Thanks to a bullish prediction by analyst EGRAG Crypto, XRP is now causing ripples in the crypto market again. He has recently done an analysis that shows the token is approaching a critical juncture. In the short term, prices may increase more than $1.50 if it can surpass the Genuine Wake-Up Line (GWUL).

Related Reading

Traders pay attention to the significant resistance levels of XRP since it displays the price pattern of the cryptocurrency. By the first of November in 2024, CoinCodex anticipates a 19.57% gain. This indicates that a significant number of market players believe the asset will increase in value.

Resistance At The Genuine Wake-Up Line

EGRAG recently released the GWUL following XRP’s successful passage of the Final Wake-Up Line, another key barrier. Since its formation following XRP’s high of $1.96 in April 2021, this new line has proved to be a formidable resistance.

The analyst theorizes that XRP is now at the edge of breaking this level of resistance, meaning there could be a strong shift in market mood. Perhaps the token would start rallying towards $1.50 if it could close above the GWUL and manage to stay above after having breached above it. Mid-term projections are even more optimistic, with potential targets set between $5.50 and $7.50.

#XRP Genuine Wake-Up Line (Micro Moves – Lower Time Frame) 🚨🚨🚨🚨🚨🚨🚨

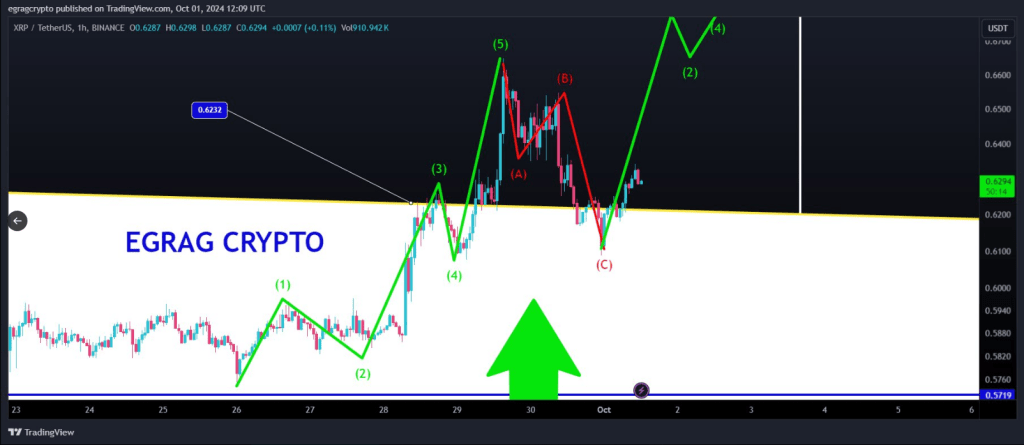

🔍 A closer look at the borders of the GWUL (Genuine Wake-Up Line) reveals an intense battle ⚔️ between the #Bulls 🐂 and #Bears 🐻. The action is heating up, but guess what? The wave count is on our side!… https://t.co/RJoVyM8RiL pic.twitter.com/QcYFFQn0vl

— EGRAG CRYPTO (@egragcrypto) October 1, 2024

EGRAG emphasizes that it is insufficient to simply barrel past the GWUL; XRP must maintain its position above this line for a minimum of three days. This confirmation is essential for the establishment of a favorable trend. At the moment, XRP is trading at approximately $0.58, which is why the next few days are so critical for its price movement.

Patterns Suggest A Conflict Between Bears And Bulls

On EGRAG’s chart, the GWUL and a yellow triangle indicate the trading conditions’ upper limit, with the Atlas Line supporting it. Within the larger yellow triangle, a smaller white triangle has also emerged, illustrating the ongoing market tug-of-war between bulls and bears.

The stakes are high as XRP approaches the convergence point of these triangles. If investors are able to elevate XRP above this triangle, it could trigger a substantial bullish wave, thereby verifying the breach of the GWUL.

Reaching the $1.50 threshold is particularly significant, as it would conclude Wave 1 of a more extensive Elliott Wave pattern, according to EGRAG. In the event that XRP surpasses this threshold, a corrective Wave 2 could occur, resulting in a decline to approximately $0.75 before a more substantive rally. This rally may ultimately result in the ambitious target of $7.50.

Related Reading

Monitoring Support Levels

Although the outlook is still positive, there’s a caveat in that XRP has to remain trading above its key support at $0.62. XRP is trading just below this critical level of support now, so there is some concern about how long it might sustain its bull run.

Markets are cautious while awaiting events. The rest of the week will show if XRP has promise. If it stays over $0.62, the token may spark a breakout.

Featured image from SETI Institute, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/breakout-looms-xrp-to-hit-7-5-after-wake-up-line-according-to-analyst/

2024-10-02 22:00:07