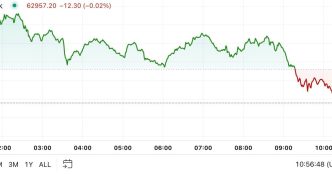

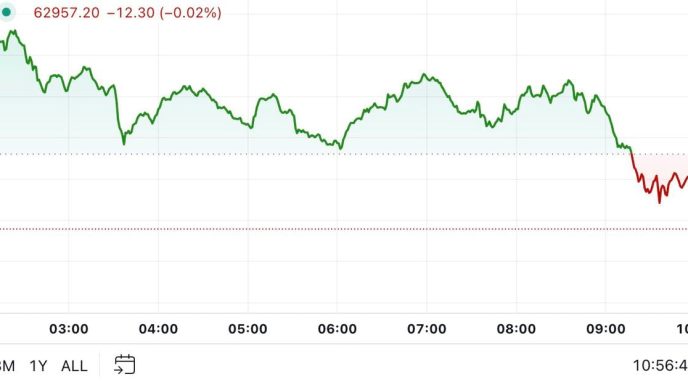

The Bitcoin price flirted with $64,000 during early European trading hours, but met some resistance. Analysts are saying BTC investors seem to be holding their breath to see how the U.S. election shakes out in a month’s time.

At the time of writing, the Bitcoin price has settled around $62,800, up 1.5% on the day, according to data from CoinGecko. The Ethereum price has largely mirrored Bitcoin’s path, rising 1.3% to around $2,450 at the time of writing, per CoinGecko data.

“It seems that the market is waiting for the November elections before committing to a clear direction in price,” wrote Jon Reader, chief investment officer at crypto lending protocol Ledn, in a note shared with Decrypt. “While the consensus is that a Republican victory will be more supportive of digital assets prices than a Democratic win, both parties have been putting forth positive statements towards digital assets, so the upward trend will be in place regardless of the outcome in my opinion.”

The U.S. presidential election sees former president and Republican candidate Donald Trump taking on Vice President Kamala Harris for the Oval Office. Voters will head to the polls on November 5. Currently, users on crypto betting site Polymarket have just shy of $1.4 billion wagered on the outcome.

At the time of writing, 51% of bettors favor Trump to retake the presidency. But it does need to be said that Polymarket, by virtue of a policy that bans on U.S. users to bet on the site, more closely tracks with how non-U.S. citizens feel the election will go.

Ledn’s Reader isn’t the only one saying crypto markets will benefit, if by varying degrees, regardless of who wins in November.

Standard Chartered’s Geoffrey Kendrick, the bank’s global head of digital assets research, has been saying for weeks now that markets will benefit regardless of who wins.

For now, traders seemed to have liked the latest unemployment numbers from last week. Even if the BTC price is currently meeting some resistance on Monday, that doesn’t change the fact that Bitcoin managed to gain roughly 5% over the weekend.

“The lower-than-expected unemployment rate fueled Bitcoin’s weekend rally, creating a fresh momentum with higher lows,” wrote BRN analyst Valentin Fournier in a note shared with Decrypt. “Bitcoin could soon test the upper boundary of its trend at $68,000. While a strong resistance is expected between $65,000 and $67,000, we believe Bitcoin will eventually break through.”

He flagged the upcoming inflation reports in the U.S., like the consumer and producer price indices, as potential catalysts for that upward momentum. The Bureau of Labor Statistics reports are due out on Thursday and Friday this week.

“While it may be too soon to see the effects of interest rate cuts reflected in these numbers, any signs that U.S. inflation is trending back toward 2% will likely have a favorable impact on the market” Valentin added.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Stacy Elliott

https://decrypt.co/284867/bitcoin-price-meets-resistance-as-traders-set-sights-on-presidential-election

2024-10-07 11:16:10