Since falling from $160 on September 30, the Solana (SOL) price has continued to hit lower levels. Recent data suggests that the token might drop to a region it has not reached in almost a month.

As of this writing, Solana’s price is $135.52. But with a grim outlook, here is why SOL could fail to notch a quick recovery.

Buying Solana Now Looks Risky

Data from crypto intelligence platform Messari shows that Solana’s Sharpe ratio has fallen. The Sharpe ratio measures a cryptocurrency’s potential risk-adjusted return.

When it rises, it implies that the potential reward of investing in the asset could be worth the risk. But for Solana, the ratio has dropped to -1.11. Five days ago, this same metric had a reading of 2.57, which suggested a possible SOL price increase.

Currently, since the ratio is on the brink of falling into negative territory, it suggests that buying SOL at the current value might not bring a positive return on investment.

Read more: Solana ETF Explained: What It Is and How It Works

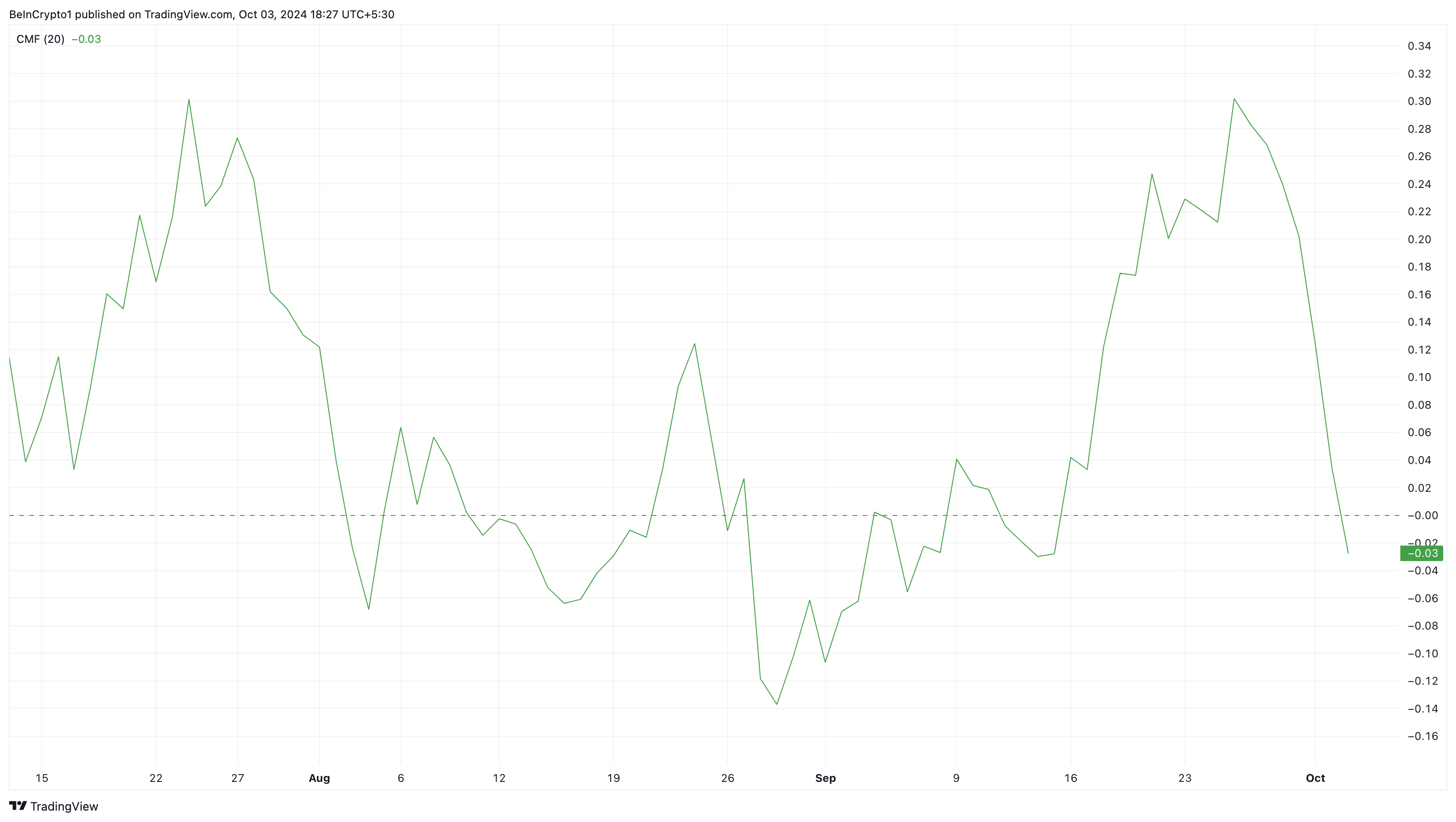

Beyond this metric above, the Chaikin Money Flow (CMF) is another indicator reinforcing the bearish thesis. The CMF considers the volume up or down at the end of a trading day. With this data, the indicator can tell whether the market is accumulating more of a token or distributing it.

When the CMF increases, accumulation takes place. On the other hand, a decline in the indicator’s reading suggests distribution. According to the daily SOL/USD chart, the CMF has dropped to the negative region, suggesting that sellers are dominant, and Solana’s price could evade a quick bounce.

SOL Price Prediction: No Rebound Yet

On September 30, Solana’s price was $158.53, with expectations high that October would produce more gains. But since then, SOL has lost almost 15% of its value and is currently priced at $135.52.

According to the daily chart, SOL could not hold the $142.21 support, so the token dropped below the threshold. Currently, the altcoin is about to hit the 23.6% Fibonacci retracement.

If this happens, Solana’s price might hit $130, possibly falling below the zone in the short term. Failure to hold the $130 support line could lead SOL down to $124.92.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

On the other hand, if bulls defend the $130 region, this prediction might not come to pass. Instead, SOL’s price could jump to $161.95.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/solana-price-at-no-go-area-prediction/

2024-10-03 19:00:00