The price of LayerZero (ZRO) has increased by 13.65% in the last 24 hours. It comes days after the LayerZero Foundation announced the end of ZRO airdrop claims and disclosed that it would reallocate unclaimed tokens to its active users.

As the distribution strategy shifts, the omnichain interoperability protocol is igniting fresh enthusiasm among investors in the market. But what does this mean for ZRO’s price in the near future?

LayerZero Foundation Gives Whales Reason to Buy

On September 20, LayerZero Foundation announced that the period to claim the first ZRO airdrop had ended. In the statement, it noted that the unclaimed tokens would be redistributed. This action is in tune with CEO Bryan Pellegrino’s disclosure in June, which hinted at the recent decision.

However, this time, the project is only allocating tokens to active users who claimed ZRO during the first airdrop and transacted on the chain afterward. Following this development and the increase in LayerZero’s price, the cryptocurrency experienced a surge in the number of addresses in profits and those who have broken even.

According to IntoTheBlock, 7,750 addresses represent 80.39% of the total ZRO holders who are now in profit. 11.85%, which is about 1.140 addresses, have hit a breakeven point, while a paltry 7.76% are holding ZRO at a loss.

Read more: What are Crypto Airdrops?

While ZRO’s price is $4.76, the rise in profitable addresses could encourage more investors to buy into the token. If that happens, this second airdrop could send the altcoin much higher. Consequently, it could also offer a contrasting outcome to the first airdrop, which triggered LayerZero’s 22% price drop.

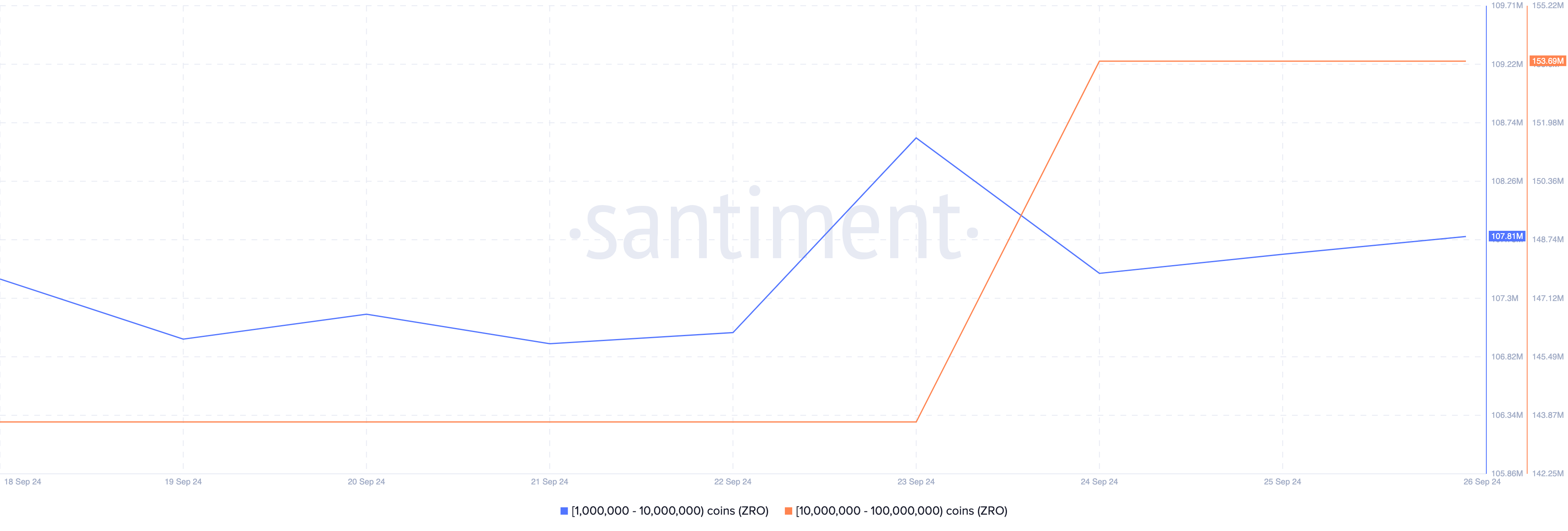

Data from Santiment reveals that crypto whales have increased their ZRO holdings over the past few days. Specifically, whales with 10 million to 100 million tokens accumulated an additional 10.26 million ZRO. Additionally, those in the 1 million to 10 million category bought about 300,000 more tokens.

If this trend continues, LayerZero’s price could keep climbing, possibly pushing it closer to its all-time high as demand strengthens among influential holders.

ZRO Price Prediction: New ATH Ahead

With ZRO’s price increase at $4.76, the daily chart shows a notable rise in the Chaikin Money Flow (CMF), which indicates whether an asset is experiencing accumulation or distribution.

When the CMF is above zero, investors are buying, and the uptrend will continue. However, if the indicator drops below the mentioned threshold, it implies that selling pressure has taken over, and a decline could be imminent.

Furthermore, The rise in the CMF gives more credence to a further upswing in ZRO’s price, indicating that the token’s price could challenge its all-time high and reach $5.60.

Read more: Top 9 Safest Crypto Exchanges in 2024

However, failure to break above $4.99 might invalidate this thesis. In that scenario, ZRO could experience a pullback to $3.83.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/layerzero-price-jumps-after-aidrop-reallocation/

2024-09-26 08:14:05