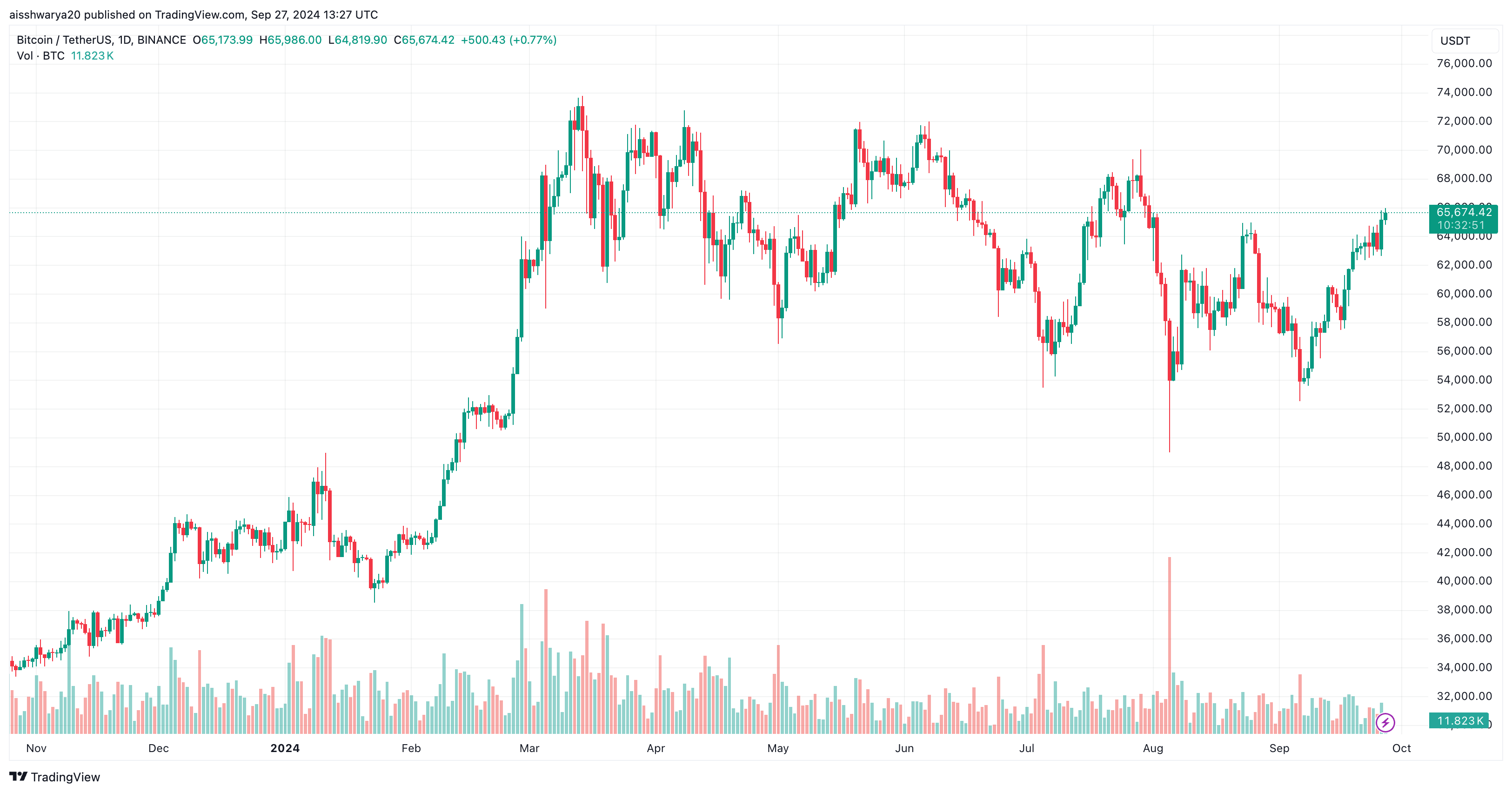

Bitcoin (BTC) looks poised to record its best September in a decade, surging past $65,000. This uncharacteristic price appreciation could be attributed to several key factors.

Reasons Behind Bitcoin’s Impressive September Gains

Historically, September has consistently been the worst month for BTC in terms of price performance. However, the apex cryptocurrency is now on track to post its best September in at least a decade, driven by several macroeconomic developments.

Related Reading

On September 18, the US Federal Reserve (Fed) initiated its interest rate cut cycle for the first time in four years, slashing rates by 50 basis points (bps) in response to slowing inflation and rising unemployment.

The rate cut immediately impacted risk-on assets, including BTC, which has appreciated by over 10% since the cut. In comparison, Bitcoin’s average price decline in September over the past decade has been 3.45%, according to the chart below from CoinGlass.

According to the Fed’s decision, the European Central Bank (ECB) and the People’s Bank of China (PBoC) lowered borrowing costs to stimulate their respective economies. This further propelled BTC’s price towards its previous highs.

Bitcoin halving is another key factor that could now be starting to show its effect on the digital asset’s price action. Bitcoin underwent its halving earlier this year in April, reducing block confirmation rewards for miners from 6.25 BTC to 3.125 BTC.

Past data indicates that halving has typically been a bullish trigger for Bitcoin due to the resulting supply scarcity. For instance, in May 2020, BTC price rose from roughly $8,900 before the halving to more than $64,000 by April 2021 – an 8x price surge in less than a year.

Meanwhile, US spot Bitcoin exchange-traded funds (ETFs) continue to witness rising interest from retail and institutional investors alike, as they recorded $365.57 million in total net daily inflows on September 26, the largest since late July. Since their launch, the cumulative net inflow for Bitcoin ETFs now totals $18.31 billion.

Cautious Optimism Key To Riding The BTC Wave

While BTC appears to have shaken off its typical September slump, it’s worth highlighting that the leading digital asset still needs to overcome certain important price levels before hitting a new all-time-high (ATH).

Related Reading

As previously reported, Bitcoin’s relative strength index (RSI) fell below 80 on the monthly chart, signaling that the cryptocurrency’s bullish momentum might fade after an enthusiastic buying spree.

In addition, a recent report by crypto exchange Bitfinex noted that despite Bitcoin’s recent upward movement, it must decisively overcome a strong resistance level of $65,200 to continue its positive momentum. The good news for bulls is that BTC is holding steady at $65,674, up 2% in the last 24 hours.

Featured image from Unsplash, Charts from CoinGlass.com and Tradingview.com

Source link

Ash Tiwari

https://www.newsbtc.com/bitcoin-news/bitcoin-set-for-biggest-september-gains-in-a-decade-heres-why/

2024-09-28 06:30:06