Ripple’s XRP token has experienced a sharp decline, losing over 10% of its value in the past 24 hours. The price drop follows the United States Securities and Exchange Commission’s (SEC) filing of a notice of appeal on October 2, challenging the previous judgment in favor of Ripple.

With growing bearish sentiment against the altcoin, it may revisit its two-month low of $0.47. This analysis explores why that is likely.

Ripple’s XRP At SEC’s Mercy

In a “notice of appeal” filed recently, the SEC announced its intent to challenge the court’s decision in its case against Ripple. This appeal follows Judge Analisa Torres’s ruling on August 7, which imposed a $125 million fine on Ripple.

The court determined that Ripple’s XRP sales to institutional investors constituted securities transactions. However, it added that these sales were neither fraudulent nor malicious, with no evidence of fraud or financial harm. Judge Torres clarified that while certain XRP transactions qualify as securities, XRP itself is not inherently a security.

SEC’s decision to appeal, exacerbated by the general market downturn, has led to a surge in XRP sell-offs. The altcoin trades at $0.53, noting an 11% price decline over the past 24 hours. During the same period, its trading volume has risen by 5%.

Read More: How To Buy XRP and Everything You Need To Know

When an asset’s price declines but its trading volume rises, it suggests a strong bearish sentiment in the market. This combination indicates that many investors are selling their assets, driving the price downward. The high trading volume implies a lot of interest in the market, but the direction of this interest is predominantly negative.

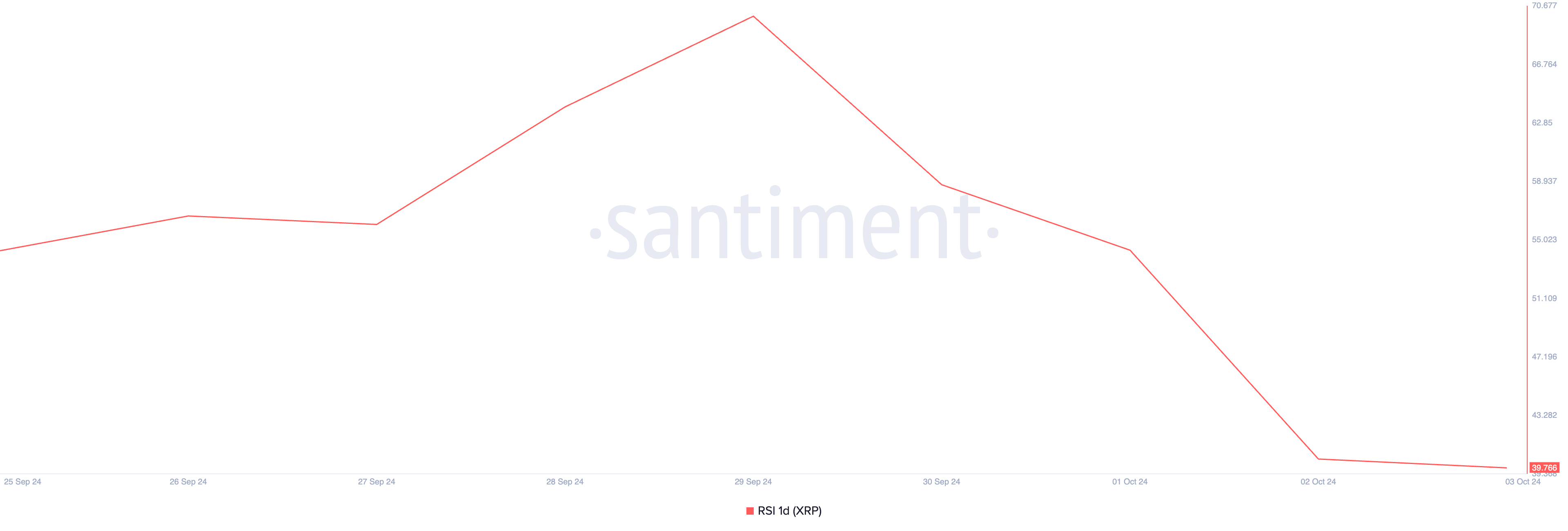

Furthermore, XRP’s declining Relative Strength Index (RSI) supports this bearish outlook. The indicator measures oversold and overbought market conditions and ranges between 0 and 100. Values above 70 suggest that an asset is overbought and due for a correction, while values under 30 indicate that an asset is oversold and may witness a rebound.

At present, XRP’s RSI stands at 39.76 and is on a downward trend, indicating that selling pressure far exceeds buying interest among market players.

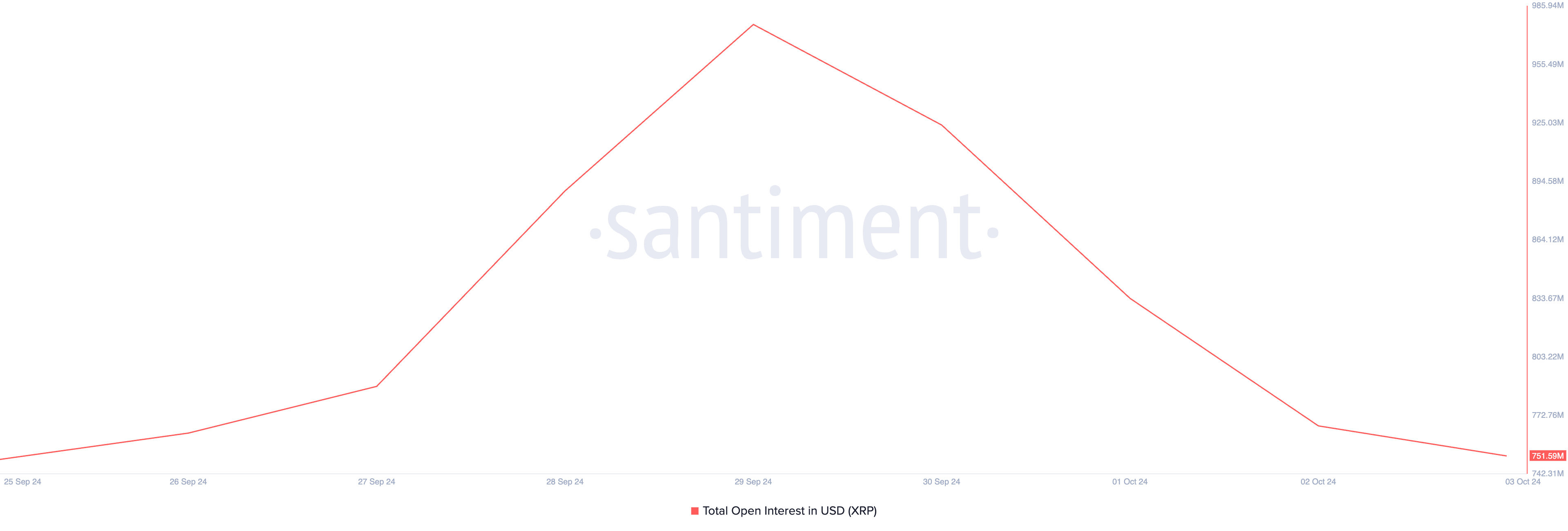

Furthermore, the drop in XRP’s open interest highlights diminishing demand for the altcoin, a pattern seen over the past few days. The token’s open interest currently sits at $752 million, reflecting a 23% decline since September 29.

Open interest represents the total number of active futures or options contracts that remain unsettled. A decrease in open interest points to reduced participation from investors in the market.

XRP Price Prediction: Token Approaches Two-Month Low

XRP’s price decline over the past week has brought it close to a key resistance level at $0.51, which it currently holds just above. If selling pressure intensifies, this level may not hold, pushing XRP to a two-month low of $0.46.

Should the token fail to turn this level into a support floor, its price could fall further to $0.38.

Read More: XRP ETF Explained: What It Is and How It Works

However, this negative outlook would be invalidated if market sentiment shifts from bearish to bullish. In that case, XRP’s price could reverse course and initiate an uptrend, targeting $0.66.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-price-nears-multi-month-low/

2024-10-03 08:38:59