Crypto analyst Ali Martinez has suggested that the Bitcoin crash might not be over despite the relief rally to $61,000. The analyst highlighted the $60,365 price level as being important to avoid a potential crash to as low as $57,000.

Bitcoin Needs To Hold Above This Price Level To Avoid Crash

Martinez stated in an X post that $60,365 is a key price level to watch for Bitcoin. He claimed a break below this could cause the flagship crypto to fall to $57,420. However, if it holds above this level, the analyst remarked that a rebound to $63,300 is on the table. Therefore, Bitcoin’s trajectory depends on the crucial support at $60,000.

Related Reading

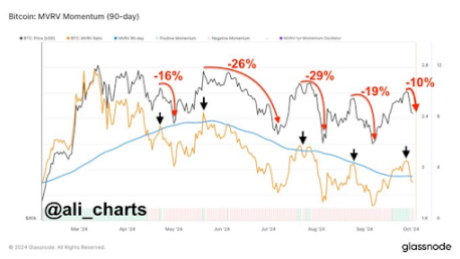

In another analysis, Martinez suggested that Bitcoin was likely to suffer more downward pressure in the short term rather than a rebound. He revealed that since May, every correction of the market value to realized value (MVRV) ratio from its 90-day average has led to a significant Bitcoin correction.

In line with this, the analyst noted that the latest rejection has already triggered a 10% drop, suggesting that Bitcoin could suffer more price decline. Analyst Justin Bennett also believes that Bitcoin will likely drop lower and predicts that it could fall to as low as $57,000. He added that a relief to take out the $63,200 short positions would be nice.

Meanwhile, he alluded to the US Job report, which is set to be released on October 4. The analyst expects significant volatility amid this inflation data. A weak job report could lead to a Bitcoin crash, similar to what happened in August, with the flagship crypto dropping to $54,000. The inflation data is also significant as it would provide insights into whether the market can expect further rate cuts from the Federal Reserve this year.

Veteran trader Peter Brandt also looks to be bearish on Bitcoin at the moment. He highlighted a ‘Three Blind Mice’ pattern that was forming on the BTC chart, indicating that the crypto is set to witness a bearish reversal following its uptrend in October.

Why A Price Crash Could Be Good

The on-chain analytics platform Santiment suggested that a Bitcoin price crash might be much needed for the flagship crypto to go higher. The platform noted that the crowd has considerably cooled off its excitement toward crypto since BTC retraced over 9% from its local high of $66,400 recorded on September 27.

Related Reading

Santiment claimed that this is encouraging, considering that markets typically move in the opposite direction of the crowd’s expectation. As such, the Bitcoin price could enjoy a surprise rally, seeing as market participants are more bearish on its trajectory.

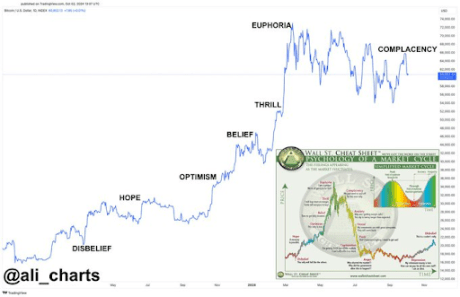

Ali Martinez noted that Bitcoin was currently in the complacency stage and just needed to cool off before it began its next rally.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-crash-not-over-60365/

2024-10-04 12:30:22