Aptos’s APT coin has experienced a resurgence in buying activity following Franklin Templeton’s announcement of the expansion of its tokenized US Treasuries fund — the Franklin OnChain US Government Money Fund (FOBXX) — on the Layer-1 (L1) blockchain.

With a surging bullish bias toward the altcoin, it is poised to revisit its six-month high. This analysis explores how soon this may occur.

Aptos Joins the FOBXX fund, APT Gains

On Wednesday, Franklin Templeton, a leading investment manager with over $1.4 trillion in assets, announced the launch of its FOBXX on the Aptos blockchain. This news drove APT to an intraday day high of $8.33. While the Aptos’ price has since shed some of these gains, it still notes a 1% hike over the past 24 hours. As of this writing, APT is trading at $7.96.

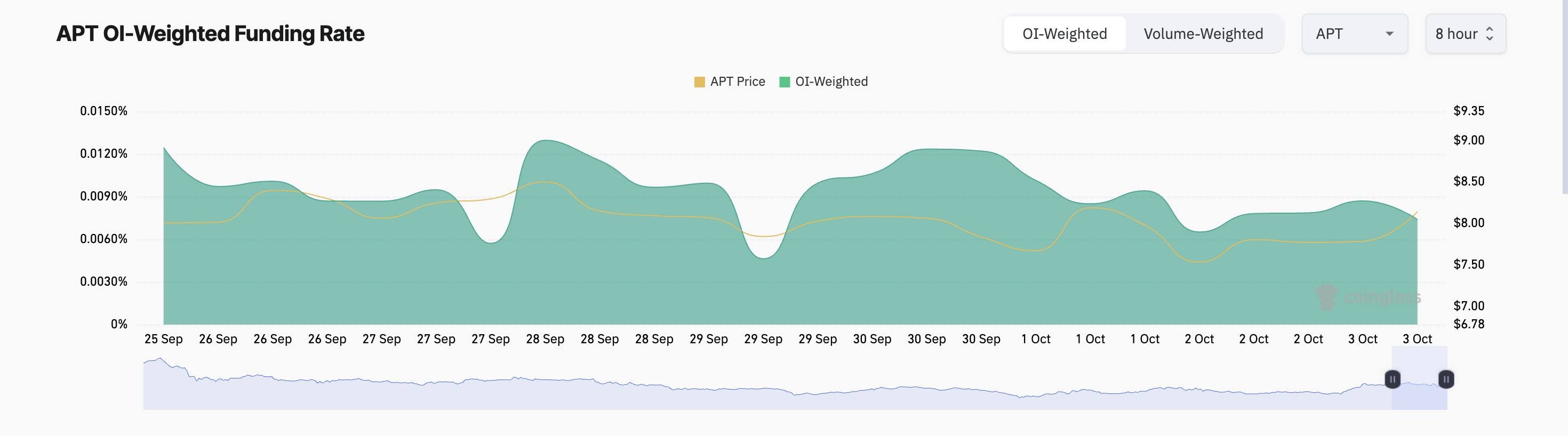

Furthermore, APT’s open interest has surged by 16% within the same period. This measures the total number of the coin’s outstanding futures or options contracts that have not been settled or closed.

Read more: Where To Buy Aptos (APT): 5 Best Platforms for 2024

The combination of rising prices and increasing open interest often reflects bullish sentiment among traders. The willingness to add new positions indicates they expect the price movement to be sustained.

APT’s positive funding rate of 0.0074% supports this bullish outlook. A positive funding rate signifies bullish sentiment among traders. It suggests that more participants are confident in the price rise, leading them to take long positions. This can create upward pressure on the price of the underlying asset.

APT Price Prediction: Price May Break Above Crucial Resistance Level

APT’s rising Relative Strength Index (RSI) reflects the surge in demand for the altcoin. At press time, the indicator stands at 61.51.

The RSI measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. Conversely, values below 30 indicate that the asset is oversold and may witness a correction.

At 62.99, APT’s RSI suggests that buying momentum is high and outweighs profit-taking activity. According to the coin’s Fibonacci Retracement tool, if this trend continues, APT’s next target is $10.11, a high it last reached in April. If it breaches this crucial resistance level, it may chart its course toward $19.48.

Read more: Aptos (APT) Price Prediction 2024/2025/2030

However, if the uptick in Aptos’ price prompts holders to begin profit-taking, the coin may lose some of its gains and drop toward its August 5 low of $4.32.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/aptos-price-fobxx-launch/

2024-10-03 15:00:00