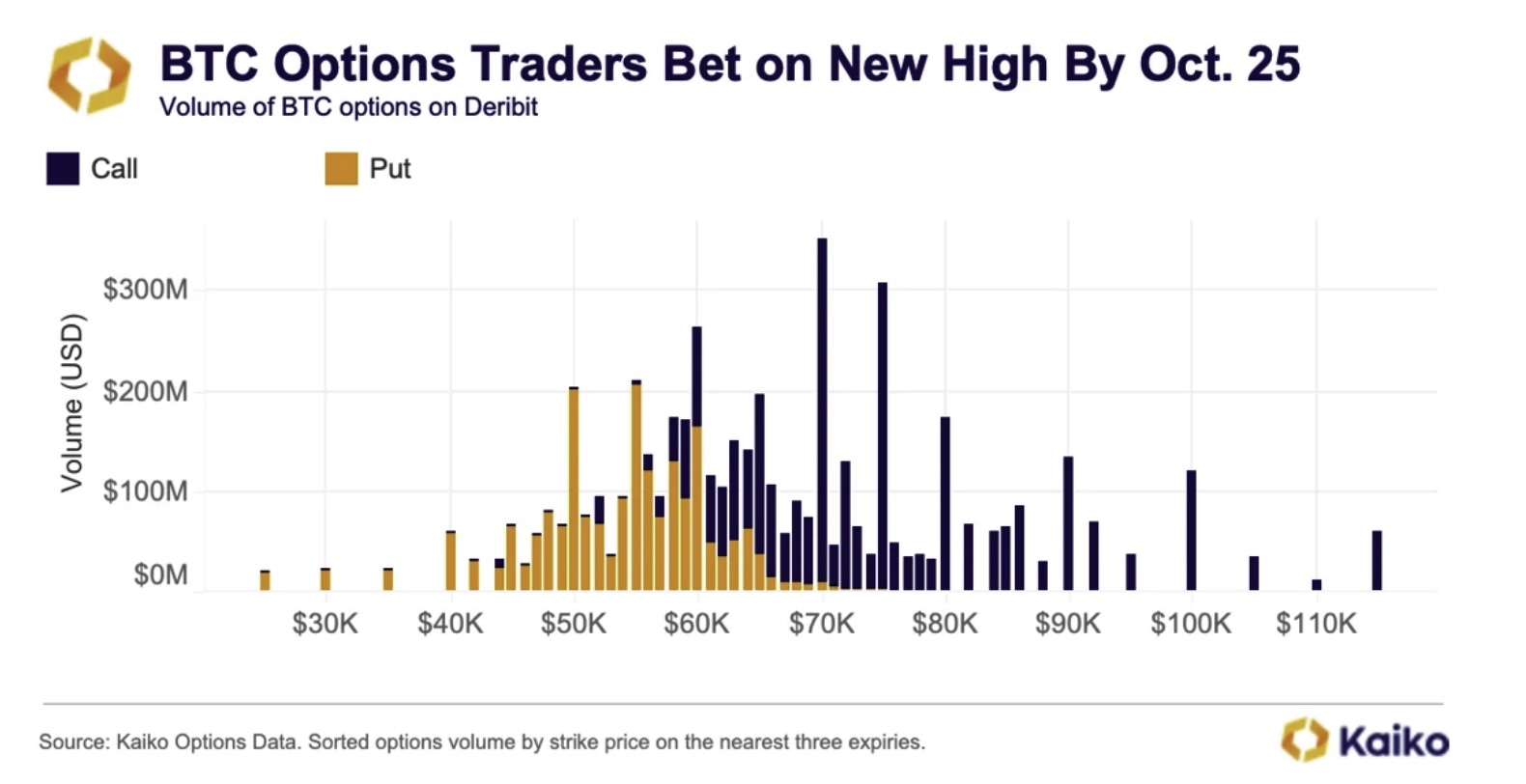

New data from the crypto market analytics firm Kaiko Research indicates traders are placing big bets that Bitcoin (BTC) will have a strong October.

In a new report, Kaiko finds that derivatives traders are betting hundreds of millions of dollars on the crypto options exchange Deribit that Bitcoin is going to regain the $70,000 range this month.

“Options volumes have increased over the past few weeks as markets shift to a risk-on mindset. Traders are positioning themselves to capture upside price movements ahead of what is historically BTC’s best trading month. BTC’s price has only ended October down twice since 2013.

Looking at the three expiries in October, we can see that most of the volume is focused on the BTC options expiring at the end of the month. Typically, the front-month contracts would have more volume and liquidity.”

According to Kaiko, new macroeconomic conditions are also contributing to the traders’ behavior.

“However, several factors make this year different. First, the US central bank began a rate-cutting cycle this month, shifting its monetary policy. The Fed’s jumbo rate cut has already boosted risk-on sentiment. The central bank has signaled two more cuts before the year’s end, prompting speculative trades on December 27 contracts with significant volume on strike prices above $100,000.

What hasn’t shown up in the markets yet is the effect of cheaper dollars and the eventual easing of the Fed’s quantitative tightening measures, which removed liquidity. Global liquidity lags the markets, so the effects of the Fed’s easing cycle will take longer to appear.”

Bitcoin is trading for $61,026 at time of writing, down 3.9% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Daily Hodl Staff

https://dailyhodl.com/2024/10/02/options-traders-betting-big-on-bullish-october-for-bitcoin-btc-according-to-analytics-firm-kaiko/

2024-10-02 20:00:17