: 5 Best Crypto Payment Gateways Every Business Should Know

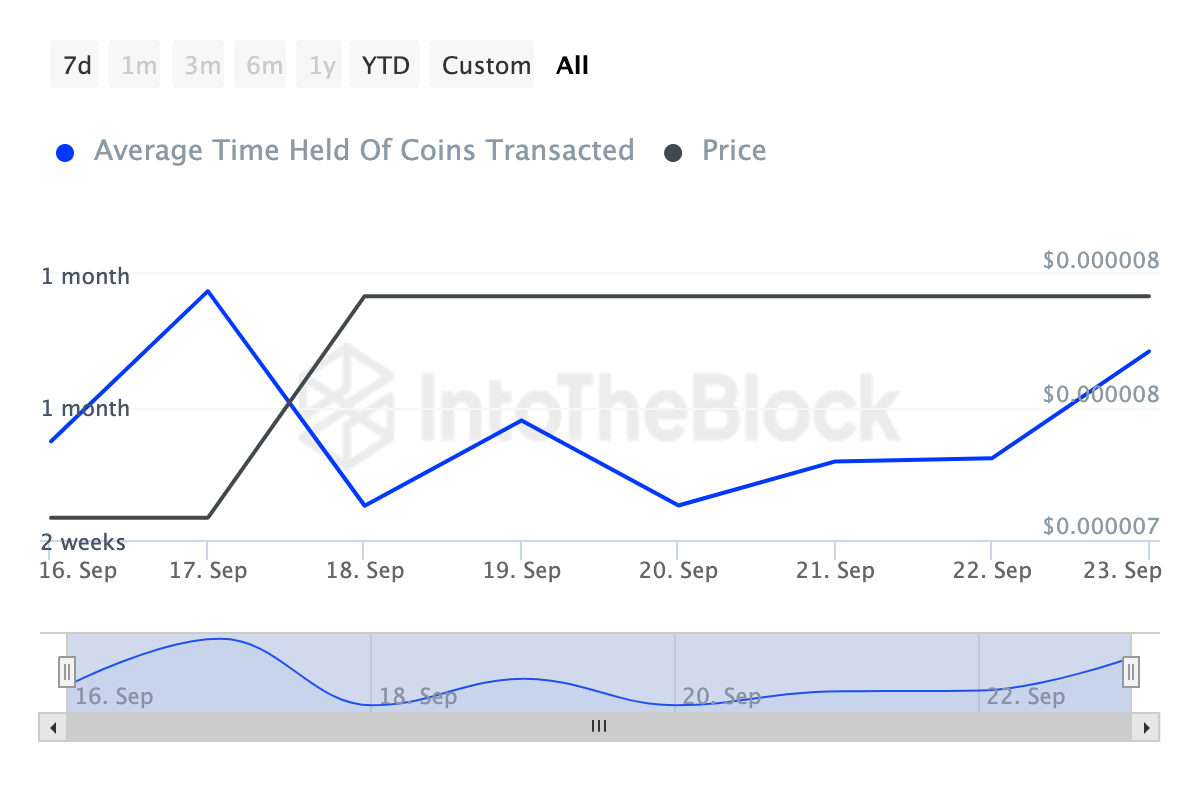

Another indicator supporting the downturn is Coins’ Holding Time — a metric that shows how long investors have held tokens without selling them. On a 30-day horizon, PEPE’s Coins Holding Time is a 90% increase.

However, over the last seven days, the ratio has decreased by 15%, indicating that the meme coin faces selling pressure. Should this continue, then PEPE’s bullish price outlook might not continue in the short term.

PEPE Price Prediction: Likely Decline

From a technical standpoint, PEPE’s price showed readiness to move toward $0.000013 at some point. This would have brought in a 63% increase from current levels. However, indications from the Ichimoku Cloud, as well as the Balance of Power (BoP), reveal that the cryptocurrency might face a pullback.

The Ichimoku Cloud is a technical indicator that measures trend direction and spot support and resistance. When the cloud is below the price, support is strong, and the price can increase. However, at press time, the indicator was above PEPE’s price.

Therefore, a retracement is likely due to resistance. The BoP, which measures the strength of buyers to sellers, also turned downward, suggesting that the latter has the upper hand. Considering this condition, Pepe’s price could drop to $0.0000074.

Read more: 5 Best Pepe (PEPE) Wallets for Beginners and Experienced Users

However, if realized gains start to decrease, PEPE’s price might have room to appreciate again. In that scenario, the meme coin’s short-term target could be around $0.000010 before another attempt at $0.000013.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/pepe-price-increase-to-be-cut-short/

2024-09-24 08:17:07