FTX Token (FTT) is now the talk of the town, thanks to speculations surrounding FTX’s plans to begin creditor and customer repayments.

With the hearing regarding the repayment plan scheduled for October 7, market participants have started accumulating FTT. Its technical setup suggests it may climb over 160%, potentially reaching a 10-month high. How feasible is this?

FTX Token Receives Special Attention From Traders

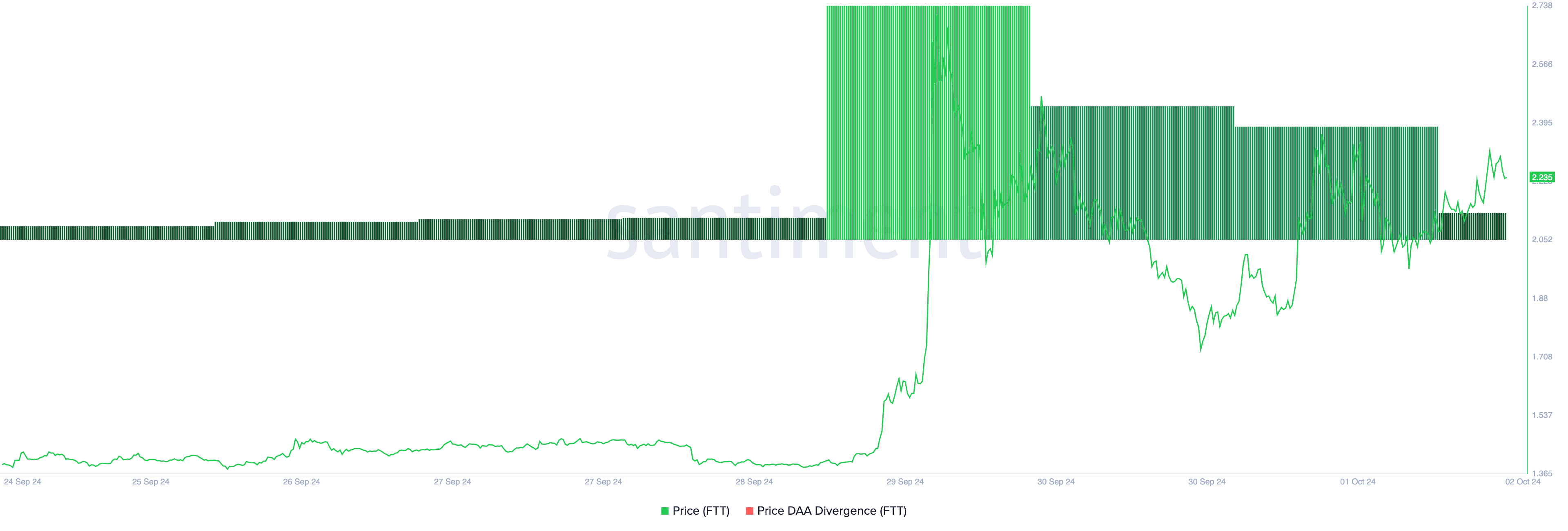

FTT is currently trading at $2.23, noting a 64% price surge over the past week. The rally is fueled by the anticipation of the October 7 hearing to discuss FTX’s plans to repay its creditors and customers.

In a post on X, Sunil Kavuri, a representative for FTX creditors, stated that if the court approves the repayment plan, claimants owed amounts under $50,000 could start receiving payments by late 2024. Those owed larger sums may have to wait until mid-2025.

Santiment data shows that long-held dormant tokens have also started to change hands as the market awaits the hearing. The current spike in the token’s age-consumed metric, which tracks the movement of long-held coins, confirms this.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Furthermore, the positive readings from FTT’s price daily active address (DAA) divergence indicate an uptick in the altcoin’s demand. This metric, which measures an asset’s price movements with the changes in its number of daily active addresses, is at 25.46%.

A price rally accompanied by a positive DAA divergence is a bullish signal, suggesting growing interest and potential for further price growth.

FTT Price Prediction: All Lies With the Court

FTT’s rising on-balance volume confirms the surge in FTT accumulation ahead of the October 7 hearing. This indicator, which measures an asset’s buying and selling pressure, now sits at its highest level since December 2023, rising by 69% over the past four days.

When OBV spikes and surpasses previous highs, it indicates that the asset is breaking out of a resistance level, suggesting a strong bullish trend. It means that buyers are accumulating the asset, which could lead to upward price momentum.

If the court approves the repayment plan and buying momentum skyrockets, FTT could break through the resistance level at $4.91. This would position it to reclaim $5.98, a price it last reached in December 2023, representing a potential 160% increase from its current value.

Read more: Who Is John J. Ray III, FTX’s New CEO?

Conversely, if the repayment plan is denied, we may see a surge in profit-taking activity, which could push FTT’s price down to $1.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ftx-token-set-to-skyrocket/

2024-10-02 14:00:00