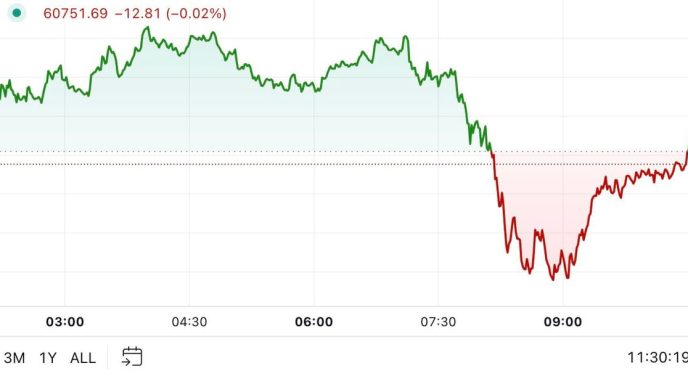

Toncoin (TON) price has experienced turbulent movement in recent weeks, with failed attempts to secure $5.96 as a support level. Since then, the price of the Telegram-linked cryptocurrency has faced a correction, and it is currently trading below key support levels.

This downward trend has raised concerns among investors, with many questioning whether TON can regain its bullish momentum and potentially break above $6 by the end of October.

Toncoin Faces Selling

The Ichimoku Cloud indicator is signaling considerable bearishness for Toncoin. The cloud is positioned above the candlesticks, which is generally viewed as a negative indicator for price action.

This formation suggests that bearish momentum could persist for TON, limiting its chances of recovery. With the Ichimoku Cloud indicating a bearish outlook through the end of October, Toncoin may struggle to make significant gains during this period.

Given the current market sentiment, Toncoin faces an uphill battle. If the bearish signals from the Ichimoku Cloud hold true, TON could remain under pressure until more favorable market conditions emerge, further delaying any attempts at reclaiming higher price levels.

Read more: What Are Telegram Bot Coins?

Toncoin’s macro momentum also shows signs of weakness, particularly when examining the behavior of large wallet holders. Toncoin whales, who hold at least 0.1% of the circulating supply, have sold approximately 21.8 million TON in the last 24 hours. This selling spree, worth $115 million, is the largest outflow seen in nearly six weeks, signaling growing concerns among the biggest investors.

Such significant outflows often suggest that large investors are uncertain about the coin’s short-term prospects. If this trend continues, it could weigh heavily on Toncoin’s price, making it even more difficult for the asset to regain support levels and resume an upward trajectory.

TON Price Prediction: Finding Support

Toncoin is currently trading at $5.29, below the crucial support level of $5.37, following an 11.5% drawdown over the past week. If the selling pressure continues, TON may drop further, with a potential decline to $4.86. This would extend the recent losses and place additional strain on the coin’s outlook.

The range between $5.37 and $4.86 has acted as a consolidation zone in the past, meaning that TON could enter another period of stagnation. If consolidation occurs, it would likely prolong investor losses and delay any potential recovery.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

To invalidate this bearish outlook, Toncoin would need to reclaim $5.37 as support. Securing this level could provide a much-needed boost, allowing the cryptocurrency to make another attempt at $5.96, bringing it closer to the $6.00 target.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/toncoin-price-likely-stuck-until-october-ends/

2024-10-03 10:30:00